bk1983

Off too Kuwait..

- Oct 17, 2008

- 1,431

- 109

- 48

In fact, no peacetime president has raised taxes so much on so many people. This is not a criticism: the tale of those increases tells you a lot about what was right with President Reagan's leadership, and what's wrong with the leadership of George W. Bush.

The first Reagan tax increase came in 1982. By then it was clear that the budget projections used to justify the 1981 tax cut were wildly optimistic. In response, Mr. Reagan agreed to a sharp rollback of corporate tax cuts, and a smaller rollback of individual income tax cuts. Over all, the 1982 tax increase undid about a third of the 1981 cut; as a share of G.D.P., the increase was substantially larger than Mr. Clinton's 1993 tax increase.

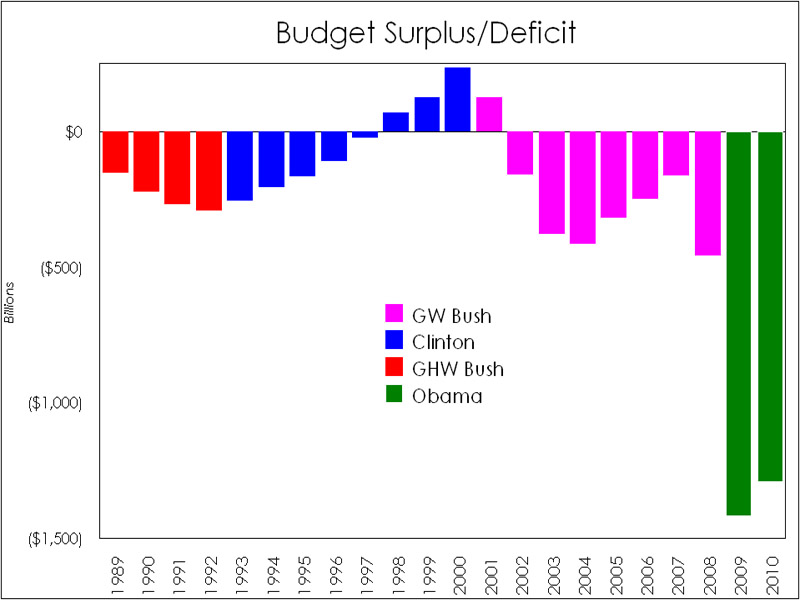

The contrast with President Bush is obvious. President Reagan, confronted with evidence that his tax cuts were fiscally irresponsible, changed course. President Bush, confronted with similar evidence, has pushed for even more tax cuts.

The Unofficial Paul Krugman Web Page

When defecits started to balloon and the recession deppened Reagan raised taxes to counteract the revenue loss. He also bailed out social security to the tune of $165 billion, payed for by raising payroll taxes. What about the tax reform act of 1986? The act which imposed the largest corporate tax increase in history. So the question is, if tax cuts are the answer to everything then why did Reagan raise taxes when faced with his expanding defecit?

The first Reagan tax increase came in 1982. By then it was clear that the budget projections used to justify the 1981 tax cut were wildly optimistic. In response, Mr. Reagan agreed to a sharp rollback of corporate tax cuts, and a smaller rollback of individual income tax cuts. Over all, the 1982 tax increase undid about a third of the 1981 cut; as a share of G.D.P., the increase was substantially larger than Mr. Clinton's 1993 tax increase.

The contrast with President Bush is obvious. President Reagan, confronted with evidence that his tax cuts were fiscally irresponsible, changed course. President Bush, confronted with similar evidence, has pushed for even more tax cuts.

The Unofficial Paul Krugman Web Page

When defecits started to balloon and the recession deppened Reagan raised taxes to counteract the revenue loss. He also bailed out social security to the tune of $165 billion, payed for by raising payroll taxes. What about the tax reform act of 1986? The act which imposed the largest corporate tax increase in history. So the question is, if tax cuts are the answer to everything then why did Reagan raise taxes when faced with his expanding defecit?