Remember the university Leftists vowing to invest only in green ventures and green energy alternatives?

And the union pension fund, the same?

And some Liberal state governments?

Well....seems they saw the great big 'Uh oh!'

1. "The fossil fuel divestment boom has turned into a serious bust. Most recently we saw this at the University of Denver where the administration determined that the future health of their endowment was worth far more than any political points scored through satisfying the demands of some environmentalist students."

2. A new report conducted by an independent consulting firm for the state of Vermont confirms what economists, pension fund managers and academics have long said about fossil fuel divestment: it’s costly, hurts pension fund returns, and has no tangible impact on climate change.

3. For over a year, Vermont has been a battleground state for divestment with prominent activists like 350.org founder Bill McKibben urging schools and pension funds to divest, and former Governor Peter Shumlin making divestment a signature issue in 2016. Yet at every turn, efforts to divest have been rejected by everyone from the Treasurer’s office to pensioners – the same sentiments reached by colleges and funds across the nation.

4. After legislative proposals to mandate state pension divestment failed in March 2016, a subcommittee of the Vermont Pension Investment Committee (VPIC) was assembled to study the issue. The result of that process is a new report, released today by the Pension Consulting Alliance (PCA), analyzing several fossil fuel divestment scenarios for the Vermont pension fund at the request of the VPIC. Across all scenarios studied, PCA concluded that divestment would have adverse impacts for pension beneficiaries.

5. .... determined that fossil fuel divestment would result in increased costs, reduced versatility in the portfolio and potential long-term losses. As with previous university studies, the report also indicated that any such risky divestment strategy would produce no real impact on the fossil fuel companies.

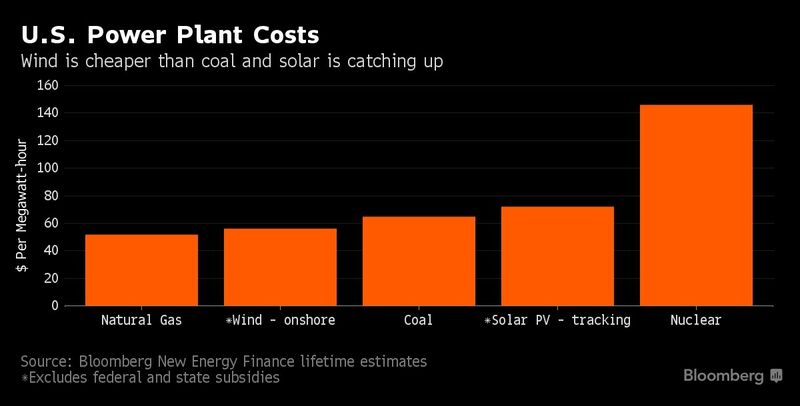

6. ... cutting their own throats for the sake of pleasing a small but vocal minority of green warriors was simply not feasible in the long run. ....Considering the fact that fossil fuels still represent one of the most consistently profitable investments available, particularly when compared to renewable energy, that’s going to be quite the trick."

Fossil fuel divestment crashes and burns in Vermont - Hot Air

And....in similar news.....Donald Trump won the presidential election.

Looks like the Left 'feels the Bern.'

And the union pension fund, the same?

And some Liberal state governments?

Well....seems they saw the great big 'Uh oh!'

1. "The fossil fuel divestment boom has turned into a serious bust. Most recently we saw this at the University of Denver where the administration determined that the future health of their endowment was worth far more than any political points scored through satisfying the demands of some environmentalist students."

2. A new report conducted by an independent consulting firm for the state of Vermont confirms what economists, pension fund managers and academics have long said about fossil fuel divestment: it’s costly, hurts pension fund returns, and has no tangible impact on climate change.

3. For over a year, Vermont has been a battleground state for divestment with prominent activists like 350.org founder Bill McKibben urging schools and pension funds to divest, and former Governor Peter Shumlin making divestment a signature issue in 2016. Yet at every turn, efforts to divest have been rejected by everyone from the Treasurer’s office to pensioners – the same sentiments reached by colleges and funds across the nation.

4. After legislative proposals to mandate state pension divestment failed in March 2016, a subcommittee of the Vermont Pension Investment Committee (VPIC) was assembled to study the issue. The result of that process is a new report, released today by the Pension Consulting Alliance (PCA), analyzing several fossil fuel divestment scenarios for the Vermont pension fund at the request of the VPIC. Across all scenarios studied, PCA concluded that divestment would have adverse impacts for pension beneficiaries.

5. .... determined that fossil fuel divestment would result in increased costs, reduced versatility in the portfolio and potential long-term losses. As with previous university studies, the report also indicated that any such risky divestment strategy would produce no real impact on the fossil fuel companies.

6. ... cutting their own throats for the sake of pleasing a small but vocal minority of green warriors was simply not feasible in the long run. ....Considering the fact that fossil fuels still represent one of the most consistently profitable investments available, particularly when compared to renewable energy, that’s going to be quite the trick."

Fossil fuel divestment crashes and burns in Vermont - Hot Air

And....in similar news.....Donald Trump won the presidential election.

Looks like the Left 'feels the Bern.'