hortysir

In Memorial of 47

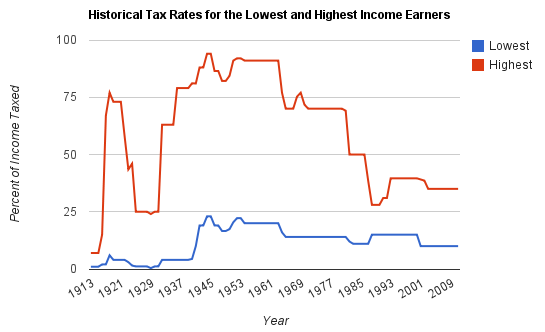

Couple examples: Reagan lowered taxes hugely in 1981. Net result within 14 months unemployment went from 7 to almost 11%. He then raised taxes on 11 occasions, and borrowed enough to triple the national debt.when has increasing federal income tax rates helped ?show me the time when decreasing federal income tax rates has helped a bad economy.

Clinton raised taxes, agains republican protests that it would tube the economy, and we had a great economy and lower unemployment for his term.

So, again, when did lowering taxes and lowering spending help in a bad economy?? Still waiting.....

The Bush tax cuts worked so well Obama's been trying to duplicate the results ever since