- Dec 29, 2008

- 19,672

- 4,729

- 280

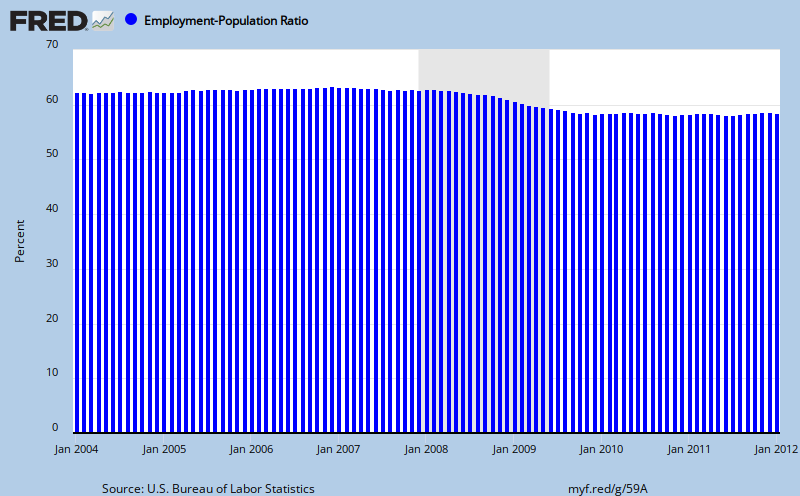

Unemployment Up in February, Obama Reelection Chances DownOn his economics blog at Barrons magazine, Gene Epstein created an index Voters Economic Well-Being, or VEWB to see how elections in the past were impacted by the state of the economy at the time. He combined the percentage increase in consumer spending during the last six months of an election year and the unemployment rate for married males over the same period. The difference is his VEWB index.

Going back to 1956 with Dwight Eisenhowers reelection, Epstein has not only calculated his index, but compared it to the election outcome. Based on his VEWB, Obama would have lost his bid for reelection if the election had been held last November.

He concluded that a flat-to-positive index is virtually required for an incumbent to win. Also, no one has ever won with the index as negative as Obamas is now. In fact, according to Epsteins analysis, Obamas index is worse than any other president seeking reelection, except Jimmy Carters. Epstein admits: The presidents number could turn at least flat or maybe even positive by November, but thats quite unlikely.

And now that the price of gasoline is nationally above $4 a gallon and likely headed for $5, consumer spending is about to take another hit. John Hofmeister, a former Shell operations manager and currently CEO of Citizens for Affordable Energy, said this increase could impact the U.S. recovery. If you turn the clock back one year, we were seeing these prices in February and the economy slowed in May, June and July and it became a grave concern of the administration.

If Gallup, Epstein and Hofmeister are all correct, then the presidents chances for reelection are in serious and increasing jeopardy.