It is not a dodge - it is EXACTLY what we need to do. I do not want anyone's taxes to raise. More to the point - this thread is about reforming the tax system to a flat rate, NOT about shifting the burden. I already stated my opinion about a flat tax and nowhere did I say we need to raise taxes for people. Revenue is not the problem with government shortages, it is the inability to control spending in ANY meaningful way that has created this mess we are in and THAT is where we need to concentrate for solving shortfalls.That's the dodge I want posters to avoid.

If you cut taxes for the rich, you lose revenue. Therefore, whose taxes do you want to raise to make up that revenue? Your own?

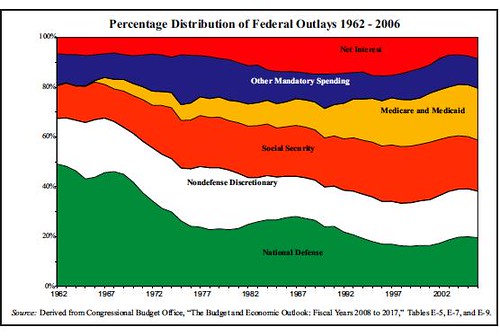

That is one of the MANY places we need to begin cutting spending. I believe that we are FINALLY looking at that part now as they are gearing to close many of the bases that we have around the world that we really do not need. Unfortunately that is ONE piece of the grater problem and the cop out that all liberals seem to take as soon as you mention cutting spending. Sorry buddy, that will not work - we need to make cuts across the board and defense is certainly in that bucket.On defense, which is the largest discretionary item on the budget?