- Banned

- #1

Who damage the economy?

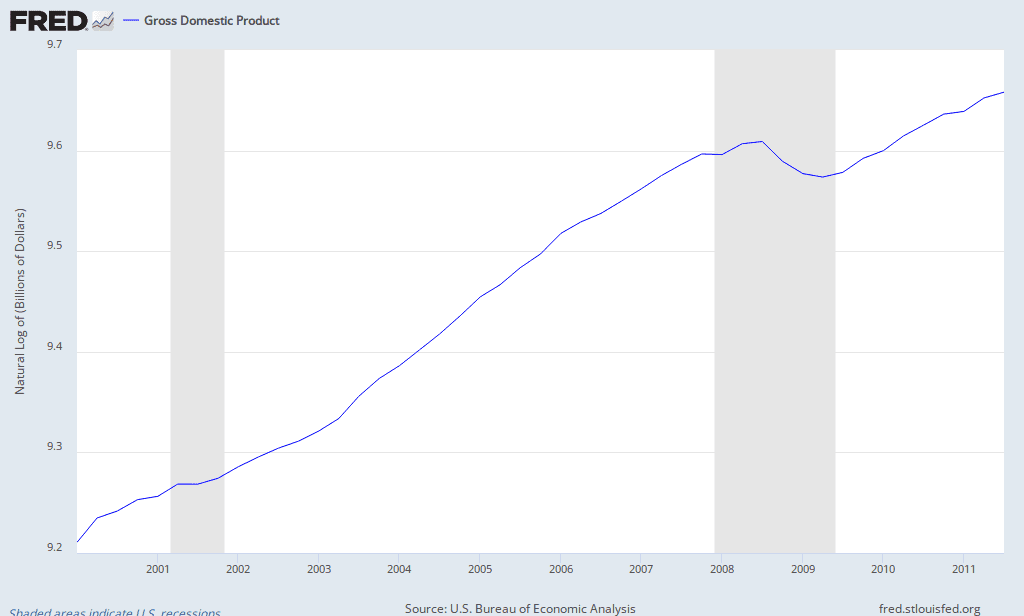

When Clinton left the W.H. the Federal benchmark interest rate was 6.5%. In Bush's term, the rate drammatically dropped in 2001. Then to the bottom of 1% in 2003 and 2004. It's the low interest rate that pushes up the economy. You could see the result from income tax revenue chart that the Federal income tax started going up from 2003, 2004, but it also created a big bubble - the housing bubble. That bubble broke out in 2007, (You could see it's the peak of income tax revenue). It also caused the financial crisis next year.(2008)

Real estate industry is an important factor of GDP. The housing bubble is still hurting the economy right now. Even now they low the interest rate to nearly zero, they can't recover the housing industry. (Because of piled up fore-closured houses from that bubble)

It's evident that Bush created the housing bubble that damaged the US economy. That bubble is still there, continuely erode the economy.

Bush's tax cut law and the war he started increased budget deficit that caused debt problem. It's ridiculous to cover up his failed policy by these fallacy.

When Clinton left the W.H. the Federal benchmark interest rate was 6.5%. In Bush's term, the rate drammatically dropped in 2001. Then to the bottom of 1% in 2003 and 2004. It's the low interest rate that pushes up the economy. You could see the result from income tax revenue chart that the Federal income tax started going up from 2003, 2004, but it also created a big bubble - the housing bubble. That bubble broke out in 2007, (You could see it's the peak of income tax revenue). It also caused the financial crisis next year.(2008)

Real estate industry is an important factor of GDP. The housing bubble is still hurting the economy right now. Even now they low the interest rate to nearly zero, they can't recover the housing industry. (Because of piled up fore-closured houses from that bubble)

It's evident that Bush created the housing bubble that damaged the US economy. That bubble is still there, continuely erode the economy.

Bush's tax cut law and the war he started increased budget deficit that caused debt problem. It's ridiculous to cover up his failed policy by these fallacy.