The difference is the scale, stupid.

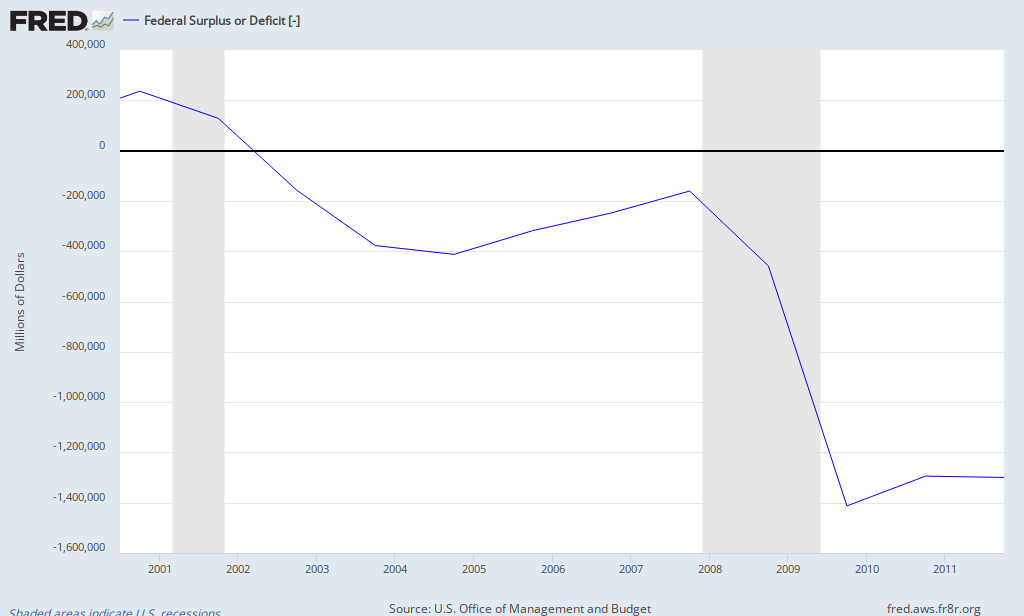

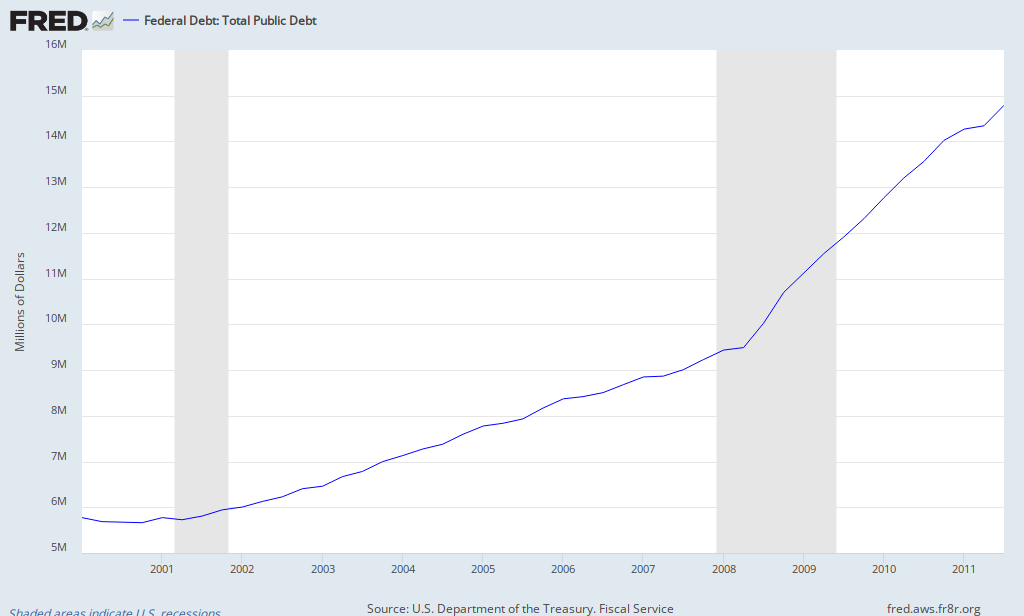

Bush averaged just about the standard deficit for all administrations even including the last year which was a disaster and included all of the expense of the TARP of which half was spent by the Big 0.

The Big 0 has consistently beat that last year and appears to like doing so.

He is spending like a pimp with three days to live.

Bush only spent like a sailor on a three day leave.

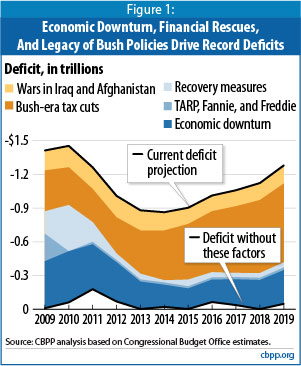

Bushs deficits vs. Obamas deficits, in one graph | Kyle Wingfield

So in Dreamland, your man is a success.

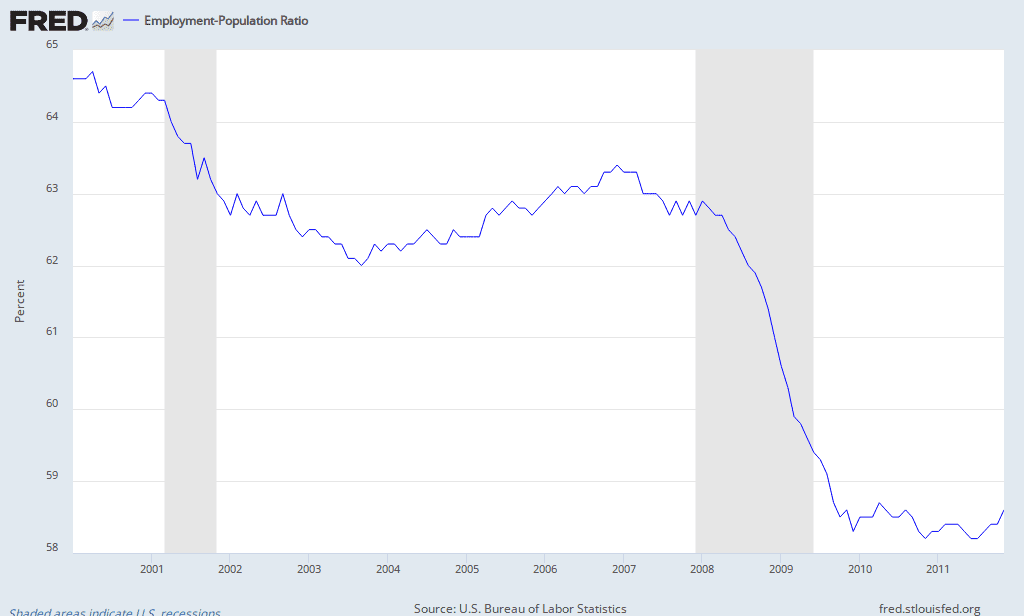

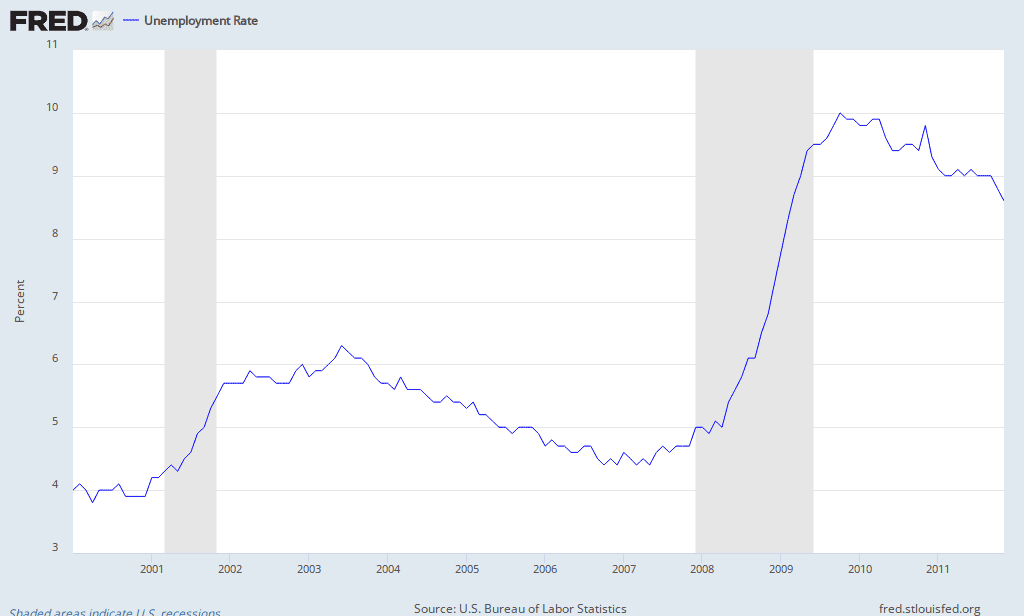

How's he doing in the real world? Oh, wait! I see it now. He's failing.

Thanks for the info, Chartboy.