Trajan

conscientia mille testes

So, I put this in political forum because this is and will be a huge a political issue in the campaign(s) ( as it already has been made so).

Call it Class Warfare, a leveling out of whos got what and why they should or should not be pay more or less, what they have paid in the past

The truth of the matter is; one of the great strengths of America has always been an upwardly mobile nation, one can given sufficient talent , ambition, grit lift oneself UP ..and, as in all things there is a balance , that upward mobility driven by those great leveler s of innovation, determination, talent, can also via creative destruction, mismanagement, bad luck what have you, put you DOWN.

Despite the medias/politicians best attempts at making it appear so, the rich just dont sit around lighting $20 cigars with $100 dollar bills the jungle of life can provide sustenance or it can eat you up. When the beast gets hungry it doesnt care what you make or what you are or are not.

Millionaires Go Missing

There's nothing like a recession to level incomes.

snip-

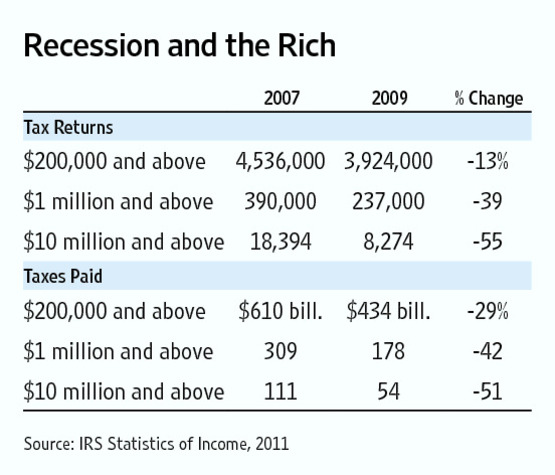

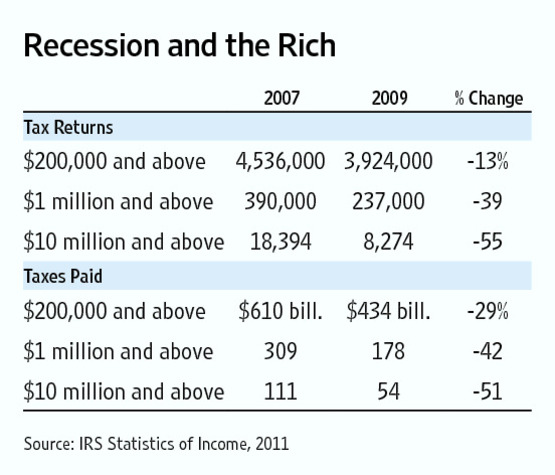

In 2007, 390,000 tax filers reported adjusted gross income of $1 million or more and paid $309 billion in taxes. In 2009, there were only 237,000 such filers, a decline of 39%.

Almost four of 10 millionaires vanished in two years, and the total taxes they paid in 2009 declined to $178 billion, a drop of 42%.

Those with $10 million or more in reported income fell to 8,274 from 18,394 in 2007, a 55% drop. As a result, their tax payments tanked by 51%.

These disappearing millionaires go a long way toward explaining why federal tax revenues have sunk to 15% of GDP in recent years. The loss of millionaires accounts for at least $130 billion of the higher federal budget deficit in 2009.

If Warren Buffett wants to reduce the deficit, he should encourage policies to create more millionaires, not campaign to tax them more.

The millionaires who are left still pay a mountain of tax.

Those who make $1 million accounted for about 0.2% of all tax returns but paid 20.4% of income taxes in 2009. Those with adjusted gross income above $200,000 a year were just under 3% of tax filers but paid 50.1% of the $866 billion in total personal income taxes. This means the top 3% paid more than the bottom 97%.

Yet the 3% are the people that President Obama claims don't pay their fair share. Before the recession, the $200,000 income group paid 54.5% of the income tax.

For the past three decades, the political left has obsessed about income inequality. As the economy experienced one of the largest and lengthiest economic booms in history from 1982-2007, the left moaned that the gains went to yacht club members.

Well, if equality of income is the priority, liberals should be thrilled with the last four years. The recession and weak recovery have been income levelers. Those who make more than $200,000 captured one-quarter of the $7.6 trillion in total income in 2009.

In 2007 the over-$200,000 crowd had one-third of reported U.S. taxable income. Those with incomes above $1 million earned 9.5% of total income in 2009, down from 16.1% in 2007.

snip-

more at

Review & Outlook: Millionaires Go Missing - WSJ.com

Call it Class Warfare, a leveling out of whos got what and why they should or should not be pay more or less, what they have paid in the past

The truth of the matter is; one of the great strengths of America has always been an upwardly mobile nation, one can given sufficient talent , ambition, grit lift oneself UP ..and, as in all things there is a balance , that upward mobility driven by those great leveler s of innovation, determination, talent, can also via creative destruction, mismanagement, bad luck what have you, put you DOWN.

Despite the medias/politicians best attempts at making it appear so, the rich just dont sit around lighting $20 cigars with $100 dollar bills the jungle of life can provide sustenance or it can eat you up. When the beast gets hungry it doesnt care what you make or what you are or are not.

Millionaires Go Missing

There's nothing like a recession to level incomes.

snip-

In 2007, 390,000 tax filers reported adjusted gross income of $1 million or more and paid $309 billion in taxes. In 2009, there were only 237,000 such filers, a decline of 39%.

Almost four of 10 millionaires vanished in two years, and the total taxes they paid in 2009 declined to $178 billion, a drop of 42%.

Those with $10 million or more in reported income fell to 8,274 from 18,394 in 2007, a 55% drop. As a result, their tax payments tanked by 51%.

These disappearing millionaires go a long way toward explaining why federal tax revenues have sunk to 15% of GDP in recent years. The loss of millionaires accounts for at least $130 billion of the higher federal budget deficit in 2009.

If Warren Buffett wants to reduce the deficit, he should encourage policies to create more millionaires, not campaign to tax them more.

The millionaires who are left still pay a mountain of tax.

Those who make $1 million accounted for about 0.2% of all tax returns but paid 20.4% of income taxes in 2009. Those with adjusted gross income above $200,000 a year were just under 3% of tax filers but paid 50.1% of the $866 billion in total personal income taxes. This means the top 3% paid more than the bottom 97%.

Yet the 3% are the people that President Obama claims don't pay their fair share. Before the recession, the $200,000 income group paid 54.5% of the income tax.

For the past three decades, the political left has obsessed about income inequality. As the economy experienced one of the largest and lengthiest economic booms in history from 1982-2007, the left moaned that the gains went to yacht club members.

Well, if equality of income is the priority, liberals should be thrilled with the last four years. The recession and weak recovery have been income levelers. Those who make more than $200,000 captured one-quarter of the $7.6 trillion in total income in 2009.

In 2007 the over-$200,000 crowd had one-third of reported U.S. taxable income. Those with incomes above $1 million earned 9.5% of total income in 2009, down from 16.1% in 2007.

snip-

more at

Review & Outlook: Millionaires Go Missing - WSJ.com