DontBeStupid

Look it up!

Boy, you really don't know jack schitt about economics or business accounting.And your solution to this "problem" is .......?

Simple. Raise taxes on corporations.

Almost everyone in the bottom 60% gets their income from their job and their employer. With corporate taxes as low as they are, there is no additional incentive for a company to pay a worker more than what it would take to keep that worker. You raise taxes, and then the corp has to decide between paying more to the worker or to the government. Which do you think they will choose?

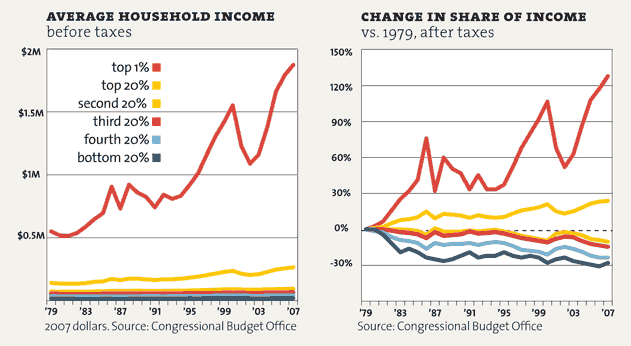

Why don't you enlighten me then? Should be simple right? I mean, it's not like we had higher taxes in the 50s and less inequality. No. That wasn't the case.