Bullshit.

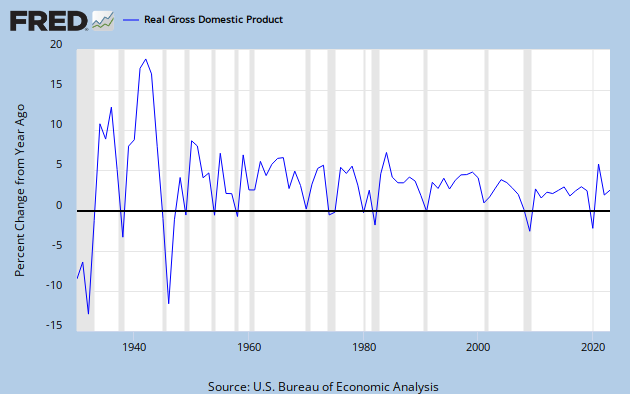

Remember your meme that WWII saved the US economy and not the new deal?

You cant even keep the republican lies straight

The WWII war did not save the economy. The tax cut in 1946 & the baby boom saved the economy. The Kennedy & Reagan tax cuts also created enormous booms. The high taxes imposed on this country by you Communist in 1918 caused the Great Depression. There was never a Great Depression in this country prior to the federal reserve, taxes & regulations.