Don't get prissy.Trump is the only relevant political issue in this discussion.I listened to Hillary's convention speech like everyone else and it sounds like she is working on this problem.Make their execs and employees ALL move -- then they can't do it. Because somebody has to stay.

If somebody is here then the business can be taxed here -- all of it can be taxes here.

That's what the Chinese and the Indians do too.

Hillary is already talking about a tax plan for corporations like that.

Donald on the other hand does not have a clue.

They can't make them all move. Realistic solutions please.

And why not tax their imports if they do move? I haven't heard a good reason to be against doing that.

Trump is oblivious to this problem.

Trump is simply another Robber Baron Romney in disguise.

What gives you the idea that I would vote for Trump? You are preaching to the choir.

It does not matter whom you yourself intend to vote for.

I was not targeting you nor your vote.

Don't get prissy.

Your posts were addressed to ME, Einstein. And don't tell me what to do. I would kick your butt.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CDZ What would you think?

- Thread starter 320 Years of History

- Start date

320 Years of History

Gold Member

- Thread starter

- #22

If they've got you by the balls then your hearts and minds will soon follow.

Well, that's certainly one of the possible outcomes. Another is that one gets pissed off enough that one innovates the "next new thing" that takes the dominant players out of the "game," or at the very least, secures one a "seat at the table where the game is played."

Wilbur Right

Silver Member

- Nov 27, 2015

- 2,710

- 363

- 90

That is why I suggested I'd be amendable, using the far simpler method of tax liability calculation I proposed, to a rate between 20% and 30%.

Your proposals seem to cost the ultra wealthy and the very, very wealthy quite a bit more money in the way of taxes.

Why would companies and the ultra wealthy support those ideas? Corporations and the ultra wealthy have spent considerable time and money to get the tax code we have. What is their motivation to support change that costs them money?

the_human_being

Gold Member

- Sep 8, 2014

- 15,277

- 2,740

- 290

Unrelated to the remarks below....The Clintons allowed the U.S. government the use of slightly over $1M of their money in 2015. In other words, they permitted fully 10% of their 2015 income to reside in the government's hands and they collected no interest or other economic value from having done so. Just to offer one illustration of contrast, though I don't earn the kind of money the Clintons do, I am blessed enough to fall into what one might call the "lower ranks" of the 1%. I never get a refund; I don't even aim to get one because I want full use of my money all year long. Instead I typically have to pay ~$500 to $2000K each April 15th.

Say what you want about the Clinton's getting a $1M+ tax refund, but one thing that happenstance says on its own is that extreme tax minimization is not the foremost concern the Clintons have as goes their own money. One million dollars is a material sum to not have use of during the course of a year, even for folks who earn $10M in that year. Frankly, I think the Clintons need a better tax accountant/advisor, but what do I know...I haven't looked at their prior years' returns, maybe 2015 was an anomalous year?

The other observation I've taken from the Clinton's tax return is that aside from their earning more than most folks, they pay taxes commensurate with the amount of income they earn. That is, their tax liability is comparable, from a fairness perspective, to that of most Americans. There's no reason to get bent out of shape over what they pay in taxes and even being able to do so, they don't go out of their way to exploit every so-called loophole they could. They go about their lives, earn what they earn, pay their taxes and that's that.

Exactly. Trump did not write the tax code. Many Congressmen and women use these same deductions and loopholes. They exist and there is nothing illegal about using them to your own advantage. Hillary and Bill used the charitable contribution deduction to write off 96% of their charitable contributions listing those charitable gifts aas going to the Clinton Foundation. It is probably legal.

You are mistaken. The Clintons made no contributions to the Clinton Foundation. Their charitable contributions consisted in 2015 of:

While you may not think so, the Clinton Foundation and the Clinton Family Foundation are distinct entities. Although not related to your remarks and FWIW, the Clinton Foundation, despite it's "trade name," is not a private foundation — which typically acts as a pass-through for private donations to other charitable organizations. Rather, it is a public charity. It conducts most of its charitable activities directly.

- $42K to Desert Classic Charities

- $1M to the Clinton Family Foundation

Additionally, you are also mistaken about the deductibility percentage of their charitable contributions. The Clintons deducted 100% of their charitable contributions because their contributions were below the 50% and 30% deductibility ceilings.

While I can totally understand the outrage, some people make a kind of good point by saying that if businesses/corporations do not get tax breaks, then it could hurt our economy because some of these businesses would just move their operations to another country where it is much cheaper to do business. We need some common sense solutions, such as taxing imports more?

How about merely assigning a a series of graduated rates and merely multiplying the applicable rate to whatever a business reports in its audited financial statements as net income? No deductions; no differences between "book" and "tax" income; no loopholes.

If one wants that rate to be lower than the current stated marginal rate, fine. I'm not wedded to any specific rate; however, seeing as corporations want "personhood" and they have it in many regards, I think they should pay at a rate comparable to what most actual wealthy persons pay. Twenty-five percent to 30% seems reasonable to me, although again, I could live with 20%. What's thoroughly unacceptable to me is that organizations like GE or Verizon, et al have effective tax rates well below 20% as a result of "loopholes."

Red:

Businesses are going to do that anyway if and when it becomes materially more profitable to do so and doing so will improve their competitive position in the marketplace.

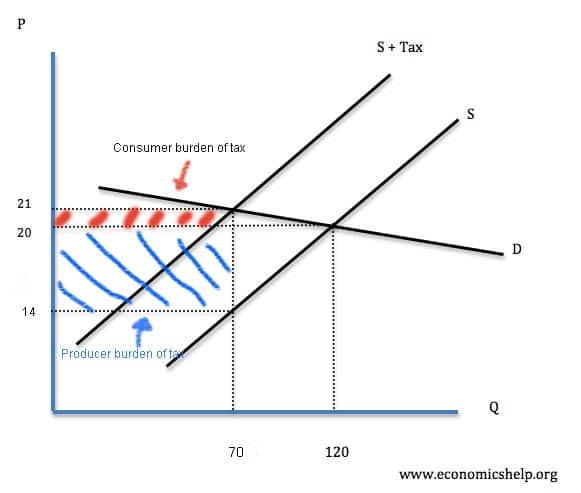

As for the tariff idea you suggested, well, that does little but make yours and my goods cost more. Additionally, tariffs reduce business profitability due to the way the incidence of taxes (tariffs in this case) work. If a tariff is high enough that it compromises profitability, the business simply will exist the market (geographic) and enter or focus on others.

As you can see from the graphs above, whether the incidence of a tax/tariff falls more heavily on a producer or consumer depends on the slope of the demand curve a given producer experiences for his/her goods or services. That's in a microeconomic sense. Macroeconomically, the principle is the same, but what changes is that it's demand for a whole region or nation's goods/services.

That's not what's being reported:

96 Percent Of Hillary’s Charitable Donations In 2015 Went To Clinton Foundation

320 Years of History

Gold Member

- Thread starter

- #25

That is why I suggested I'd be amendable, using the far simpler method of tax liability calculation I proposed, to a rate between 20% and 30%.

Your proposals seem to cost the ultra wealthy and the very, very wealthy quite a bit more money in the way of taxes.

Why would companies and the ultra wealthy support those ideas? Corporations and the ultra wealthy have spent considerable time and money to get the tax code we have. What is their motivation to support change that costs them money?

Just to be clear, I haven't here proposed anything specifically affecting very wealth individuals; my remarks were with regard to corporate income tax rates and tariffs (which affect businesses and consumers). Additionally, while I cited the rates I did in the post above, in the original post where I proposed my general idea, I did mention that I wasn't committed to the rate and that I wasn't sure just what the actual rate should be.

If one wants that rate to be lower than the current stated marginal rate, fine. I'm not wedded to any specific rate

The motivations for nearly all, if not all, of my tax policy suggestions are:

- My belief that corporations should not have person status.

- My recognition that corporations (or similarly large/moneyed organizations), given the current "rules" for how politics works, have a disproportionate amount of influence on the political processes that, at the end of the day, affect persons who are not corporations and who, as individuals and often as huge blocs of individuals, do not have nearly as much political influence as does any one very large moneyed entity.

- My belief that individuals -- wealthy or not, but not abjectly poor -- should have roughly equal amounts of access and influence in terms of having their voices heard in the political process.

- My belief that tax provisions should exist for one and only one reason: to fund the government. I do not cotton to the idea of taxation as a means to catalyze or deter behavior, be it individual's behavior or entity's behavior.

- My belief that the profit is sufficient cause for businesses to invest in developing "this or that" innovation.

- My recognition that insofar as huge multinational corporations and ultra wealthy individuals demand and rely upon the services and infrastructural support of the U.S. government, they must pay for them just as you and I do. E.g., roads and organized air transportation systems, aid of the navy in interdicting pirates, aid of the U.S. government if a foreign nation nationalizes businesses, assistance with structuring trade deals with other nations businesses and governments, etc.

- My recognition that when it comes to international support and services, wealthy individuals rely upon and demand more of the U.S. government than do the vast majority of citizens. When it comes to domestic support and services, wealthy individuals and companies rely on them just as much as do all other citizens, even though that on which some folks rely differs from that on which others rely.

- My recognition that government services are not offerable on an "a la carte" basis. They are sort of, but not entirely, like fire extinguishers, electricity, chairs and toilet paper:

- Some of them we have a minimum sum of them available for when we need them, even though we hope never to need them.

- Some of them we need and use all the time without giving any thought to the fact that we are using them. We use as much or as little as we want at any given time, but there's always enough of it at the instant we demand it.

- Some of them we have and have more than we routinely use/need, but they are there for when our need exceeds our typical usage levels.

- Some of them we know we will need/use, and need/use every bit that we have and will need more eventually, but we can't say precisely when nor can we say who will use a given quantity of them.

- [Note: I hate trying to use analogies in this venue because invariably some loon will come along and remark how "this or that" other aspect of "whatever" doesn't apply, all the while ignoring the sole purpose of the analogy is to illustrate one or several dominant contextual aspects of a situation, not to show those aspects as the sole pertinent ones of the matter in all contexts.]

To the nature of your specific questions, wealthy individuals (whom I didn't aim to discuss with the post to which you referred) and corporations will be amenable to paying somewhat higher sums in taxes or yield some of their political power in order to avoid engendering an outcome similar to that which the jagirdars caused in the Mughal Empire. I could just as easily have cited the Bolsheviks who overthrew the Tsar; the same basic thing. Too much power and influence was held by the wealthy and politically involved/employed (which often, one was indistinguishable from the other) and not enough enjoyed by the masses. "Enough" being the operative word there. I don't want to see the U.S. become a place where cognitively "unwashed" masses actually have equal or greater power than folks who are well informed, willing and able to conduct complex analysis before making decisions, but they need to have enough of it to influence things in a meaningful way from time to time, even if not all the time or most of the time. That may sound elitist, but the reality is that the "blind leading the blind and everyone else" is a far worse governance model.

The fact is that only in the U.S. can corporations actually get away with paying a disproportionately low income tax relative to their actual earnings. As noted above, the U.S. corporate tax code is written such that the stated marginal tax rate is all but irrelevant for nearly nobody actually pays at that rate. Additionally, the rates at which most corporations actually pay is dramatically lower than that in other roughly similar nations. Thus even if the code simplified to eliminate the possibility of corporations legally avoiding incurring a tax liability, they still have no similar nation to which they can move and enjoy all the benefits that come from being a U.S. corporation.

For very wealthy individuals, it's much the same. One could move to a very low individual tax rate country, say Monaco, UAT, BVI, and so on; however, in doing so one must give up quite a lot in terms of economics and security, plus one will then have to incur new costs associated with not being a U.S. citizen that one doesn't incur as a U.S. citizen. Wealthy folks can probably afford those costs simply because they are so very, very well off, but it's still money spent for nothing in return. Suppose, say, one is a citizen of Monaco who gets abducted by foreign nationals. What exactly will the Monacan government bring to bear to secure one's release? Mostly pressure on the French government to act to obtain the safe release of some rich SOB from Monaco.

In light of the above, I'm pretty sure corporations will acquiesce, however begrudgingly, to paying higher taxes than they currently do. As go wealthy individuals, I think the current rates are high enough and I think so long as wealthy folks pay at a higher rate (~30% - 40%) than do the remaining 99% of the country, as opposed to folks having incomes similar to the Clintons or Trump paying at 15% - 20% rates as do most folks, those rich folks aren't going anywhere. The "grass often can look greener on the other side of the street," but upon walking through it, one often discovers it's crabgrass, chickweed and dandelions, rather than tall fescue, zoysia, or Kentucky blue. Now if one is okay with "crabgrass," fine, pick and move. I'm not, and I think a lot of wealthy folks and corporations aren't either.

320 Years of History

Gold Member

- Thread starter

- #26

Unrelated to the remarks below....The Clintons allowed the U.S. government the use of slightly over $1M of their money in 2015. In other words, they permitted fully 10% of their 2015 income to reside in the government's hands and they collected no interest or other economic value from having done so. Just to offer one illustration of contrast, though I don't earn the kind of money the Clintons do, I am blessed enough to fall into what one might call the "lower ranks" of the 1%. I never get a refund; I don't even aim to get one because I want full use of my money all year long. Instead I typically have to pay ~$500 to $2000K each April 15th.

Say what you want about the Clinton's getting a $1M+ tax refund, but one thing that happenstance says on its own is that extreme tax minimization is not the foremost concern the Clintons have as goes their own money. One million dollars is a material sum to not have use of during the course of a year, even for folks who earn $10M in that year. Frankly, I think the Clintons need a better tax accountant/advisor, but what do I know...I haven't looked at their prior years' returns, maybe 2015 was an anomalous year?

The other observation I've taken from the Clinton's tax return is that aside from their earning more than most folks, they pay taxes commensurate with the amount of income they earn. That is, their tax liability is comparable, from a fairness perspective, to that of most Americans. There's no reason to get bent out of shape over what they pay in taxes and even being able to do so, they don't go out of their way to exploit every so-called loophole they could. They go about their lives, earn what they earn, pay their taxes and that's that.

Exactly. Trump did not write the tax code. Many Congressmen and women use these same deductions and loopholes. They exist and there is nothing illegal about using them to your own advantage. Hillary and Bill used the charitable contribution deduction to write off 96% of their charitable contributions listing those charitable gifts aas going to the Clinton Foundation. It is probably legal.

You are mistaken. The Clintons made no contributions to the Clinton Foundation. Their charitable contributions consisted in 2015 of:

While you may not think so, the Clinton Foundation and the Clinton Family Foundation are distinct entities. Although not related to your remarks and FWIW, the Clinton Foundation, despite it's "trade name," is not a private foundation — which typically acts as a pass-through for private donations to other charitable organizations. Rather, it is a public charity. It conducts most of its charitable activities directly.

- $42K to Desert Classic Charities

- $1M to the Clinton Family Foundation

Additionally, you are also mistaken about the deductibility percentage of their charitable contributions. The Clintons deducted 100% of their charitable contributions because their contributions were below the 50% and 30% deductibility ceilings.

While I can totally understand the outrage, some people make a kind of good point by saying that if businesses/corporations do not get tax breaks, then it could hurt our economy because some of these businesses would just move their operations to another country where it is much cheaper to do business. We need some common sense solutions, such as taxing imports more?

How about merely assigning a a series of graduated rates and merely multiplying the applicable rate to whatever a business reports in its audited financial statements as net income? No deductions; no differences between "book" and "tax" income; no loopholes.

If one wants that rate to be lower than the current stated marginal rate, fine. I'm not wedded to any specific rate; however, seeing as corporations want "personhood" and they have it in many regards, I think they should pay at a rate comparable to what most actual wealthy persons pay. Twenty-five percent to 30% seems reasonable to me, although again, I could live with 20%. What's thoroughly unacceptable to me is that organizations like GE or Verizon, et al have effective tax rates well below 20% as a result of "loopholes."

Red:

Businesses are going to do that anyway if and when it becomes materially more profitable to do so and doing so will improve their competitive position in the marketplace.

As for the tariff idea you suggested, well, that does little but make yours and my goods cost more. Additionally, tariffs reduce business profitability due to the way the incidence of taxes (tariffs in this case) work. If a tariff is high enough that it compromises profitability, the business simply will exist the market (geographic) and enter or focus on others.

As you can see from the graphs above, whether the incidence of a tax/tariff falls more heavily on a producer or consumer depends on the slope of the demand curve a given producer experiences for his/her goods or services. That's in a microeconomic sense. Macroeconomically, the principle is the same, but what changes is that it's demand for a whole region or nation's goods/services.

That's not what's being reported:

96 Percent Of Hillary’s Charitable Donations In 2015 Went To Clinton Foundation

What's being reported is accurate. What you wrote, your paraphrasing of what's being reported, is not accurate. Ninety-six percent of one's charitable donations going to a given organization is not the same as writing off 96% of one's charitable donations.

- Write off 96% of contribution means, for example:

- Donate $100 to charity

- Write off $96 of the $100 donated

the_human_being

Gold Member

- Sep 8, 2014

- 15,277

- 2,740

- 290

Unrelated to the remarks below....The Clintons allowed the U.S. government the use of slightly over $1M of their money in 2015. In other words, they permitted fully 10% of their 2015 income to reside in the government's hands and they collected no interest or other economic value from having done so. Just to offer one illustration of contrast, though I don't earn the kind of money the Clintons do, I am blessed enough to fall into what one might call the "lower ranks" of the 1%. I never get a refund; I don't even aim to get one because I want full use of my money all year long. Instead I typically have to pay ~$500 to $2000K each April 15th.

Say what you want about the Clinton's getting a $1M+ tax refund, but one thing that happenstance says on its own is that extreme tax minimization is not the foremost concern the Clintons have as goes their own money. One million dollars is a material sum to not have use of during the course of a year, even for folks who earn $10M in that year. Frankly, I think the Clintons need a better tax accountant/advisor, but what do I know...I haven't looked at their prior years' returns, maybe 2015 was an anomalous year?

The other observation I've taken from the Clinton's tax return is that aside from their earning more than most folks, they pay taxes commensurate with the amount of income they earn. That is, their tax liability is comparable, from a fairness perspective, to that of most Americans. There's no reason to get bent out of shape over what they pay in taxes and even being able to do so, they don't go out of their way to exploit every so-called loophole they could. They go about their lives, earn what they earn, pay their taxes and that's that.

Exactly. Trump did not write the tax code. Many Congressmen and women use these same deductions and loopholes. They exist and there is nothing illegal about using them to your own advantage. Hillary and Bill used the charitable contribution deduction to write off 96% of their charitable contributions listing those charitable gifts aas going to the Clinton Foundation. It is probably legal.

You are mistaken. The Clintons made no contributions to the Clinton Foundation. Their charitable contributions consisted in 2015 of:

While you may not think so, the Clinton Foundation and the Clinton Family Foundation are distinct entities. Although not related to your remarks and FWIW, the Clinton Foundation, despite it's "trade name," is not a private foundation — which typically acts as a pass-through for private donations to other charitable organizations. Rather, it is a public charity. It conducts most of its charitable activities directly.

- $42K to Desert Classic Charities

- $1M to the Clinton Family Foundation

Additionally, you are also mistaken about the deductibility percentage of their charitable contributions. The Clintons deducted 100% of their charitable contributions because their contributions were below the 50% and 30% deductibility ceilings.

While I can totally understand the outrage, some people make a kind of good point by saying that if businesses/corporations do not get tax breaks, then it could hurt our economy because some of these businesses would just move their operations to another country where it is much cheaper to do business. We need some common sense solutions, such as taxing imports more?

How about merely assigning a a series of graduated rates and merely multiplying the applicable rate to whatever a business reports in its audited financial statements as net income? No deductions; no differences between "book" and "tax" income; no loopholes.

If one wants that rate to be lower than the current stated marginal rate, fine. I'm not wedded to any specific rate; however, seeing as corporations want "personhood" and they have it in many regards, I think they should pay at a rate comparable to what most actual wealthy persons pay. Twenty-five percent to 30% seems reasonable to me, although again, I could live with 20%. What's thoroughly unacceptable to me is that organizations like GE or Verizon, et al have effective tax rates well below 20% as a result of "loopholes."

Red:

Businesses are going to do that anyway if and when it becomes materially more profitable to do so and doing so will improve their competitive position in the marketplace.

As for the tariff idea you suggested, well, that does little but make yours and my goods cost more. Additionally, tariffs reduce business profitability due to the way the incidence of taxes (tariffs in this case) work. If a tariff is high enough that it compromises profitability, the business simply will exist the market (geographic) and enter or focus on others.

As you can see from the graphs above, whether the incidence of a tax/tariff falls more heavily on a producer or consumer depends on the slope of the demand curve a given producer experiences for his/her goods or services. That's in a microeconomic sense. Macroeconomically, the principle is the same, but what changes is that it's demand for a whole region or nation's goods/services.

That's not what's being reported:

96 Percent Of Hillary’s Charitable Donations In 2015 Went To Clinton Foundation

What's being reported is accurate. What you wrote, your paraphrasing of what's being reported, is not accurate. Ninety-six percent of one's charitable donations going to a given organization is not the same as writing off 96% of one's charitable donations.

- Write off 96% of contribution means, for example:

- Donate $100 to charity

- Write off $96 of the $100 donated

You left off the rest of what you said:

You are mistaken. The Clintons made no contributions to the Clinton Foundation. Their charitable contributions consisted in 2015 of:

- $42K to Desert Classic Charities

- $1M to the Clinton Family Foundation

320 Years of History

Gold Member

- Thread starter

- #28

Unrelated to the remarks below....The Clintons allowed the U.S. government the use of slightly over $1M of their money in 2015. In other words, they permitted fully 10% of their 2015 income to reside in the government's hands and they collected no interest or other economic value from having done so. Just to offer one illustration of contrast, though I don't earn the kind of money the Clintons do, I am blessed enough to fall into what one might call the "lower ranks" of the 1%. I never get a refund; I don't even aim to get one because I want full use of my money all year long. Instead I typically have to pay ~$500 to $2000K each April 15th.

Say what you want about the Clinton's getting a $1M+ tax refund, but one thing that happenstance says on its own is that extreme tax minimization is not the foremost concern the Clintons have as goes their own money. One million dollars is a material sum to not have use of during the course of a year, even for folks who earn $10M in that year. Frankly, I think the Clintons need a better tax accountant/advisor, but what do I know...I haven't looked at their prior years' returns, maybe 2015 was an anomalous year?

The other observation I've taken from the Clinton's tax return is that aside from their earning more than most folks, they pay taxes commensurate with the amount of income they earn. That is, their tax liability is comparable, from a fairness perspective, to that of most Americans. There's no reason to get bent out of shape over what they pay in taxes and even being able to do so, they don't go out of their way to exploit every so-called loophole they could. They go about their lives, earn what they earn, pay their taxes and that's that.

Exactly. Trump did not write the tax code. Many Congressmen and women use these same deductions and loopholes. They exist and there is nothing illegal about using them to your own advantage. Hillary and Bill used the charitable contribution deduction to write off 96% of their charitable contributions listing those charitable gifts aas going to the Clinton Foundation. It is probably legal.

You are mistaken. The Clintons made no contributions to the Clinton Foundation. Their charitable contributions consisted in 2015 of:

While you may not think so, the Clinton Foundation and the Clinton Family Foundation are distinct entities. Although not related to your remarks and FWIW, the Clinton Foundation, despite it's "trade name," is not a private foundation — which typically acts as a pass-through for private donations to other charitable organizations. Rather, it is a public charity. It conducts most of its charitable activities directly.

- $42K to Desert Classic Charities

- $1M to the Clinton Family Foundation

Additionally, you are also mistaken about the deductibility percentage of their charitable contributions. The Clintons deducted 100% of their charitable contributions because their contributions were below the 50% and 30% deductibility ceilings.

While I can totally understand the outrage, some people make a kind of good point by saying that if businesses/corporations do not get tax breaks, then it could hurt our economy because some of these businesses would just move their operations to another country where it is much cheaper to do business. We need some common sense solutions, such as taxing imports more?

How about merely assigning a a series of graduated rates and merely multiplying the applicable rate to whatever a business reports in its audited financial statements as net income? No deductions; no differences between "book" and "tax" income; no loopholes.

If one wants that rate to be lower than the current stated marginal rate, fine. I'm not wedded to any specific rate; however, seeing as corporations want "personhood" and they have it in many regards, I think they should pay at a rate comparable to what most actual wealthy persons pay. Twenty-five percent to 30% seems reasonable to me, although again, I could live with 20%. What's thoroughly unacceptable to me is that organizations like GE or Verizon, et al have effective tax rates well below 20% as a result of "loopholes."

Red:

Businesses are going to do that anyway if and when it becomes materially more profitable to do so and doing so will improve their competitive position in the marketplace.

As for the tariff idea you suggested, well, that does little but make yours and my goods cost more. Additionally, tariffs reduce business profitability due to the way the incidence of taxes (tariffs in this case) work. If a tariff is high enough that it compromises profitability, the business simply will exist the market (geographic) and enter or focus on others.

As you can see from the graphs above, whether the incidence of a tax/tariff falls more heavily on a producer or consumer depends on the slope of the demand curve a given producer experiences for his/her goods or services. That's in a microeconomic sense. Macroeconomically, the principle is the same, but what changes is that it's demand for a whole region or nation's goods/services.

That's not what's being reported:

96 Percent Of Hillary’s Charitable Donations In 2015 Went To Clinton Foundation

What's being reported is accurate. What you wrote, your paraphrasing of what's being reported, is not accurate. Ninety-six percent of one's charitable donations going to a given organization is not the same as writing off 96% of one's charitable donations.

- Write off 96% of contribution means, for example:

- Donate $100 to charity

- Write off $96 of the $100 donated

You left off the rest of what you said:

You are mistaken. The Clintons made no contributions to the Clinton Foundation. Their charitable contributions consisted in 2015 of:

Check out your first statement above.

- $42K to Desert Classic Charities [DCC]

- $1M to the Clinton Family Foundation [CFF]

Yes, but you wrote that they wrote off 96% of their charitable contributions. The Clintons deducted (wrote off) 100% of their charitable contributions -- 100% of what they donated to DCC and to CFF -- not 96% of what they donated to either individually nor 96% of what they donated to both combined. 96% of the contributions they made went to CFF, but 100% of that was written off.

the_human_being

Gold Member

- Sep 8, 2014

- 15,277

- 2,740

- 290

Unrelated to the remarks below....The Clintons allowed the U.S. government the use of slightly over $1M of their money in 2015. In other words, they permitted fully 10% of their 2015 income to reside in the government's hands and they collected no interest or other economic value from having done so. Just to offer one illustration of contrast, though I don't earn the kind of money the Clintons do, I am blessed enough to fall into what one might call the "lower ranks" of the 1%. I never get a refund; I don't even aim to get one because I want full use of my money all year long. Instead I typically have to pay ~$500 to $2000K each April 15th.

Say what you want about the Clinton's getting a $1M+ tax refund, but one thing that happenstance says on its own is that extreme tax minimization is not the foremost concern the Clintons have as goes their own money. One million dollars is a material sum to not have use of during the course of a year, even for folks who earn $10M in that year. Frankly, I think the Clintons need a better tax accountant/advisor, but what do I know...I haven't looked at their prior years' returns, maybe 2015 was an anomalous year?

The other observation I've taken from the Clinton's tax return is that aside from their earning more than most folks, they pay taxes commensurate with the amount of income they earn. That is, their tax liability is comparable, from a fairness perspective, to that of most Americans. There's no reason to get bent out of shape over what they pay in taxes and even being able to do so, they don't go out of their way to exploit every so-called loophole they could. They go about their lives, earn what they earn, pay their taxes and that's that.

Exactly. Trump did not write the tax code. Many Congressmen and women use these same deductions and loopholes. They exist and there is nothing illegal about using them to your own advantage. Hillary and Bill used the charitable contribution deduction to write off 96% of their charitable contributions listing those charitable gifts aas going to the Clinton Foundation. It is probably legal.

You are mistaken. The Clintons made no contributions to the Clinton Foundation. Their charitable contributions consisted in 2015 of:

While you may not think so, the Clinton Foundation and the Clinton Family Foundation are distinct entities. Although not related to your remarks and FWIW, the Clinton Foundation, despite it's "trade name," is not a private foundation — which typically acts as a pass-through for private donations to other charitable organizations. Rather, it is a public charity. It conducts most of its charitable activities directly.

- $42K to Desert Classic Charities

- $1M to the Clinton Family Foundation

Additionally, you are also mistaken about the deductibility percentage of their charitable contributions. The Clintons deducted 100% of their charitable contributions because their contributions were below the 50% and 30% deductibility ceilings.

While I can totally understand the outrage, some people make a kind of good point by saying that if businesses/corporations do not get tax breaks, then it could hurt our economy because some of these businesses would just move their operations to another country where it is much cheaper to do business. We need some common sense solutions, such as taxing imports more?

How about merely assigning a a series of graduated rates and merely multiplying the applicable rate to whatever a business reports in its audited financial statements as net income? No deductions; no differences between "book" and "tax" income; no loopholes.

If one wants that rate to be lower than the current stated marginal rate, fine. I'm not wedded to any specific rate; however, seeing as corporations want "personhood" and they have it in many regards, I think they should pay at a rate comparable to what most actual wealthy persons pay. Twenty-five percent to 30% seems reasonable to me, although again, I could live with 20%. What's thoroughly unacceptable to me is that organizations like GE or Verizon, et al have effective tax rates well below 20% as a result of "loopholes."

Red:

Businesses are going to do that anyway if and when it becomes materially more profitable to do so and doing so will improve their competitive position in the marketplace.

As for the tariff idea you suggested, well, that does little but make yours and my goods cost more. Additionally, tariffs reduce business profitability due to the way the incidence of taxes (tariffs in this case) work. If a tariff is high enough that it compromises profitability, the business simply will exist the market (geographic) and enter or focus on others.

As you can see from the graphs above, whether the incidence of a tax/tariff falls more heavily on a producer or consumer depends on the slope of the demand curve a given producer experiences for his/her goods or services. That's in a microeconomic sense. Macroeconomically, the principle is the same, but what changes is that it's demand for a whole region or nation's goods/services.

That's not what's being reported:

96 Percent Of Hillary’s Charitable Donations In 2015 Went To Clinton Foundation

What's being reported is accurate. What you wrote, your paraphrasing of what's being reported, is not accurate. Ninety-six percent of one's charitable donations going to a given organization is not the same as writing off 96% of one's charitable donations.

- Write off 96% of contribution means, for example:

- Donate $100 to charity

- Write off $96 of the $100 donated

You left off the rest of what you said:

You are mistaken. The Clintons made no contributions to the Clinton Foundation. Their charitable contributions consisted in 2015 of:

Check out your first statement above.

- $42K to Desert Classic Charities [DCC]

- $1M to the Clinton Family Foundation [CFF]

Yes, but you wrote that they wrote off 96% of their charitable contributions. The Clintons deducted (wrote off) 100% of their charitable contributions -- 100% of what they donated to DCC and to CFF -- not 96% of what they donated to either individually nor 96% of what they donated to both combined. 96% of the contributions they made went to CFF, but 100% of that was written off.

What made you want to write something you knew was not true?

320 Years of History

Gold Member

- Thread starter

- #30

Unrelated to the remarks below....The Clintons allowed the U.S. government the use of slightly over $1M of their money in 2015. In other words, they permitted fully 10% of their 2015 income to reside in the government's hands and they collected no interest or other economic value from having done so. Just to offer one illustration of contrast, though I don't earn the kind of money the Clintons do, I am blessed enough to fall into what one might call the "lower ranks" of the 1%. I never get a refund; I don't even aim to get one because I want full use of my money all year long. Instead I typically have to pay ~$500 to $2000K each April 15th.

Say what you want about the Clinton's getting a $1M+ tax refund, but one thing that happenstance says on its own is that extreme tax minimization is not the foremost concern the Clintons have as goes their own money. One million dollars is a material sum to not have use of during the course of a year, even for folks who earn $10M in that year. Frankly, I think the Clintons need a better tax accountant/advisor, but what do I know...I haven't looked at their prior years' returns, maybe 2015 was an anomalous year?

The other observation I've taken from the Clinton's tax return is that aside from their earning more than most folks, they pay taxes commensurate with the amount of income they earn. That is, their tax liability is comparable, from a fairness perspective, to that of most Americans. There's no reason to get bent out of shape over what they pay in taxes and even being able to do so, they don't go out of their way to exploit every so-called loophole they could. They go about their lives, earn what they earn, pay their taxes and that's that.

You are mistaken. The Clintons made no contributions to the Clinton Foundation. Their charitable contributions consisted in 2015 of:

While you may not think so, the Clinton Foundation and the Clinton Family Foundation are distinct entities. Although not related to your remarks and FWIW, the Clinton Foundation, despite it's "trade name," is not a private foundation — which typically acts as a pass-through for private donations to other charitable organizations. Rather, it is a public charity. It conducts most of its charitable activities directly.

- $42K to Desert Classic Charities

- $1M to the Clinton Family Foundation

Additionally, you are also mistaken about the deductibility percentage of their charitable contributions. The Clintons deducted 100% of their charitable contributions because their contributions were below the 50% and 30% deductibility ceilings.

How about merely assigning a a series of graduated rates and merely multiplying the applicable rate to whatever a business reports in its audited financial statements as net income? No deductions; no differences between "book" and "tax" income; no loopholes.

If one wants that rate to be lower than the current stated marginal rate, fine. I'm not wedded to any specific rate; however, seeing as corporations want "personhood" and they have it in many regards, I think they should pay at a rate comparable to what most actual wealthy persons pay. Twenty-five percent to 30% seems reasonable to me, although again, I could live with 20%. What's thoroughly unacceptable to me is that organizations like GE or Verizon, et al have effective tax rates well below 20% as a result of "loopholes."

Red:

Businesses are going to do that anyway if and when it becomes materially more profitable to do so and doing so will improve their competitive position in the marketplace.

As for the tariff idea you suggested, well, that does little but make yours and my goods cost more. Additionally, tariffs reduce business profitability due to the way the incidence of taxes (tariffs in this case) work. If a tariff is high enough that it compromises profitability, the business simply will exist the market (geographic) and enter or focus on others.

As you can see from the graphs above, whether the incidence of a tax/tariff falls more heavily on a producer or consumer depends on the slope of the demand curve a given producer experiences for his/her goods or services. That's in a microeconomic sense. Macroeconomically, the principle is the same, but what changes is that it's demand for a whole region or nation's goods/services.

That's not what's being reported:

96 Percent Of Hillary’s Charitable Donations In 2015 Went To Clinton Foundation

What's being reported is accurate. What you wrote, your paraphrasing of what's being reported, is not accurate. Ninety-six percent of one's charitable donations going to a given organization is not the same as writing off 96% of one's charitable donations.

- Write off 96% of contribution means, for example:

- Donate $100 to charity

- Write off $96 of the $100 donated

You left off the rest of what you said:

You are mistaken. The Clintons made no contributions to the Clinton Foundation. Their charitable contributions consisted in 2015 of:

Check out your first statement above.

- $42K to Desert Classic Charities [DCC]

- $1M to the Clinton Family Foundation [CFF]

Yes, but you wrote that they wrote off 96% of their charitable contributions. The Clintons deducted (wrote off) 100% of their charitable contributions -- 100% of what they donated to DCC and to CFF -- not 96% of what they donated to either individually nor 96% of what they donated to both combined. 96% of the contributions they made went to CFF, but 100% of that was written off.

What made you want to write something you knew was not true?

WTH? Are you adopting the "say X of me and I'll say the same of you" strategy? Have you lost your mind? Are your basic arithmetic skills so poor that you truly think that your original remark about the "96%" is somehow accurate?

Similar threads

- Replies

- 178

- Views

- 1K

- Replies

- 21

- Views

- 251

- Replies

- 52

- Views

- 501

- Replies

- 4

- Views

- 287

Latest Discussions

- Replies

- 4K

- Views

- 57K

- Replies

- 74

- Views

- 441

- Replies

- 0

- Views

- 1

- Replies

- 3K

- Views

- 43K

Forum List

-

-

-

-

-

Political Satire 8013

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 466

-

-

-

-

-

-

-

-

-

-