Middleoftheroad

Active Member

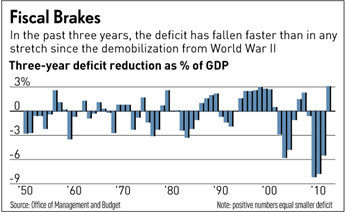

The deficit was going down even though Bush cut taxes and was fighting two wars using credit cards?

Yes. Of course the deficits never went to zero even at the height of the housing bubble, when the economy was at its peak.

And those deficits happened instead of trillions of dollars in surpluses that were projected when Bush took the office. So his tax cuts and wars did cost us many trillions in additional debt.

My problem with that is the way they borrow money from Social Security and claim they aren't increasing the deficit at the same time.

What? No one is claiming that. Intra-government bond holdings are counted as part of the total debt, otherwise the debt would be only around 11T. In fact, we are one of the only countries that DO count it.