JoeTheEconomist

VIP Member

- Sep 4, 2015

- 531

- 62

- 80

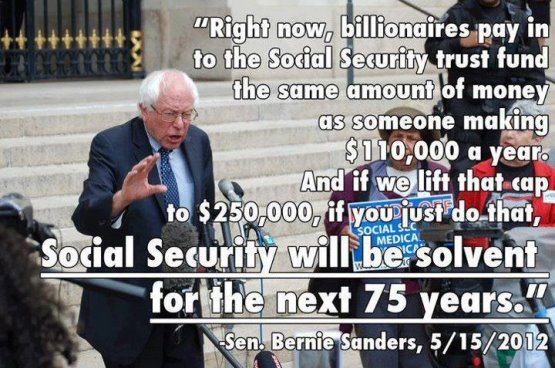

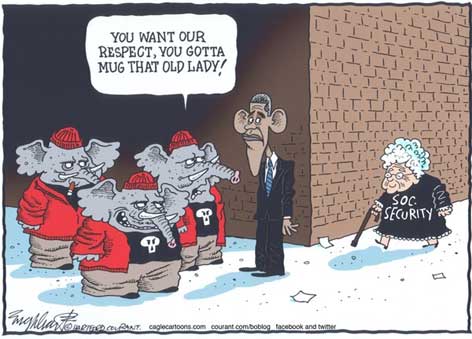

The most popular response to the question how did Social Security go off track is : someone (insert a variety of names) stole the money. Chris Christie - the only candidate willing to talk about Social Security - has invoked the crazy card in both of the GOP debates. They stole it without ever asserting who 'they' is.

There is exactly zero evidence that any money has been misused. What people call 'worthless IOUs', investment professionals call cash equivalents. The Trust Fund today is what separates us from immediate 12% reduction in benefits.

It is easier for people to believe that someone stole the money rather than the system is simply broken, spinning promises out of control.

The longer article is now Independent Voter News,

Despite What You've Heard, No One Is Stealing from Social Security - IVN.us

There is exactly zero evidence that any money has been misused. What people call 'worthless IOUs', investment professionals call cash equivalents. The Trust Fund today is what separates us from immediate 12% reduction in benefits.

It is easier for people to believe that someone stole the money rather than the system is simply broken, spinning promises out of control.

The longer article is now Independent Voter News,

Despite What You've Heard, No One Is Stealing from Social Security - IVN.us

Ask the activities aide there at the old folks home to get you some.

Ask the activities aide there at the old folks home to get you some.