CA95380

USMB Member

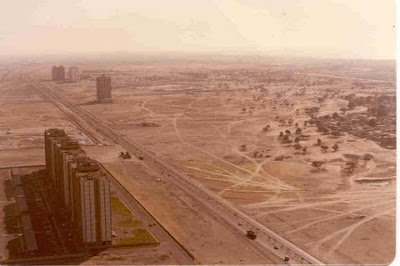

Dubai became part of the United Arab Emirates at its founding in 1971.

dubai encyclopedia topics | Reference.com

1990

2003

Dubai last year

-More-

Eye On The World: Something you should ponder as you pump gas into your car