- Nov 26, 2011

- 123,518

- 54,796

- 2,290

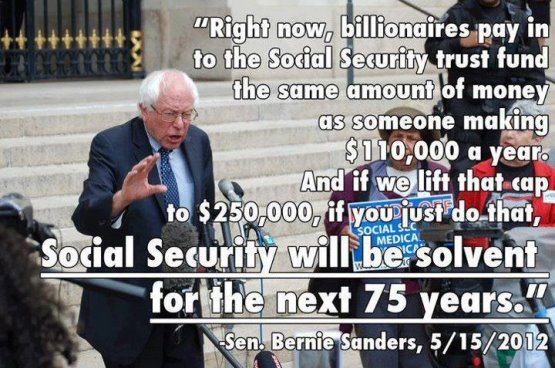

Removing the Social Security earnings cap virtually eliminates funding gapWithout false premises, distortions and lies, what would right wingers EVER have?

A combination of factual inaccuracy and noise spewed by Bernie Sanders. Sanders solution has dropped from 75 years to 46 - provided that the economy cooperates. Sander's is the king of disinformation on Social Security.