yes so who controls the money supply if not the Fed and what makes you think they control it????

What makes you think the Fed controls it?

For instance, what did the Fed do during the Great Depression to shrink money supply by 1/3rd?

why try to change subject????

so for 4th time who controls the money supply if not the Fed and what makes you think they control it????

It's slow work trying to educate you.

I'd rather not hold your hand, you're not a child, are you?

Did you ever learn what makes up money supply?

For instance, what makes up M2?

why try to change subject????

so for 5th time who controls the money supply if not the Fed and what makes you think they control it????

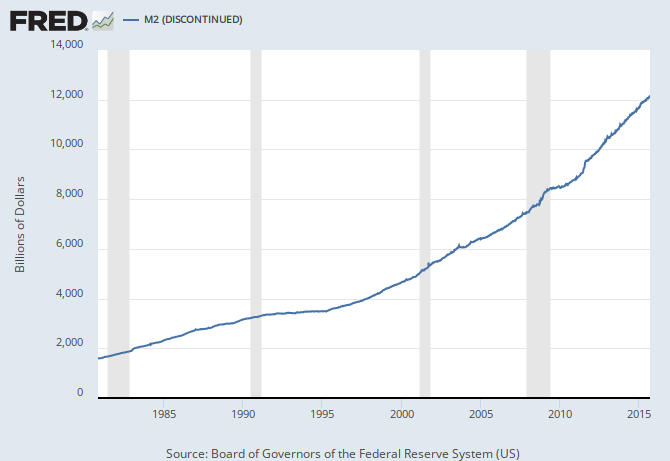

M2 includes a broader set of financial assets held principally by households. M2 consists of M1 plus: (1) savings deposits (which include money market deposit accounts, or MMDAs); (2) small-denomination time deposits (time deposits in amounts of less than $100,000); and (3) balances in retail money market mutual funds (MMMFs). Seasonally adjusted M2 is computed by summing savings deposits, small-denomination time deposits, and retail MMMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1.

Let me know if this is too complicated for you, I'll be happy to try to simply it so you can understand.

M2 consists of M1 plus: (1) savings deposits (which include money market deposit accounts, or MMDAs); (2) small-denomination time deposits (time deposits in amounts of less than $100,000); and (3) balances in retail money market mutual funds (MMMFs).

If I opened a savings account, money market account, money mutual fund or CD, and the bank makes a loan from it, the money supply has increased. Get it?