- Sep 19, 2020

- 7,036

- 8,156

- 2,138

How'd your portfolio do?

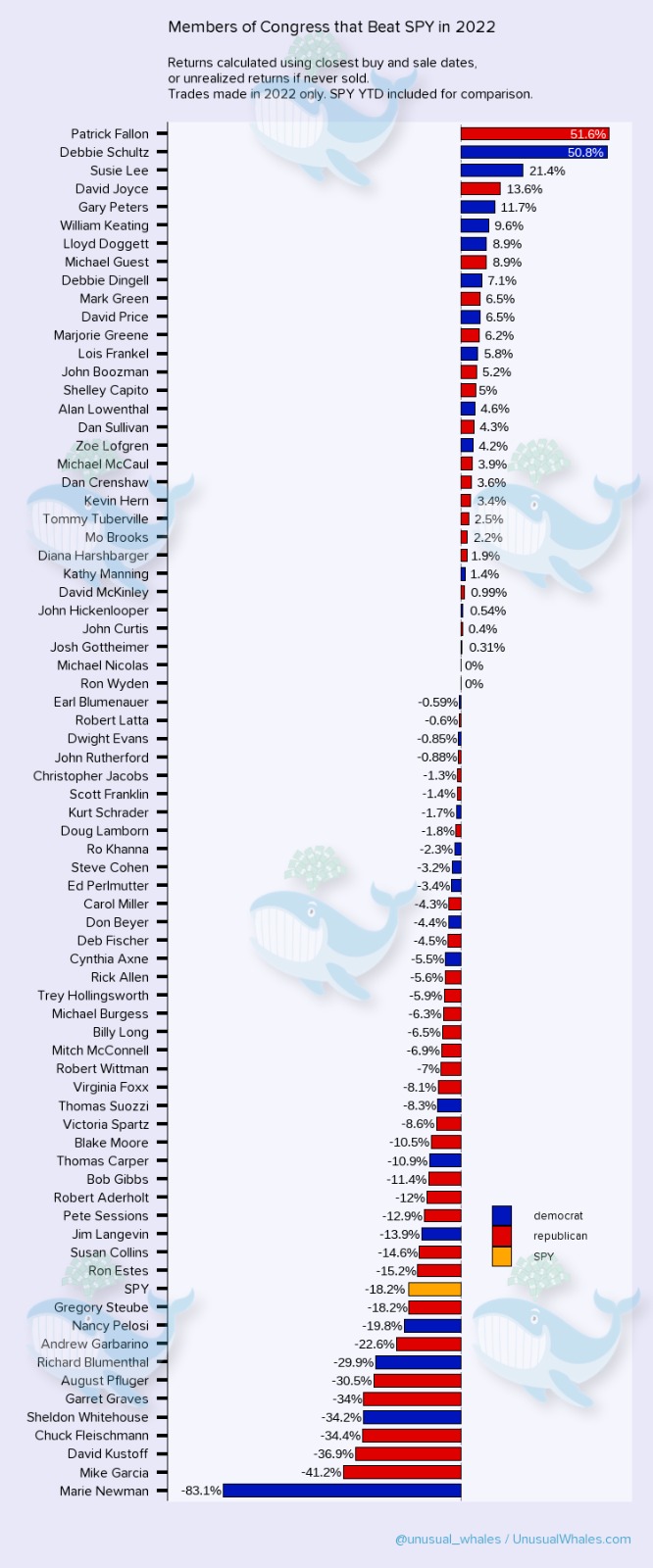

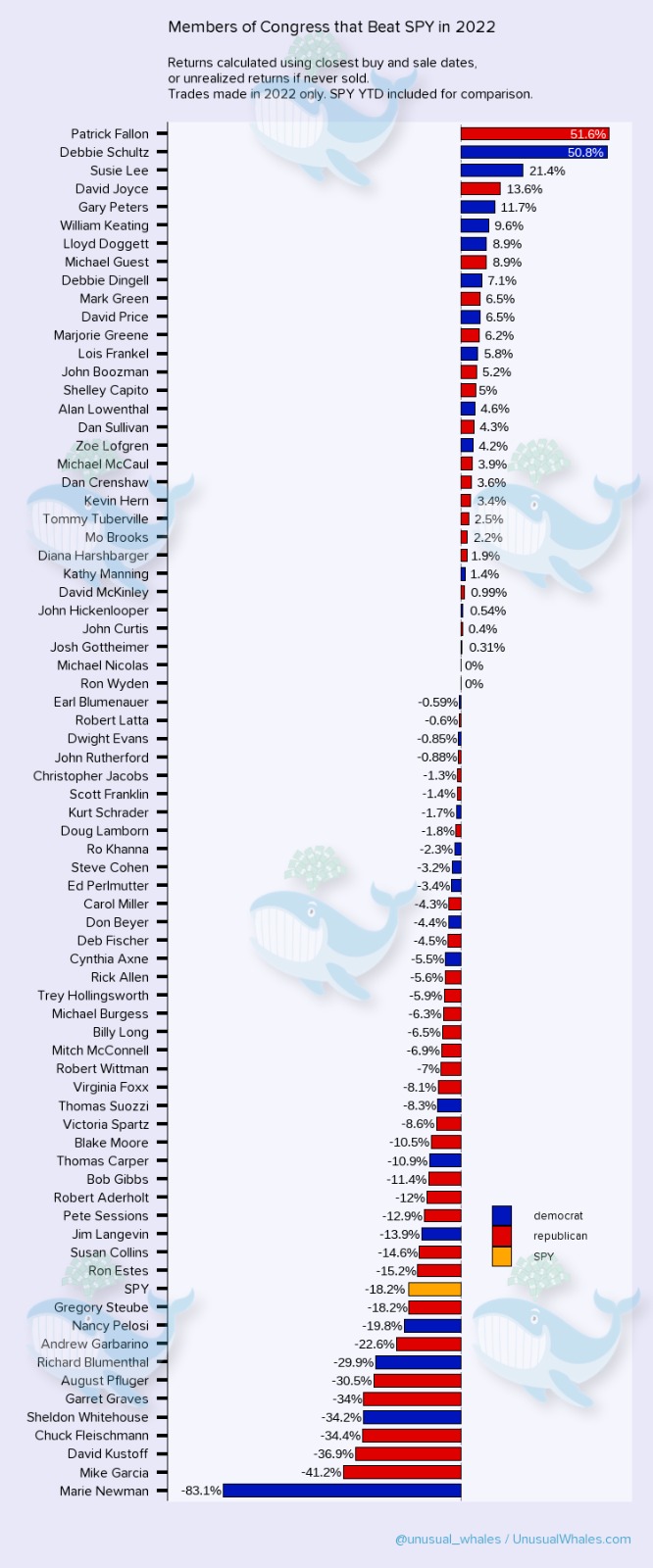

Both Democrat and Republican lawmakers on average beat the stock market again in 2022, according to Unusual Whales’ annual report.

Despite the stock market having one of the worst years since 2008, lawmakers were able to avoid huge losses in 2022. While the total value of stocks traded shrunk, some politicians, such as far-left Rep. Ro Khanna (D-CA), made more than 5,700 trades in 2022, the report shows.

In 2022, the S&P 500 was down 18 percent. Yet on average, Republicans collectivity beat the market by 0.4 percent, while Democrats were only down -1.76 percent.

www.breitbart.com

www.breitbart.com

Comments: There a couple of ETFs proposed to track Congressional stock trades. I think a good ticker symbol would be Senate/House Insider Trading Fund ($#!+)

Full report here (tons of data with helpful charts):

unusualwhales.com

unusualwhales.com

Below you will find specific examples of trades which may explain how Congress is so talented at picking stock winners and losers...

Unusual Committee Conflicts

Both Democrat and Republican lawmakers on average beat the stock market again in 2022, according to Unusual Whales’ annual report.

Despite the stock market having one of the worst years since 2008, lawmakers were able to avoid huge losses in 2022. While the total value of stocks traded shrunk, some politicians, such as far-left Rep. Ro Khanna (D-CA), made more than 5,700 trades in 2022, the report shows.

In 2022, the S&P 500 was down 18 percent. Yet on average, Republicans collectivity beat the market by 0.4 percent, while Democrats were only down -1.76 percent.

Report: Democrat, GOP Lawmakers Beat Terrible Stock Market in 2022

Both Democrat and Republican lawmakers on average beat the stock market again in 2022, according to Unusual Whales' annual report.

Comments: There a couple of ETFs proposed to track Congressional stock trades. I think a good ticker symbol would be Senate/House Insider Trading Fund ($#!+)

Full report here (tons of data with helpful charts):

The Unusual Whales Congress Trading Report for 2022

Congress has beaten the markets once again in 2022. We've explored numerous ways on how Congress traded, their trends, as well as the most unusual of trades. Read it now to see how Congress beats the market and performs with conflicts, privy information, and power over laws that benefit them.

Below you will find specific examples of trades which may explain how Congress is so talented at picking stock winners and losers...

Unusual Committee Conflicts

- Alan Lowenthal - member of the Natural Resources House Committee - has disclosed sixteen different investments, fifteen made by his spouse, and one disclosed jointly, in the company Sunrun. Sunrun is a provider of photovoltaic solar energy generation systems and battery energy storage products. Averaging 261% across the sixteen investments. He is the chair of the Energy and Mineral Resources (EMR) Sub-committee . The jurisdiction of the EMR includes the “planning for and development of energy from solar and wind resources on land belonging to the United States, including the outer Continental Shelf.” (Source)

- Similarly, Debbie Wasserman Schultz - another member of the House Natural Resources Committee as well as the House Oversight Committee - has disclosed investments in Patterson-UTI Energy, which provides land drilling and pressure pumping services, directional drilling, rental equipment and technology to clients in the United States and western Canada. Her investments in Patterson currently yield a 68% return.

- Senator Jerry Moran, disclosed purchasing Halliburton Company, on March 10, 2020, and is as of the time of this report, up over 325%. Moran is a member of the Appropriations Committee, Banking, Housing, and Urban Affairs Committee, Commerce, Science, and Transportation Committee, and Health, Education, Labor, and Pensions Committee.

- Senator Bill Casidy - a member of the Energy and Natural Resources, is up 58% since March 9th, 2020 in an investment his spouse made in Phillips 66, an energy manufacturing and logistics company, you may recognize from its many gas stations. .

- House Republican Andrew Garbarino, who sits on the Committee on Small Business, bought and sold up to $15k in OneSpaWorld Holdings ($OSW) stocks, which conveniently lobbied the government on “Small Business” issues. He sold for +1.05%.

- House Democrat Josh Gottheimer, who sits on the Committee on Financial Services, bought up to $30k and sold up to $15k in BHP Group Limited ($BHP) stocks, which lobbied the government on “Financial Institutions/Investments/Securities” and “Taxation/Internal Revenue Code” among many other issues. He also traded HCA Healthcare ($HCA) several times in 2021, which also lobbied on “Taxation/Internal Revenue Code”, “Budget/Appropriations”, and “Insurance”. By the end of 2021, his most recent purchase of up to $15k had gained +40%.

- House Democrat Lloyd Doggett, who sits on both Committees on the Budget, and on Ways and Means (which together have jurisdictions over government spending, revenue and taxation), bought Procter & Gamble Co. ($PG) stocks four times throughout 2021. PG lobbied the government on “Taxation/Internal Revenue Code”. Taking his earliest purchase date, he was up 30.5% by the end of 2021.

- House Republican Kevin Hern, who also sits on the Committee on Ways and Means, bought and sold FS Investments ($FSK) stocks. The company lobbied Congress on “Taxation/Internal Revenue Code”. Rep. Hern was up 33.2% at the time of selling.

- House Democrat Thomas Suozzi, who also sits on the Committee on Ways and Means, bought and sold CVS Health ($CVS), MGM Resort ($MGM), and Eli Lilly ($LLY) stocks throughout 2021. All companies lobbied Congress on “Taxation/Internal Revenue Code”. He bought up to $130k and sold up to $65k in $CVS, and one of these trades was up 52.6%. change to: He bought up to $130k and sold up to $65k in $CVS, and one of these trades was up 52.6% as of May 1, 2022.

- House Democrat Earl Blumenauer sits on the Committee on Ways and Means and its Subcommittee on Health. He bought $15k in Pfizer ($PFE) stocks on May 7, 2021 and has held (up 50% by end of 2021, but down in 2022). Pfizer lobbied Congress on several issues including: “Health Issues,” “Medicare/Medicaid,” and “Taxation/Internal Revenue Code”.

- House Democrat John Yarmuth sits on the House Committee on the Budget, and bought $15k in 3M ($MMM) stocks in September 2021. 3M has lobbied on a variety of issues, but relevant to Representative Yarmuth, they lobbied on “Budget/Appropriations”. He was only up 1.21% by the end of the year.

- House Republican Mark Green, known for his excessive trading in the oil and gas industry, sits on the Committee on Foreign Affairs. In Q1 2021, he bought up to $750k in BP Midstream Partners ($BPMP) and later sold off up to $500k in Q2 (up 9.74%). BP America lobbied Congress on many issues related to the oil and gas industry, but of interest here were “Foreign Relations” and “Trade (Domestic & Foreign)”.

- Republican Senator Tommy Tuberville, who sits on the Committee on Health, Education, Labor and Pensions. He bought and sold 3M ($MMM) and Procter & Gamble Co. ($PG) stocks during 2021, sold $MMM during 2021 and sold off $PG in early 2022. Both companies have lobbied Congress on “Health Issues”.

- Freshman Senate Democrat John Hickenlooper sits on the Senate Committee on Commerce, Science and Technology, bought Dragoneer Growth Opportunities Corporation (previously $DGNR), a SPAC, on February 21, 2021. Dragoneer and CCC Intelligent Solutions Inc. (previously $CCC, now $CCCS) announced their intent to merge at the beginning of February and completed said merger in August. CCC Intelligent Solutions lobbied the government on “Science/Technology” among other issues for a total of $240,000 in lobbying contributions. Senator Hickenlooper also sits on the Committee on Small Business and Entrepreneurship.

- Tuberville’s colleague, Republican Senator Jerry Moran, also sits on the same committee and sold off up to $15k in CVS stocks in late 2021. Taking his earlier purchase date back in August 2020, he was +63% as of May 1, 2022. CVS lobbied the government on “Health Issues” as well, along with “Medicare/Medicaid” and “Insurance”, noting lobbying expenses just under $9M.