- Sep 19, 2011

- 28,409

- 9,985

- 900

I know a lot of people reading this say "duh"... of course it is vital!

But if a lot of people know it, when then support an agenda that discourages full employment?

First why ..

Tax money coming in less money going out..

a) Full employment or 96% working means billions MORE in Social security/Medicare payments from BOTH employees and Employers!

b) More working means more consumer spending meaning more profits meaning more income taxes.

c) Less unemployed means less unemployment benefits ($300/week for 99 weeks) $30,000 for 5.6 million or $166 billion!

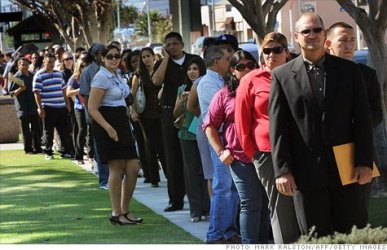

The latest numbers show 12.7 million unemployed and 5.6 million getting benefits, compared with 13.9 million jobless and 7.3 million receiving

aid at the same time last year.Unemployment Less Forgiving As Fewer Receive Benefits

HOW can we get "full employment"??

Well we shouldn't be discouraging employers. We shouldn't be ENCOURAGING the people with money to move money out of the USA.

Political risk. Or, as he puts in a nice legal euphemism, "jurisdictional diversification."

The new reason, though, is political risk: "Diversification from our government, policies, and banking systems," says Duggan. The last few years have shaken faith in our system. Duggan says growing numbers of his clients are worried about the financial system, confiscation -- the whole shebang. "They're concerned about our government, and where our society is headed. There's a lot of socialistic tendencies, capital controls, the redistribution of wealth."

Once again it's easy to scoff. Financially, the very wealthy have probably never had it so good in this country. Corporate profits and financial assets are booming. Tax rates on dividends and long-term capital gains are very, very low. But Duggan says the wealthy feel under attack, and government rhetoric is making them nervous.

But there's a logical problem here. Imagine a future government did decide to confiscate assets. They'd go after the money you held in Switzerland just as much as the money you held in New York, and the penalties for tax evasion would be as medieval as they are now.

The Real Reasons the Rich Are Moving Cash to the Caymans - SmartMoney.com

So for all of you that laugh at concerns about Obama's socialistic agenda... the above is the reality!

But if the MONEY is flowing out of the country because the wealthy fear "confiscation"!

So why would the "smartest" President put in place rules,regulations, discouraging business creation, discouraging hiring unless he wants the USA to fail!

It is NOT the recipe for growth when more people think by Obama's actions he wants to take their wealth!

But if a lot of people know it, when then support an agenda that discourages full employment?

First why ..

Tax money coming in less money going out..

a) Full employment or 96% working means billions MORE in Social security/Medicare payments from BOTH employees and Employers!

b) More working means more consumer spending meaning more profits meaning more income taxes.

c) Less unemployed means less unemployment benefits ($300/week for 99 weeks) $30,000 for 5.6 million or $166 billion!

The latest numbers show 12.7 million unemployed and 5.6 million getting benefits, compared with 13.9 million jobless and 7.3 million receiving

aid at the same time last year.Unemployment Less Forgiving As Fewer Receive Benefits

HOW can we get "full employment"??

Well we shouldn't be discouraging employers. We shouldn't be ENCOURAGING the people with money to move money out of the USA.

Political risk. Or, as he puts in a nice legal euphemism, "jurisdictional diversification."

The new reason, though, is political risk: "Diversification from our government, policies, and banking systems," says Duggan. The last few years have shaken faith in our system. Duggan says growing numbers of his clients are worried about the financial system, confiscation -- the whole shebang. "They're concerned about our government, and where our society is headed. There's a lot of socialistic tendencies, capital controls, the redistribution of wealth."

Once again it's easy to scoff. Financially, the very wealthy have probably never had it so good in this country. Corporate profits and financial assets are booming. Tax rates on dividends and long-term capital gains are very, very low. But Duggan says the wealthy feel under attack, and government rhetoric is making them nervous.

But there's a logical problem here. Imagine a future government did decide to confiscate assets. They'd go after the money you held in Switzerland just as much as the money you held in New York, and the penalties for tax evasion would be as medieval as they are now.

The Real Reasons the Rich Are Moving Cash to the Caymans - SmartMoney.com

So for all of you that laugh at concerns about Obama's socialistic agenda... the above is the reality!

But if the MONEY is flowing out of the country because the wealthy fear "confiscation"!

So why would the "smartest" President put in place rules,regulations, discouraging business creation, discouraging hiring unless he wants the USA to fail!

It is NOT the recipe for growth when more people think by Obama's actions he wants to take their wealth!