The real unemployment rate, the one that most media talking heads rarely mention, is called the U-6, and according to the Department of Labor, the U-6 rate is now 11.3%. Under Obama the U-6 has been as high as 17%. See:

Chart What s the real unemployment rate

U6 Unemployment Rate Portal Seven

The Big Lie 5.6 Unemployment

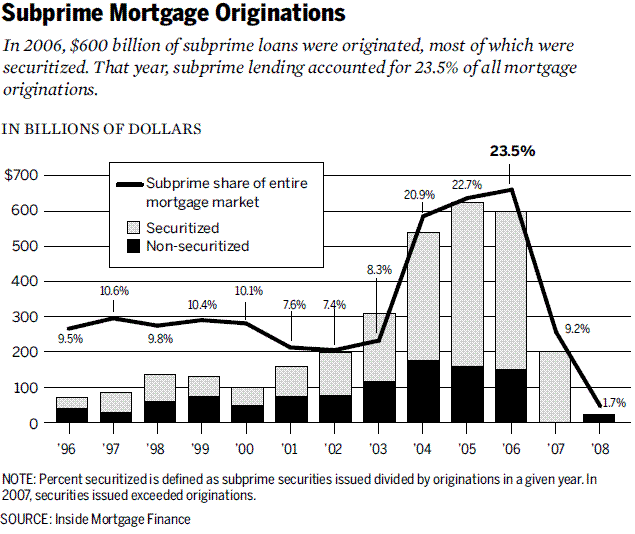

In contrast, under George W. Bush, the U-6 stayed below 10% for the vast majority of his presidency, and it didn't go above 12% until the last three months of his second term. That sharp upswing came because of the Great Recession in 2008, which was largely caused by massive--and disastrous--federal intervention in the home loan industry (via Fannie Mae, Freddie Mac, and the CRA), which led to the housing crisis, which in turn triggered--and largely caused--the Great Recession. See:

Did Deregulation and Capitalism Cause the Financial Crisis

(And it's worth noting that the Great Recession was needlessly made worse by senseless federal regulations such as the ridiculous federal mark-to-market regulations. Those regulations were later quietly changed, in recognition of the damage they had done during the early stages of the recession. For more on the damage done by the federal mark-to-market restrictions, see Suspend Mark-To-Market Now - Forbes and The mark to market fiasco.)

Chart What s the real unemployment rate

U6 Unemployment Rate Portal Seven

The Big Lie 5.6 Unemployment

In contrast, under George W. Bush, the U-6 stayed below 10% for the vast majority of his presidency, and it didn't go above 12% until the last three months of his second term. That sharp upswing came because of the Great Recession in 2008, which was largely caused by massive--and disastrous--federal intervention in the home loan industry (via Fannie Mae, Freddie Mac, and the CRA), which led to the housing crisis, which in turn triggered--and largely caused--the Great Recession. See:

Did Deregulation and Capitalism Cause the Financial Crisis

(And it's worth noting that the Great Recession was needlessly made worse by senseless federal regulations such as the ridiculous federal mark-to-market regulations. Those regulations were later quietly changed, in recognition of the damage they had done during the early stages of the recession. For more on the damage done by the federal mark-to-market restrictions, see Suspend Mark-To-Market Now - Forbes and The mark to market fiasco.)

Last edited: