I've seen it written around here that Reaganomics is wrong and that everyone knows that if the gov't gives money to the low income people, they'll spend it, thereby increasing demand which leads to more jobs. "Priming the pump" it's called, to get the money flowing and the economy moving. Sounds great, so why doesn't it work? Bush43 gave out a couple of tax rebate checks, neither of which helped. Japan tried 10 different stimulus packages, that didn't work. And of course Obama tried a couple of stimulus packages that didn't work too well either. So why weren't those efforts more successful?

I think it's mostly because people don't see the permanence of it. They don't need a check for a couple hundred bucks, they need a job. There needs to be reasons why people believe the future looks better financially, and indeed in every other way too. A stimulus program doesn't cut it, not by itself. You need a change of policy that is significant enough and logical enough to convince the public that we're on the right track. Have you sen the latest poll numbers, 69% think we're on the wrong track in this country. I think we need substance over smoke and mirrors.

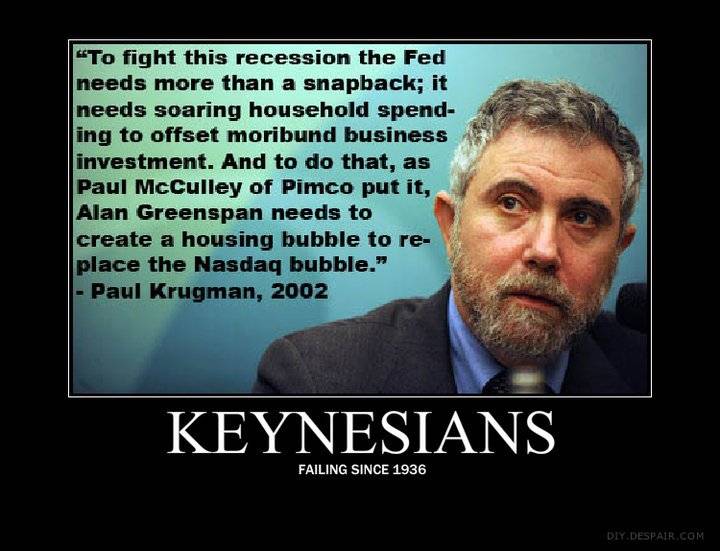

Paul Krugman and others on the left think that we need to double down, more stimulus money to the low income people. Raise taxes on the rich to pay for it? But that's not really an increase in spending, but rather just a different group of people doing the spending. Saving money in a bank, or investing in a company has the same effect on a macrolevel because that money finds it's way into the system too. Borrow money internally within the gov't or with US citizens? Same deal, there's no real net increase in consumption if you take a dollar from here and give it to someone over there. How about printing more money? Then the value if your currency goes down and you eventually end up with inflation.

History tells us that increased gov't spending doesn't help your economy get out of a financial hole. That's why every other country in financial trouble is reducing their spending. Keynes' model was designed for a closed authoritarian economy, and maybe it would help in some circumstances. But I'm not seeing it for us, we'd be just adding more debt and getting nowhere.

I think it's mostly because people don't see the permanence of it. They don't need a check for a couple hundred bucks, they need a job. There needs to be reasons why people believe the future looks better financially, and indeed in every other way too. A stimulus program doesn't cut it, not by itself. You need a change of policy that is significant enough and logical enough to convince the public that we're on the right track. Have you sen the latest poll numbers, 69% think we're on the wrong track in this country. I think we need substance over smoke and mirrors.

Paul Krugman and others on the left think that we need to double down, more stimulus money to the low income people. Raise taxes on the rich to pay for it? But that's not really an increase in spending, but rather just a different group of people doing the spending. Saving money in a bank, or investing in a company has the same effect on a macrolevel because that money finds it's way into the system too. Borrow money internally within the gov't or with US citizens? Same deal, there's no real net increase in consumption if you take a dollar from here and give it to someone over there. How about printing more money? Then the value if your currency goes down and you eventually end up with inflation.

History tells us that increased gov't spending doesn't help your economy get out of a financial hole. That's why every other country in financial trouble is reducing their spending. Keynes' model was designed for a closed authoritarian economy, and maybe it would help in some circumstances. But I'm not seeing it for us, we'd be just adding more debt and getting nowhere.