Mad Scientist

Feels Good!

- Sep 15, 2008

- 24,196

- 5,431

- 270

That is why our economy will not recover.

The Problem In A Nutshell: Annualized GDP Growth Of 1%; Annualized US Debt Growth of 21% | ZeroHedge

And during those war years we were manufacturing EVERYTHING! What does the US manufacture now?

Jack Sh*t.

We sent all of those jobs overseas in "Free not Fair Trade Agreements".

Any Politician that says we can turn things around by just tweaking things a little here or there is blowing smoke.

The Problem In A Nutshell: Annualized GDP Growth Of 1%; Annualized US Debt Growth of 21% | ZeroHedge

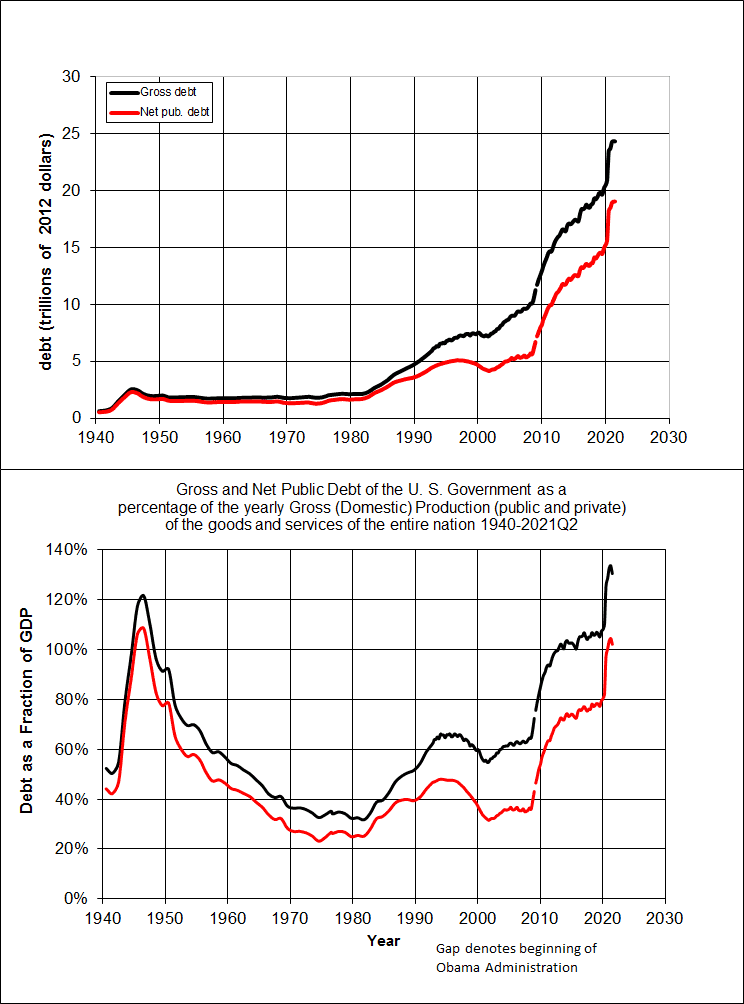

Total US Debt/GDP highest since WWII.As the chart shows total US marketable debt has doubled in the past 4 years, or an annualized growth rate of just above 21%. And as Zero Hedge has shown before, total US Debt/GDP is on the verge of crossing 102%, the highest since WWII. Simply said, the divergence between the two data series will only accelerate as every incremental dollar of debt generates ever less bank for the GDP buck. And that, from a "sustainability" perspective, is what the problem is in a nutshell.

And during those war years we were manufacturing EVERYTHING! What does the US manufacture now?

Jack Sh*t.

We sent all of those jobs overseas in "Free not Fair Trade Agreements".

Any Politician that says we can turn things around by just tweaking things a little here or there is blowing smoke.