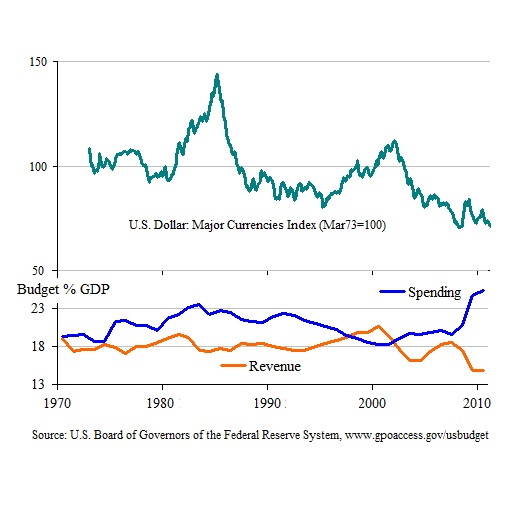

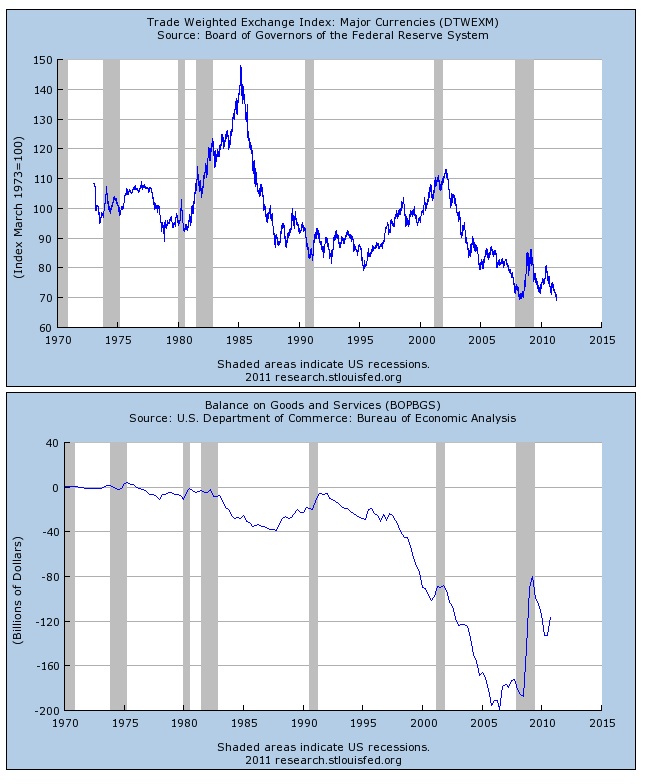

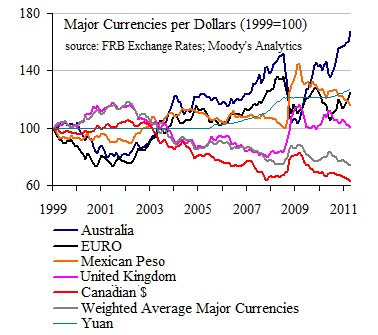

The sinking dollar will do wonders for our trade balance.

AT FIRST, only because imports will go down, of course.

But if the decline in the dollar become the norm?

Well then that will also make our manufactures cheaper on the world markets.

A slow decline in the dollar's worth over time can be a good thing.

A rapid drop in value will be disaster.