Say US company A imports a product from foreign company B, and pays them X dollars for it. B now has the bucks, in a bank somewhere. They either convert it to their own currency, or they invest those dollars in our economy, right? Or maybe they use those dollars in another transaction with foreign company C, whatever. I don't see a debt problem yet, the US gov't doesn't owe anybody anything at this point. If the US gov't were not running a deficit, there would be no debt, regardless of the trade imbalance. Foreign interests could invest here or buy US assets, but I see no connection between the trade imbalance and our national debt.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trade Imblance and Debt

- Thread starter Wiseacre

- Start date

Norman

Diamond Member

- Sep 24, 2010

- 31,254

- 15,176

- 1,590

Say US company A imports a product from foreign company B, and pays them X dollars for it. B now has the bucks, in a bank somewhere. They either convert it to their own currency, or they invest those dollars in our economy, right? Or maybe they use those dollars in another transaction with foreign company C, whatever. I don't see a debt problem yet, the US gov't doesn't owe anybody anything at this point. If the US gov't were not running a deficit, there would be no debt, regardless of the trade imbalance. Foreign interests could invest here or buy US assets, but I see no connection between the trade imbalance and our national debt.

Well, first of all money can not be converted, but exchanged. If you exchange via bank, someone has to buy and sell the currencies. So in the end there are 2 choices. Invest the money or buy something with it(balance the trade). On the other hand, investing is only done because you are expecting future returns so in the really end you only want to buy something with the cash. But that is besides the point.

Anyway, the problem is, company B invested those bucks into your debt. So the chinese company (more like central bank) owns a lot of the US govts debt.

Of course company B could also have invested the money into Company A's equity, in which case you would not technically owe them anything I guess. But then the government could not have gotten all the debt. OFC the US government is running ponzi scheme with this like it is with everything else, lulz.

Also one problem with china and USA is that their central bank owns so many dollars and debt. This means they could easily dump the dollars and debt, which would cause a lot of inflation and government default in USA.

Finally, the trade imbalance has nothing to do with this. The US gov could get foreign debt even if you had trade surplus, it would just mean the country as whole still has trade surplus. But it is a cause in the sense that foreigners have all the dollars and they just decided to invest a lot of them into US govt bonds instead of businesses (which would have probably been a lot better choice for both parties).

I had topic kind of like this a lot earlier here....

Last edited:

- Thread starter

- #3

" Anyway, the problem is, company B invested those bucks into your debt. "

Yeah, but that's a separate issue, right? They don't have to buy treasuries, and that isn't totally a bad thing anyway unless you let it get out of hand with too much debt like we have know. Point is, our trade imbalance means the rest of the world has a lot of US capital as a result of the imbalance. That is not a debt problem. It'd actually a monetary value problem isn't it, the value of the dollar should depreciate if gov'ts don't interfere with the process. True?

" Also one problem with china and USA is that their central bank owns so many dollars and debt. This means they could easily dump the dollars and debt, which would cause a lot of inflation and government default in USA. "

Dump their dollars? Dunno how that would work, outside of investing in US companies or buying US assets. And then dump their debt? IOW, stop buying our treasuries and when the ones they have expire we give 'em more dollars that are worth less due to inflation that they themselves caused?

Say the Chinese did that, wouldn't they essentially be cutting their own throats? What would happen to the world economy if the US defaulted, or experienced high inflation? Dollars would be worth a whole lot less, how does that help them? Who would buy their stuff then?

Sorry I missed your thread, probably coulda learned something.

Yeah, but that's a separate issue, right? They don't have to buy treasuries, and that isn't totally a bad thing anyway unless you let it get out of hand with too much debt like we have know. Point is, our trade imbalance means the rest of the world has a lot of US capital as a result of the imbalance. That is not a debt problem. It'd actually a monetary value problem isn't it, the value of the dollar should depreciate if gov'ts don't interfere with the process. True?

" Also one problem with china and USA is that their central bank owns so many dollars and debt. This means they could easily dump the dollars and debt, which would cause a lot of inflation and government default in USA. "

Dump their dollars? Dunno how that would work, outside of investing in US companies or buying US assets. And then dump their debt? IOW, stop buying our treasuries and when the ones they have expire we give 'em more dollars that are worth less due to inflation that they themselves caused?

Say the Chinese did that, wouldn't they essentially be cutting their own throats? What would happen to the world economy if the US defaulted, or experienced high inflation? Dollars would be worth a whole lot less, how does that help them? Who would buy their stuff then?

Sorry I missed your thread, probably coulda learned something.

Norman

Diamond Member

- Sep 24, 2010

- 31,254

- 15,176

- 1,590

" Anyway, the problem is, company B invested those bucks into your debt. "

Yeah, but that's a separate issue, right? They don't have to buy treasuries, and that isn't totally a bad thing anyway unless you let it get out of hand with too much debt like we have know. Point is, our trade imbalance means the rest of the world has a lot of US capital as a result of the imbalance. That is not a debt problem. It'd actually a monetary value problem isn't it, the value of the dollar should depreciate if gov'ts don't interfere with the process. True?

" Also one problem with china and USA is that their central bank owns so many dollars and debt. This means they could easily dump the dollars and debt, which would cause a lot of inflation and government default in USA. "

Dump their dollars? Dunno how that would work, outside of investing in US companies or buying US assets. And then dump their debt? IOW, stop buying our treasuries and when the ones they have expire we give 'em more dollars that are worth less due to inflation that they themselves caused?

Say the Chinese did that, wouldn't they essentially be cutting their own throats? What would happen to the world economy if the US defaulted, or experienced high inflation? Dollars would be worth a whole lot less, how does that help them? Who would buy their stuff then?

Sorry I missed your thread, probably coulda learned something.

Well, what is a debt problem?

Kinda hard to define, because if you take a lot of debt to invest into factories, you are going to be prosperous and you don't have any problems. On the other hand if you take a lot of debt and blow it in consumer goods, then everything will be all dandy the year you do it, but next year... So view of this is personal, personally I believe free market will always get it the rightest.

So it is all about priorities.

China is selling their stuff to get dollars which buys them stuff from USA. If they find out that the dollars buy almost nothing, ofc they should dump them (buy all they can with them). So it may be better for them to not send good money after bad but just stop it. China does not export to USA just so they could get useless paper. They export to in the end import. If they think dumping all the dollars quickly buys them more imports in the long run, they should do that.

- Thread starter

- #5

" Well, first of all money can not be converted, but exchanged. If you exchange via bank, someone has to buy and sell the currencies. So in the end there are 2 choices. Invest the money or buy something with it(balance the trade). On the other hand, investing is only done because you are expecting future returns so in the really end you only want to buy something with the cash. But that is besides the point.

Anyway, the problem is, company B invested those bucks into your debt. So the chinese company (more like central bank) owns a lot of the US govts debt. "

Here's where we go off the rails. When US company A imports something from a foreign company B, they pay for it, there ain't no debt. We got goods or services, they got our currency, there's no debt anywhere. Multiple that by a thousand transactionss, there's still no debt. For anybody.

Now, at some point the foreign companies may elect to buy US assets, property, stock, bonds, whatever. If they buy bonds, either federal, state, local, or private, then you get a debt to repay. But that transaction is entirely independent of the trade imbalance, they could do that with their own currency. Otherwise, if they invest in our economy by buying assets or stock, there's no debt there either.

Trade imbalances and debt at any level are separate issues, you can run a trade surplus and still have debt, and you can also have a negative trade imbalance with no debt. At various times I believe the US has had both situations.

Anyway, the problem is, company B invested those bucks into your debt. So the chinese company (more like central bank) owns a lot of the US govts debt. "

Here's where we go off the rails. When US company A imports something from a foreign company B, they pay for it, there ain't no debt. We got goods or services, they got our currency, there's no debt anywhere. Multiple that by a thousand transactionss, there's still no debt. For anybody.

Now, at some point the foreign companies may elect to buy US assets, property, stock, bonds, whatever. If they buy bonds, either federal, state, local, or private, then you get a debt to repay. But that transaction is entirely independent of the trade imbalance, they could do that with their own currency. Otherwise, if they invest in our economy by buying assets or stock, there's no debt there either.

Trade imbalances and debt at any level are separate issues, you can run a trade surplus and still have debt, and you can also have a negative trade imbalance with no debt. At various times I believe the US has had both situations.

Norman

Diamond Member

- Sep 24, 2010

- 31,254

- 15,176

- 1,590

" Well, first of all money can not be converted, but exchanged. If you exchange via bank, someone has to buy and sell the currencies. So in the end there are 2 choices. Invest the money or buy something with it(balance the trade). On the other hand, investing is only done because you are expecting future returns so in the really end you only want to buy something with the cash. But that is besides the point.

Anyway, the problem is, company B invested those bucks into your debt. So the chinese company (more like central bank) owns a lot of the US govts debt. "

Here's where we go off the rails. When US company A imports something from a foreign company B, they pay for it, there ain't no debt. We got goods or services, they got our currency, there's no debt anywhere. Multiple that by a thousand transactionss, there's still no debt. For anybody.

Now, at some point the foreign companies may elect to buy US assets, property, stock, bonds, whatever. If they buy bonds, either federal, state, local, or private, then you get a debt to repay. But that transaction is entirely independent of the trade imbalance, they could do that with their own currency. Otherwise, if they invest in our economy by buying assets or stock, there's no debt there either.

Trade imbalances and debt at any level are separate issues, you can run a trade surplus and still have debt, and you can also have a negative trade imbalance with no debt. At various times I believe the US has had both situations.

I am just reading an macro economic book here, and it does view trade deficit as net debt. However it's not like this book is crafted by Chuck Norris who gave it down in silver plating from mount Mosaic.

Anyway, debt is promise to pay. And USA has to accept dollars, which are a promise to pay "whatever they buy". So USA as whole does owe whatever the dollars happen to buy to foreigners.

Foreigners buying US debt/equities just widens the outflow of dollars and promises to pay whatever they buy. This is of course not a bad thing for USA, unless the government gets the money and spends it inefficiently.

So again, it can be viewed as debt, but debt is not a bad thing.

- Thread starter

- #7

What book are you reading? I'd like to see the rationale the author uses. Look, if a US company buys a product from a foreign firm, then of course there is a debt for the US company. Which I assume is paid according to the stipulations of the contract. But the US Gov't at this point has no involvement, and as a taxpayer I am not on the hook for whatever some company decides to do. Maybe I'm dense, but I'm not seeing any debt until and unless the foreign company buys US Treasuries or S bonds of some kind.

Norman

Diamond Member

- Sep 24, 2010

- 31,254

- 15,176

- 1,590

What book are you reading? I'd like to see the rationale the author uses. Look, if a US company buys a product from a foreign firm, then of course there is a debt for the US company. Which I assume is paid according to the stipulations of the contract. But the US Gov't at this point has no involvement, and as a taxpayer I am not on the hook for whatever some company decides to do. Maybe I'm dense, but I'm not seeing any debt until and unless the foreign company buys US Treasuries or S bonds of some kind.

Don't mix the federal debt and trade deficit.

Obviously the government owes no one till it burrows. So trade deficit is not the government's obligation to provide anything.

However any US business is obligated to take in the dollars and give in goods to the chinese. That is what the debt is about, and that is also why chinese are giving their products for the green pieces of paper in the first place.

The book used rationale that a dollar is basically a share of US economy and thus trade deficit is debt. Or something like that. I may put the exact translation here later.

Also this is all related to the Savings = Investment - trade deficit. Which is part of GDP equation.

Although not in the book, if you think about it in terms of gold standard it may make more sense.

Last edited:

- Apr 12, 2011

- 3,814

- 758

- 130

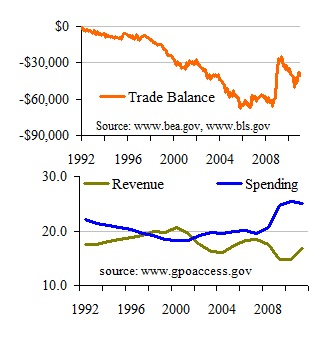

...but I see no connection between the trade imbalance and our national debt.

You're not seeing it hypothetically. Let's see how this works in the real world--

--so changes of the trade balance have gone up and down regardless of the budget deficit. Sometimes together and sometimes opposite. No relationship whatsoever. Your hypothesis is now a theory backed by observation.

America's Debt Crisis...

We will have another crisis...

May 17, 2011: Robert Rodriguez, CEO of the FPA investment house, says there are plenty of risks out there and that investors have not learned the lessons of the past few years.

See also:

The Great Recession's lost generation

May 17, 2011: The brutal job market brought on by the recession has been hard on everyone, but especially devastating on the youngest members of the labor force.

We will have another crisis...

May 17, 2011: Robert Rodriguez, CEO of the FPA investment house, says there are plenty of risks out there and that investors have not learned the lessons of the past few years.

Few mutual fund managers could pull off what Robert Rodriguez did. During the tumultuous 2000s, his FPA Capital stock portfolio, which is closed to new investors, managed to earn an annualized 9% even as the S&P 500 lost money. At the same time, he also co-managed FPA New Income, a bond fund that earned a spot on our Money 70 list of best funds.

Rodriguez, 62, is known for thinking big: In early 2007 he laid out a detailed case for why housing debt could trigger a crisis. Now he's just as worried about the federal debt. Rodriguez took a sabbatical in 2010 -- he traveled the globe, read about the fall of Rome, indulged his car-racing hobby -- and has returned to FPA as CEO, with an advisory role on the funds. He spoke with editor-at-large Penelope Wang; the conversation has been edited.

Now that you're back, do you have a different perspective on the economy?

I would say a lot of nothing has changed. Before I left, I was vocal about the difficulties that were going to hit the U.S. economy: the growing federal debt and the lack of meaningful fiscal reform. These issues still have not been addressed. Meanwhile, banks are operating much as before -- "too big to fail" is continuing. Investors are still chasing after higher yields and loading up on risky investments. The search for safety in the wake of the financial crisis lasted maybe two years. Very little has been learned.

Won't the economic recovery help us grow out of these problems?

See also:

The Great Recession's lost generation

May 17, 2011: The brutal job market brought on by the recession has been hard on everyone, but especially devastating on the youngest members of the labor force.

About 60% of recent graduates have not been able to find a full-time job in their chosen profession, according to job placement firm Adecco. And for those just entering the workplace, a bout of long-term unemployment can affect their career plans for years to come. Meghan O'Halloran was one of those who had her career derailed by the timing of her graduation. She left Cornell University with a degree in architecture and six summers of internships at top firms in New York, Milan and London. "I thought getting a job would be a snap," she said.

But after graduating in December 2008, just as job losses in the economy were reaching a high point, she was confronted with a very cold reception into the labor force. She followed her boyfriend to China for a year, and found architecture work plentiful in the building boom there. But when she returned home at the end of 2009, not much had improved, and no one was hiring. "I've applied for temporary work," she said. "The answer is always the same, 'We wish we could hire you.'" She's decided to leave behind her hopes for a career as an architect and has started her own business making custom fabric, carpets and furniture.

O'Halloran's experience is not unique. Last year, the unemployment rate for college graduates age 24 and younger rose to 9.4%, the highest since the Labor Department began keeping records in 1985. One reason is because recent hires with limited experience have the toughest time competing in a job market flooded with experienced candidates. "We know that young people coming out of college have the least experience," said Kathy Kane, senior vice president of talent management at Adecco. "And these entry-level jobs can be the easiest for companies to reduce." But long stretches of unemployment are only part of the problem young job seekers face.

MORE

Last edited:

Granny says dem politicians gonna bankrupt us yet...

US debt deal deadlocked again

Sat, May 28, 2011 - FOURTH ROUND:Aides said a fundamental stumbling block remains: Democrats will not consider cuts to health benefits until Republicans consider tax increases

US debt deal deadlocked again

Sat, May 28, 2011 - FOURTH ROUND:Aides said a fundamental stumbling block remains: Democrats will not consider cuts to health benefits until Republicans consider tax increases

US Vice President Joe Biden and top lawmakers on Thursday faced an impasse on taxes and healthcare as they worked on a deal to tame the US debt and increase its borrowing limit. Republican and Democratic negotiators briefly discussed health costs, a major driver of the national debt, in a fourth round of talks that lasted a little more than an hour. The normally voluble Biden left the meeting without comment. Were not doing a lot of talking for obvious reasons, said Republican Senator Jon Kyl, a member of the group. The group said it could agree on more than US$1 trillion in deficit savings over 10 years, but aides said a fundamental stumbling block remains: Democrats will not consider cuts to health benefits until Republicans consider tax increases.

With next years election season already under way, political pressures could push a deal out of reach as both sides turn their disagreements into campaign slogans. The congressional calendar poses another hurdle as the House of Representatives and the Senate will be in session at the same time for only four of the coming 10 weeks. Kyl said the group could hold a telephone conference next week and staffers could look at specific ideas in the meantime. The group is trying to hammer out a deal that would give lawmakers political cover to raise the US$14.3 trillion debt ceiling a limit on the federal governments borrowing set by Congress before an Aug. 2 deadline. US Treasury Secretary Timothy Geithner, who participated in the talks, has warned the US could face a catastrophic default that would roil global markets if Congress does not raise the debt ceiling by Aug. 2.

In a letter, 17 Republican senators said that Treasury could avoid a default if it prioritized debt service over other spending after Aug. 2. Even if the debt ceiling remains where it is, there will be more than enough money in the Treasury to make the governments debt payments, the letter said. US President Barack Obamas former budget director, Peter Orszag, warned that a crisis of confidence in the bond markets will be needed to spur Congress into action. Finding common ground could be difficult.

Democrats say the Republican plan to save trillions of dollars in coming decades by scaling back the Medicare and Medicaid health coverage programs for the elderly and the poor is unacceptable and see a chance to score gains in the presidential and congressional elections by campaigning against it. Public sentiment is everything, and the public sentiment is to preserve Medicare, House Democratic Leader Nancy Pelosi said at a news conference. Public unease with the Republican plan will give Democrats a chance to win back the House, said Representative Steve Israel, the lawmaker in charge of that effort.

Republicans won control of the House last fall on a promise to slash government spending, but polls show voters oppose their plan to revamp the two popular programs, which account for one-quarter of government spending and are expected to eat up a growing portion of the budget in coming decades. Republicans sought to shift the conversation to their plans to create jobs by cutting taxes and reducing regulations. They said Democrats were more concerned with winning next years election than solving the countrys long-term fiscal woes. The Democrats plan is to do nothing, House Speaker John Boehner said. Doing nothing means that the Medicare plan will go bankrupt and seniors benefits will be cut.

US debt deal deadlocked again - Taipei Times

cpduprovider

Rookie

- May 29, 2011

- 29

- 4

- 1

Cheney said deficits don't matter.

cpduprovider

Rookie

- May 29, 2011

- 29

- 4

- 1

Say US company A imports a product from foreign company B, and pays them X dollars for it. B now has the bucks, in a bank somewhere. They either convert it to their own currency, or they invest those dollars in our economy, right? Or maybe they use those dollars in another transaction with foreign company C, whatever. I don't see a debt problem yet, the US gov't doesn't owe anybody anything at this point. If the US gov't were not running a deficit, there would be no debt, regardless of the trade imbalance. Foreign interests could invest here or buy US assets, but I see no connection between the trade imbalance and our national debt.

Ever hear of the petrodollar and petrodollar recycling? But, consider if all we ever do is buy and have nothing to sell, then people are going to get tired of holding our paper. Dollars are not ony money, but they are also debt. Our system is a debt-based system used in money creation. How much aggregate debt that can be created determines our money supply.

Granny says we oughta default onna Chinese - let `em sit inna corner eatin' chop suey...

Failure on debt could spell trouble for economy

5/27/2011 - Without action, Treasury will be forced to stop paying some big bills

Failure on debt could spell trouble for economy

5/27/2011 - Without action, Treasury will be forced to stop paying some big bills

The government has maxed out its borrowing limit, and Treasury officials have warned of dire consequences if Congress and the White House can't agree soon on a plan for raising the debt ceiling. Failure to act on a plan could force the Treasury to make steep spending cuts to avoid defaulting on debt payments, with potentially serious damage to the current weak economic recovery.

The Senate this week shot down a proposal by Rep. Paul Ryan, R-Wis., to cut $6 trillion in federal spending over the next 10 years. That put Congress back on square one as lawmakers look for a compromise that would allow the government to continue operating without some kind of automated cuts to stay under the spending cap. Though the government hit its official $14 trillion credit limit May 16, the Treasury has said it has some wiggle room to remain under the ceiling for the next two months or so.

The biggest fear is that the government won't be able to pay the interest on its existing $14 trillion in debt, but some budget analysts believe that scenario is unlikely. Interest on the national debt only accounts for about 10 percent of federal spending, and the government can pay off old bonds that come due with the proceeds of fresh debt sales. (The debt limit only applies to the total amount outstanding.)

There are also a variety of accounting tricks, some never used before, that the Treasury is considering to postpone the day when it runs out of cash. Treasury Secretary Tim Geithner has said the government can free up some $232 billion with what he calls "extraordinary measures." The government has already suspended contributions to federal employee pension funds. It may also stop making payments into a government fund that buys and sells foreign currencies.

MORE

Granny says dey eatin' our lunch, just like Uncle Ferd said dey'd do if dey ever caught on to capitalism...

Chinese trade surplus widens

June 9, 2011 -- China's monthly trade balance showed a wider surplus in May, although the rate of export growth slowed.

Chinese trade surplus widens

June 9, 2011 -- China's monthly trade balance showed a wider surplus in May, although the rate of export growth slowed.

The world's second largest economy reported a $13.05 billion surplus in May, up from its $11.4 billion surplus recorded in April, China's General Administration of Customs said Friday. Exports grew at a 19.4% rate year-over-year, to $157.16 billion in May. While that's still a fast rate, it marks a slip from the staggering 29.9% growth in April.

Import growth sped up, expanding at a 28.4% rate to $144.11 billion. The data came a week after China reported itsmanufacturing activity slowed to a 10-month low in May. Economists have been expecting China's rapidly growing economy to decelerate gently in the spring.

Rapid inflation had already started quelching both business and consumer spending, they say. Meanwhile, the Chinese government has tightened monetary policy controls in hopes of taming inflation and preventing the economy from overheating.

Even in light of a slight slowdown, China's economic growth far exceeds that of the United States, with gross domestic product growth at rates consistently near 10% a year.

Source

Similar threads

- Replies

- 259

- Views

- 9K

- Replies

- 19

- Views

- 201

Latest Discussions

- Replies

- 285

- Views

- 2K

- Replies

- 5K

- Views

- 74K

Forum List

-

-

-

-

-

Political Satire 8013

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 466

-

-

-

-

-

-

-

-

-

-