Widdekind

Member

- Mar 26, 2012

- 813

- 35

- 16

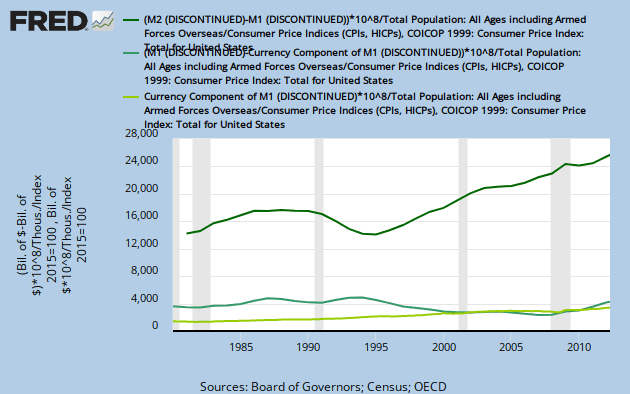

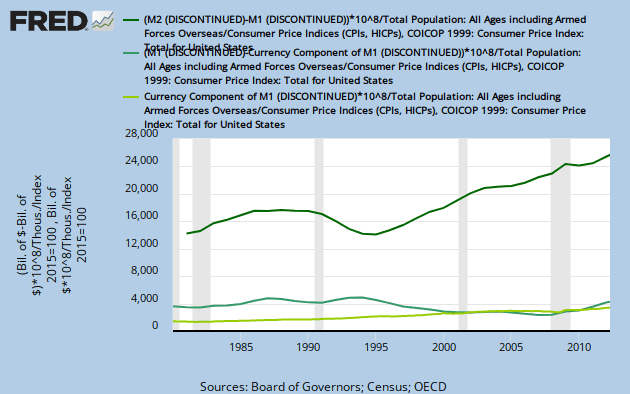

"M2 - M1" represents "savings accounts" in banks. Before NAFTA, US citizens were drawing down their "savings accounts", as measured by "M2 - M1" per capita, inflation adjusted (via CPI):

If Americans have been spending more, on cheaper foreign imports, since NAFTA; then who has been saving more 'real' (inflation-adjusted) Money, into "savings accounts", since c.1993 ?

If Americans have been spending more, on cheaper foreign imports, since NAFTA; then who has been saving more 'real' (inflation-adjusted) Money, into "savings accounts", since c.1993 ?