ScienceRocks

Democrat all the way!

- Banned

- #1

Wind and Solar Are Crushing Fossil Fuels

Record clean energy investment outpaces gas and coal 2 to 1

Quote

Here's what's shaping power markets, in six charts from BNEF:

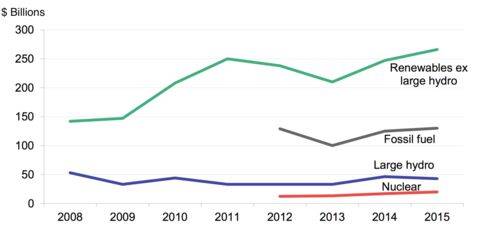

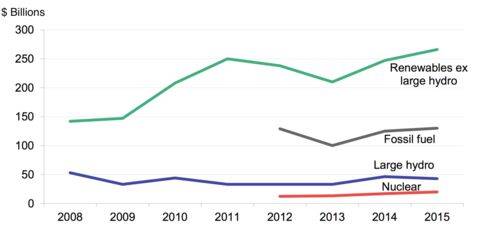

Renewables are beating fossil fuels 2 to 1

Investment in Power Capacity, 2008-2015

Source: BNEF, UNEP

Quote

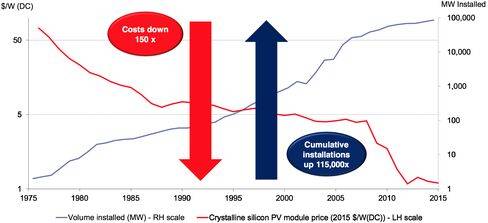

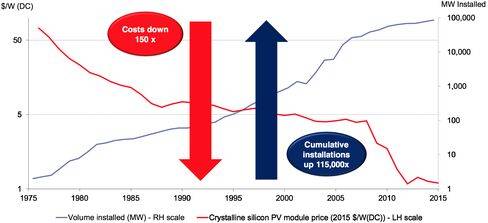

As solar prices fall, installations boom

The price has dropped so much that the private sector is starting to favor solar and wind!

Record clean energy investment outpaces gas and coal 2 to 1

Quote

Wind and solar have grown seemingly unstoppable.

While two years of crashing prices for oil, natural gas, and coal triggered dramatic downsizing in those industries, renewables have been thriving. Clean energy investment broke new records in 2015 and is now seeing twice as much global funding as fossil fuels.

One reason is that renewable energy is becoming ever cheaper to produce. Recent solar and wind auctions in Mexico and Morocco ended with winning bids from companies that promised to produce electricity at the cheapest rate, from any source, anywhere in the world, said Michael Liebreich, chairman of the advisory board for Bloomberg New Energy Finance (BNEF).

"We're in a low-cost-of-oil environment for the foreseeable future," Liebreich said during his keynote address at the BNEF Summit in New York on Tuesday. "Did that stop renewable energy investment? Not at all."

Here's what's shaping power markets, in six charts from BNEF:

Renewables are beating fossil fuels 2 to 1

Investment in Power Capacity, 2008-2015

Source: BNEF, UNEP

Quote

Government subsidies have helped wind and solar get a foothold in global power markets, but economies of scale are the true driver of falling prices: The cost of solar power has fallen to 1/150th of its level in the 1970s, while the total amount of installed solar has soared 115,000-fold.

As solar prices fall, installations boom

The price has dropped so much that the private sector is starting to favor solar and wind!