- Apr 12, 2011

- 3,814

- 758

- 130

from: http://www.nytimes.com/2017/04/06/business/dealbook/donald-trump-elizabeth-warren-big-banks.html

So that's what the NY Times says that Trump, Warren, and Cohn say. Those three may have acctually said what was in the NYT quotes, but they're all living in a pseudo-reality when they say "Glass-Steagall... ...repealed in 1999" and "2008 recession... ...caused by the financial crisis", and then suggest deregulation caused the recession.

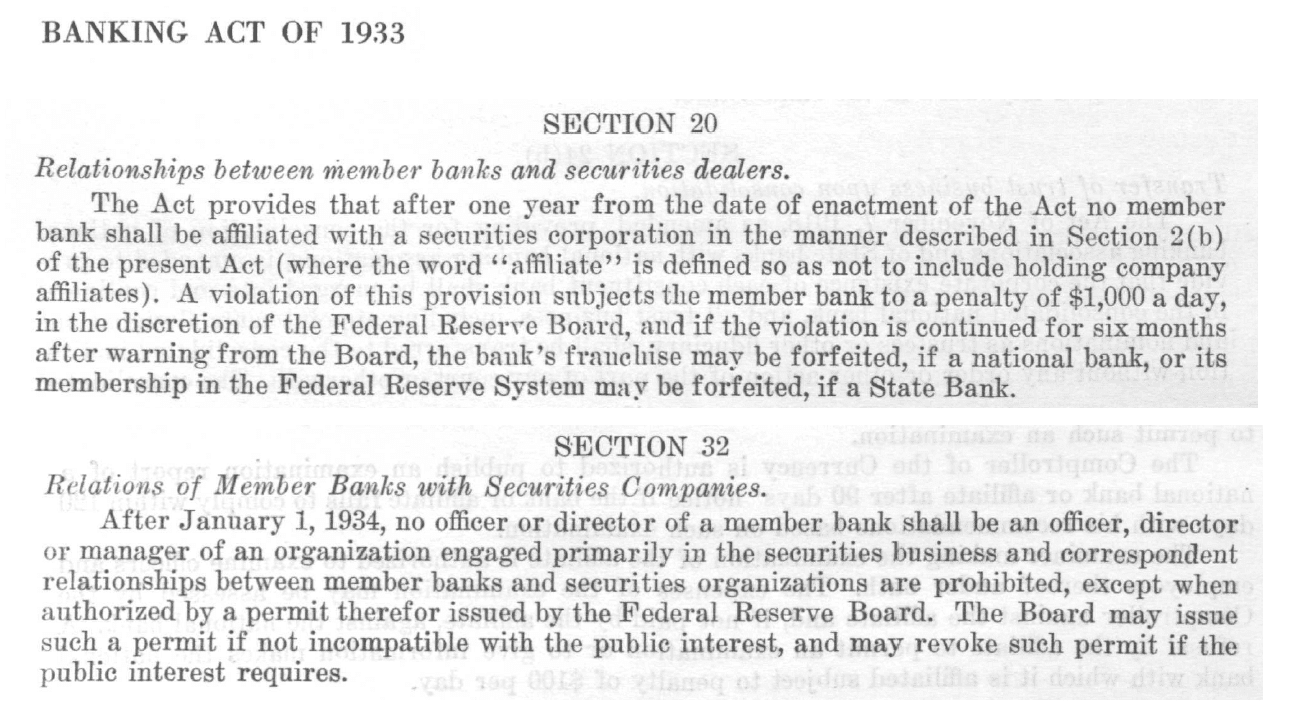

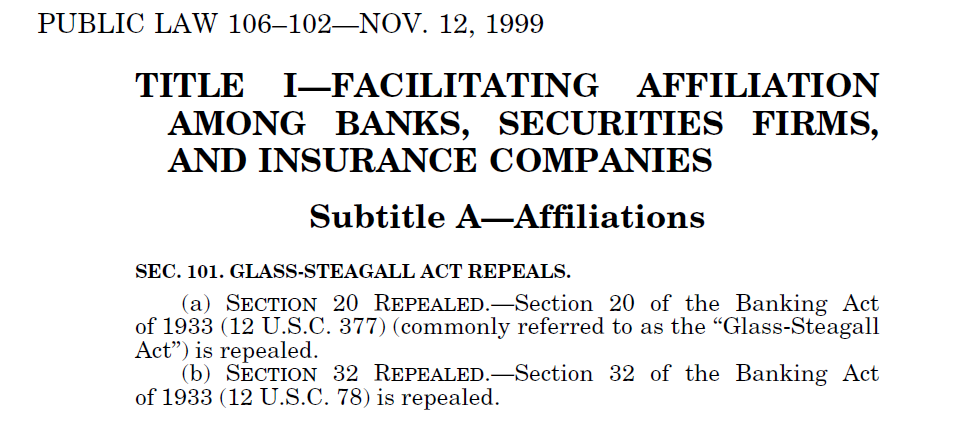

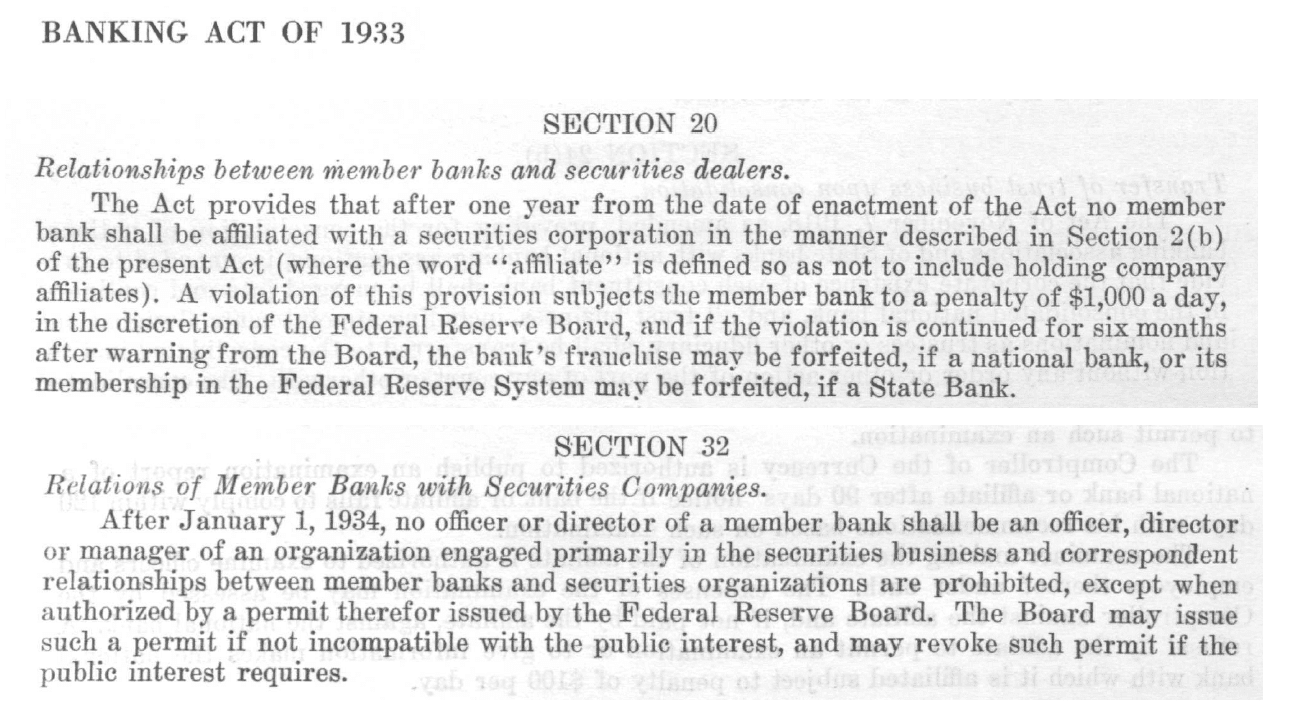

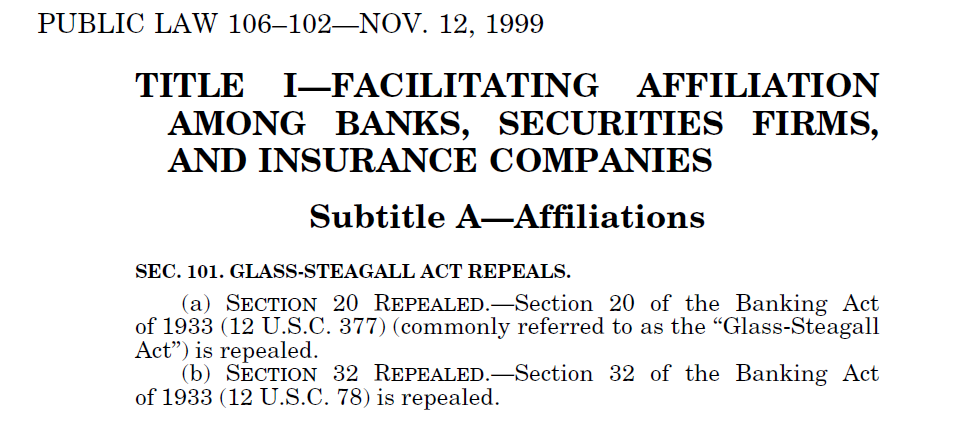

The reality is that the original 'Glass-Steagal' (full text at http://ungb.org/econ/1933_glass_steagall.pdf ) had 34 sections and it banned stuff like banks using deposits to buy stocks. None of that was changed w/ the '1999 repeal' (full text at http://ungb.org/econ/1999repeal.pdf ); what did happen was only these two sections of the 1933 law were cut:

buy this provision in 1999:

To be generous, maybe we can say that Trump, Warren, Cohn, and the NYTimes aren't exactly intentionally making false statements so as to decieve. More probably they could not care less if their statements are true or not, as long as they can push their agenda. Reality never even enters their minds.

MICHAEL CORKERY and JESSICA SILVER-GREENBERG APRIL 6, 2017

President Trump has vowed to roll back financial regulation, saying that it is preventing banks from lending and businesses from growing.

Wall Street, it would seem, has found its dream president.

There is just one possible complication: His top advisers continue to float an idea that would not only hurt the nation’s largest banks, it would upend them.

In a meeting on Wednesday with senators from both parties, Gary D. Cohn, Mr. Trump’s chief economic adviser, said the administration was considering a proposal that would require separating retail banking from investment banking and trading. Mr. Cohn mentioned the idea to members of the Senate Banking Committee as one of several financial regulations on the table.

He offered few specifics on how the proposal would work or when it could be carried out, according to people briefed on the matter. It was part of a wide-ranging discussion, reported earlier by Bloomberg, that also touched on the president’s tax policy....

...invoking Glass-Steagall, which was repealed in 1999, seems tailored to appeal directly to the angry voters who elected Mr. Trump.

Many Americans are still smarting from the 2008 recession, which was caused by the financial crisis, and still believe that the Obama administration did not go far enough in reining in Wall Street.

Still, it is unclear whether a return to Glass-Steagall is politically feasible.

Banking lobbyists dismissed Mr. Cohn’s comments as empty politics and ineffective policy.

President Trump has vowed to roll back financial regulation, saying that it is preventing banks from lending and businesses from growing.

Wall Street, it would seem, has found its dream president.

There is just one possible complication: His top advisers continue to float an idea that would not only hurt the nation’s largest banks, it would upend them.

In a meeting on Wednesday with senators from both parties, Gary D. Cohn, Mr. Trump’s chief economic adviser, said the administration was considering a proposal that would require separating retail banking from investment banking and trading. Mr. Cohn mentioned the idea to members of the Senate Banking Committee as one of several financial regulations on the table.

He offered few specifics on how the proposal would work or when it could be carried out, according to people briefed on the matter. It was part of a wide-ranging discussion, reported earlier by Bloomberg, that also touched on the president’s tax policy....

...invoking Glass-Steagall, which was repealed in 1999, seems tailored to appeal directly to the angry voters who elected Mr. Trump.

Many Americans are still smarting from the 2008 recession, which was caused by the financial crisis, and still believe that the Obama administration did not go far enough in reining in Wall Street.

Still, it is unclear whether a return to Glass-Steagall is politically feasible.

Banking lobbyists dismissed Mr. Cohn’s comments as empty politics and ineffective policy.

= = = = = = = = = = = =

So that's what the NY Times says that Trump, Warren, and Cohn say. Those three may have acctually said what was in the NYT quotes, but they're all living in a pseudo-reality when they say "Glass-Steagall... ...repealed in 1999" and "2008 recession... ...caused by the financial crisis", and then suggest deregulation caused the recession.

The reality is that the original 'Glass-Steagal' (full text at http://ungb.org/econ/1933_glass_steagall.pdf ) had 34 sections and it banned stuff like banks using deposits to buy stocks. None of that was changed w/ the '1999 repeal' (full text at http://ungb.org/econ/1999repeal.pdf ); what did happen was only these two sections of the 1933 law were cut:

buy this provision in 1999:

To be generous, maybe we can say that Trump, Warren, Cohn, and the NYTimes aren't exactly intentionally making false statements so as to decieve. More probably they could not care less if their statements are true or not, as long as they can push their agenda. Reality never even enters their minds.