Saw an article on gold and in April 2011 it was at $1,923 per ounce and now it is struggling to stay above $1,200. Last year alone if fell 35%. I don't own gold in my portfolio and may never because it is nothing like looking in to a stock or mutual fund. How do you know when it will rise or fall? What factors contribute to either. Also, if you actually go and buy cold coins you better hope you don't get robbed or lose them. Also do you insure them if they are kept in your home? Do you want to pay for a bank box to keep them in? As a young man I panned for gold in California and it was a blast as my brother and I both found some but not enough to match the weight of a house fly. If you are thinking about buying in to gold do so with only money you can afford to lose.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buying Gold- Can Be "Fools Gold"

- Thread starter fmdog44

- Start date

Roadrunner

Roadrunner

I have a stack of $300 Krugerrands.Saw an article on gold and in April 2011 it was at $1,923 per ounce and now it is struggling to stay above $1,200. Last year alone if fell 35%. I don't own gold in my portfolio and may never because it is nothing like looking in to a stock or mutual fund. How do you know when it will rise or fall? What factors contribute to either. Also, if you actually go and buy cold coins you better hope you don't get robbed or lose them. Also do you insure them if they are kept in your home? Do you want to pay for a bank box to keep them in? As a young man I panned for gold in California and it was a blast as my brother and I both found some but not enough to match the weight of a house fly. If you are thinking about buying in to gold do so with only money you can afford to lose.

I'm still good.

I get e-mails from landwatch about property on gold streams in Alabama.

I imagine you would have to have a lot of time on your hands to make enough for a good meal.

Ernie S.

Diamond Member

Bought at $900 and sold at $1800. I did OK. Considering about buying back in, but I'm thinking that where I'm at right now will be more profitable for the next 6 months.

william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,402

- 280

Gold like any other part of a balanced portfolio should be kept at target proportion of portfolio.

william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,402

- 280

That depends on whether you want a stable portfolio or you are shooting for a quick profit.

Trying to time the goal market has the same pit falls of all market timing. The smart move is to hold a small percentage of gold in order to lessen the effect of market crashes and recessions on your portfolio.

william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,402

- 280

As Moskowitz demonstrated back in the 1950s in the work that won him his Nobel Correlation is a bigger danger to a person's wealth than volatility.Trying to time the goal market has the same pit falls of all market timing. The smart move is to hold a small percentage of gold in order to lessen the effect of market crashes and recessions on your portfolio.

Crashes are where the money is made and bubbles are where money is lost, which is why balanced portfolios of almost any type out perform all but the very best of fundamentalist investors as the greatest fundamentalist investor pointed out in "The Intelligent Investor". The more balance sectors in the portfolio the more often you buy low and sell high.

Very good advice. When you allocate your funds across various sectors and asset classes you can reduce the impact of market crashes or economic slowdowns and get a more consistent return on your money. When shit happens as it does with most everyone, you are in a much better position to deal with it if you have a well balanced portfolio. I know many people that bailed out of the market in 2008 because they could not handle the huge drop in their portfolio value or because they lost their job or had other financial set backs.As Moskowitz demonstrated back in the 1950s in the work that won him his Nobel Correlation is a bigger danger to a person's wealth than volatility.Trying to time the goal market has the same pit falls of all market timing. The smart move is to hold a small percentage of gold in order to lessen the effect of market crashes and recessions on your portfolio.

Crashes are where the money is made and bubbles are where money is lost, which is why balanced portfolios of almost any type out perform all but the very best of fundamentalist investors as the greatest fundamentalist investor pointed out in "The Intelligent Investor". The more balance sectors in the portfolio the more often you buy low and sell high.

william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,402

- 280

Very good advice. When you allocate your funds across various sectors and asset classes you can reduce the impact of market crashes or economic slowdowns and get a more consistent return on your money. When shit happens as it does with most everyone, you are in a much better position to deal with it if you have a well balanced portfolio. I know many people that bailed out of the market in 2008 because they could not handle the huge drop in their portfolio value or because they lost their job or had other financial set backs.As Moskowitz demonstrated back in the 1950s in the work that won him his Nobel Correlation is a bigger danger to a person's wealth than volatility.Trying to time the goal market has the same pit falls of all market timing. The smart move is to hold a small percentage of gold in order to lessen the effect of market crashes and recessions on your portfolio.

Crashes are where the money is made and bubbles are where money is lost, which is why balanced portfolios of almost any type out perform all but the very best of fundamentalist investors as the greatest fundamentalist investor pointed out in "The Intelligent Investor". The more balance sectors in the portfolio the more often you buy low and sell high.

Exactly. Especially when the risk of creative destruction is so high that Apple is right on the borderline of market saturation because the modern computer chip era is about 60 years old right now. Lithium battery factories are under extreme pressure right this minute from capacitors, high-tech led batteries and to some degree from maser transmission. Also FREAK a 1990s US technology export restriction backdoor is in all of their current models and could send the Dow crashing at anytime.Very good advice. When you allocate your funds across various sectors and asset classes you can reduce the impact of market crashes or economic slowdowns and get a more consistent return on your money. When shit happens as it does with most everyone, you are in a much better position to deal with it if you have a well balanced portfolio. I know many people that bailed out of the market in 2008 because they could not handle the huge drop in their portfolio value or because they lost their job or had other financial set backs.As Moskowitz demonstrated back in the 1950s in the work that won him his Nobel Correlation is a bigger danger to a person's wealth than volatility.Trying to time the goal market has the same pit falls of all market timing. The smart move is to hold a small percentage of gold in order to lessen the effect of market crashes and recessions on your portfolio.

Crashes are where the money is made and bubbles are where money is lost, which is why balanced portfolios of almost any type out perform all but the very best of fundamentalist investors as the greatest fundamentalist investor pointed out in "The Intelligent Investor". The more balance sectors in the portfolio the more often you buy low and sell high.

Having a well diversified portfolio means no sleepless nights. To me, that's worth a lot. I have almost no chance of a 40% return this year but I won't have a 40% loss. I think I have an excellent chance of a 9% average yearly return over the next ten years without any major yearly loss in value in my portfolio. I guess some people would not be satisfied with that but I am and that's what's important to me..Very good advice. When you allocate your funds across various sectors and asset classes you can reduce the impact of market crashes or economic slowdowns and get a more consistent return on your money. When shit happens as it does with most everyone, you are in a much better position to deal with it if you have a well balanced portfolio. I know many people that bailed out of the market in 2008 because they could not handle the huge drop in their portfolio value or because they lost their job or had other financial set backs.As Moskowitz demonstrated back in the 1950s in the work that won him his Nobel Correlation is a bigger danger to a person's wealth than volatility.Trying to time the goal market has the same pit falls of all market timing. The smart move is to hold a small percentage of gold in order to lessen the effect of market crashes and recessions on your portfolio.

Crashes are where the money is made and bubbles are where money is lost, which is why balanced portfolios of almost any type out perform all but the very best of fundamentalist investors as the greatest fundamentalist investor pointed out in "The Intelligent Investor". The more balance sectors in the portfolio the more often you buy low and sell high.Exactly. Especially when the risk of creative destruction is so high that Apple is right on the borderline of market saturation because the modern computer chip era is about 60 years old right now. Lithium battery factories are under extreme pressure right this minute from capacitors, high-tech led batteries and to some degree from maser transmission. Also FREAK a 1990s US technology export restriction backdoor is in all of their current models and could send the Dow crashing at anytime.Very good advice. When you allocate your funds across various sectors and asset classes you can reduce the impact of market crashes or economic slowdowns and get a more consistent return on your money. When shit happens as it does with most everyone, you are in a much better position to deal with it if you have a well balanced portfolio. I know many people that bailed out of the market in 2008 because they could not handle the huge drop in their portfolio value or because they lost their job or had other financial set backs.As Moskowitz demonstrated back in the 1950s in the work that won him his Nobel Correlation is a bigger danger to a person's wealth than volatility.Trying to time the goal market has the same pit falls of all market timing. The smart move is to hold a small percentage of gold in order to lessen the effect of market crashes and recessions on your portfolio.

Crashes are where the money is made and bubbles are where money is lost, which is why balanced portfolios of almost any type out perform all but the very best of fundamentalist investors as the greatest fundamentalist investor pointed out in "The Intelligent Investor". The more balance sectors in the portfolio the more often you buy low and sell high.

william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,402

- 280

Having a well diversified portfolio means no sleepless nights. To me, that's worth a lot. I have almost no chance of a 40% return this year but I won't have a 40% loss. I think I have an excellent chance of a 9% average yearly return over the next ten years without any major yearly loss in value in my portfolio. I guess some people would not be satisfied with that but I am and that's what's important to me..Very good advice. When you allocate your funds across various sectors and asset classes you can reduce the impact of market crashes or economic slowdowns and get a more consistent return on your money. When shit happens as it does with most everyone, you are in a much better position to deal with it if you have a well balanced portfolio. I know many people that bailed out of the market in 2008 because they could not handle the huge drop in their portfolio value or because they lost their job or had other financial set backs.As Moskowitz demonstrated back in the 1950s in the work that won him his Nobel Correlation is a bigger danger to a person's wealth than volatility.Trying to time the goal market has the same pit falls of all market timing. The smart move is to hold a small percentage of gold in order to lessen the effect of market crashes and recessions on your portfolio.

Crashes are where the money is made and bubbles are where money is lost, which is why balanced portfolios of almost any type out perform all but the very best of fundamentalist investors as the greatest fundamentalist investor pointed out in "The Intelligent Investor". The more balance sectors in the portfolio the more often you buy low and sell high.

Exactly. Especially when the risk of creative destruction is so high that Apple is right on the borderline of market saturation because the modern computer chip era is about 60 years old right now. Lithium battery factories are under extreme pressure right this minute from capacitors, high-tech led batteries and to some degree from maser transmission. Also FREAK a 1990s US technology export restriction backdoor is in all of their current models and could send the Dow crashing at anytime.

A good portfolio will not only let you sleep but put you to sleep. Of course some stuff is just too freaky. 12% dividend yield on a utility ETF, investment grade munis paying more than treasuries and my own favorite my wife asking investment advice without getting her research notes out.

Gold has never been worth zero.

You might lose money holding gold but you can never lose all of your wealth.

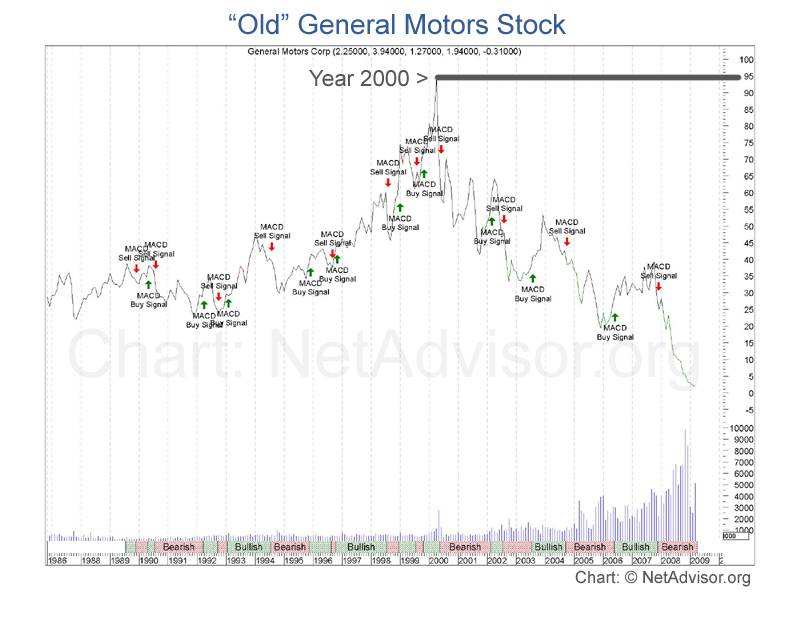

Now consider the wealth of countless widows and children whose trust funds were heavy on General Motors stock when Obama decided to seize the company and redistribute it to the unions.

You might lose money holding gold but you can never lose all of your wealth.

Now consider the wealth of countless widows and children whose trust funds were heavy on General Motors stock when Obama decided to seize the company and redistribute it to the unions.

william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,402

- 280

Gold has never been worth zero.

You might lose money holding gold but you can never lose all of your wealth.

Now consider the wealth of countless widows and children whose trust funds were heavy on General Motors stock when Obama decided to seize the company and redistribute it to the unions.

The desire for a one size fits all solution has provided Larry NIven with the majority of his stories based on his Great great grandfather's fortune and how his descendants have tried to improve on it. The three Hunt families also provide such stories as well. An unbalanced portfolio will get you everytime.Gold has never been worth zero.

You might lose money holding gold but you can never lose all of your wealth.

Now consider the wealth of countless widows and children whose trust funds were heavy on General Motors stock when Obama decided to seize the company and redistribute it to the unions.

Most of the people losing money are the loons who bought it at $1700 thinking it was going to go to $10,000. Stupid is as stupid does.Bought at $900 and sold at $1800. I did OK. Considering about buying back in, but I'm thinking that where I'm at right now will be more profitable for the next 6 months.

william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,402

- 280

Speculation is rough. The highest credible claimed batting average is Tudor Roberts at .300. I doubt anyone on the internet is going to beat that.

GM stock peaked in 1999 at about 95 a share and fell steadily for 10 years before going belly up. Any trustee that carried this trash in a trust for windows and children was an incompetent boob.Gold has never been worth zero.

You might lose money holding gold but you can never lose all of your wealth.

Now consider the wealth of countless widows and children whose trust funds were heavy on General Motors stock when Obama decided to seize the company and redistribute it to the unions.

Similar threads

- Replies

- 5

- Views

- 96

- Replies

- 97

- Views

- 1K

Latest Discussions

- Replies

- 7

- Views

- 46

- Replies

- 153

- Views

- 874

- Replies

- 2

- Views

- 38

- Replies

- 75

- Views

- 858

Forum List

-

-

-

-

-

Political Satire 7995

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 465

-

-

-

-

-

-

-

-

-

-