Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Top tax rates were at 70% when Microsoft and Apple were founded

- Thread starter ilia25

- Start date

Old Rocks

Diamond Member

And how many people were in the "top tax rate" at that time compared to today?

Personally, I would rather the country have lots of rich people paying the taxes rather than a few rich people paying 70%. But that's just me, I believe the more rich people the better, I know that goes against the progressive wet dream, but there it is.

I would much rather have a nation with a very strong middle class paying the 35% or so we pay, than a nation with 1% paying 13%. Not only is the nation stronger, the government has more money to make the repairs that our infrastructure so direly needs. Why should a person with an income like that of Romney pay only 13%, or less, while someone making 100k off the sweat of their brow pays 35% total SS, Medicare, and Federal Income Tax? Time for all income to be taxed at the same rate as that of the middle class.

Old Rocks

Diamond Member

It no longer amazes how quickly some posters here resort to vulgar and profane responses - probably due to their lack of intelligence.

Yep. Doesn't require much IQ to be a 'Conservative'

What's the point of raising tax rates?

Libs want more money in the treasury so they can spend more on

food stamps,welfare,more bureaucracy,bigger government,more social programs,more free stuff....

Which means they get more votes and stay in power.

- Sep 19, 2011

- 28,389

- 9,969

- 900

Try a 70% tax rate in today's multi-polar hyper-competitive world, and see what happens

Yeah...they planned it that way. They won't be satisfied till what used to be the middle class works 80 hours a week with no benefits.....about like a Maylasian day laborer:

Total U S Debt

09/30/2009 $11,909,829,003,511.75(80% Of All Debt Across 232 Years Borrowed By Reagan And Bushes)

09/30/2008 $10,024,724,896,912.49(Times Square Debt Clock Modified To Accomodate Tens of Trillions)

09/30/2007 $9,007,653,372,262.48

09/30/2006 $8,506,973,899,215.23

09/30/2005 $7,932,709,661,723.50

09/30/2004 $7,379,052,696,330.32

09/30/2003 $6,783,231,062,743.62(Second Bush Tax Cuts Enacted Using Reconciliation)

09/30/2002 $6,228,235,965,597.16

09/30/2001 $5,807,463,412,200.06(First Bush Tax Cuts Enacted Using Reconciliation)

09/30/2000 $5,674,178,209,886.86(Administration And Congress Arguing About How To Use Surplus)

09/30/1999 $5,656,270,901,615.43(First Surplus Generated...On Track To Pay Off Debt By 2012)

09/30/1998 $5,526,193,008,897.62

09/30/1997 $5,413,146,011,397.34

09/30/1996 $5,224,810,939,135.73

09/29/1995 $4,973,982,900,709.39

09/30/1994 $4,692,749,910,013.32

09/30/1993 $4,411,488,883,139.38(Debt Quadrupled By Reagan/Bush41)

09/30/1992 $4,064,620,655,521.66

09/30/1991 $3,665,303,351,697.03

09/28/1990 $3,233,313,451,777.25

09/29/1989 $2,857,430,960,187.32

09/30/1988 $2,602,337,712,041.16

09/30/1987 $2,350,276,890,953.00

09/30/1986 $2,125,302,616,658.42

09/30/1985 $1,823,103,000,000.00

09/30/1984 $1,572,266,000,000.00

09/30/1983 $1,377,210,000,000.00

09/30/1982 $1,142,034,000,000.00(Total Debt Passes $1 Trillion)

09/30/1981 $997,855,000,000.00

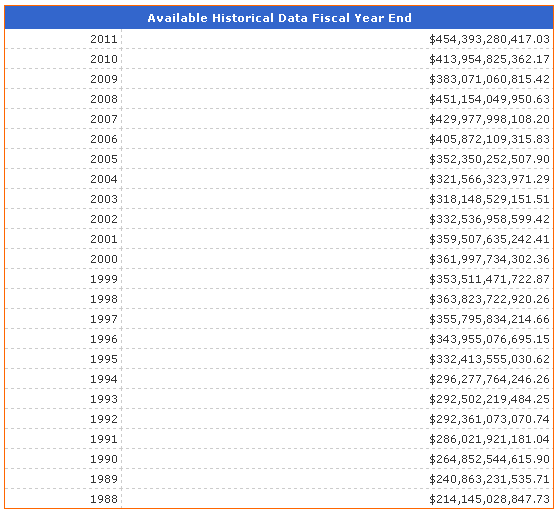

.........................ANNUAL INTEREST ON THE NATIONAL DEBT......................

http://en.wikipedia.org/wiki/Misery_index_(economics)

Misery Index Carter 16.26 Obama 10.75 Bush 8.11

2) Carter Misery Index that consisted of:

Prime

Inflation Interest rate Unemployment

1977 6.5% 7.75% 7.1%

1978 7.6% 11.50% 6.1%

1979 11.2% 15.75% 5.8%

1980 13.5% 21.50% 7.1%

Skull Pilot

Diamond Member

- Nov 17, 2007

- 45,446

- 6,163

- 1,830

I guess they forgot to tell Steve Jobs and Bill Gates that high tax rates kill incentives to innovate.

What you forget to mention is that someone making 24000 a year in 1975 was in the 36% bracket.

So if you want to go back to 1975 be prepared to pay more in taxes yourself.

Individual Income Tax Parameters

Married Filing Jointly

1971-1976

Rate

$0 - $1,000 14%

$1,000 - $2,000 15%

$2,000 - $3,000 16%

$3,000 - $4,000 17%

$4,000 - $8,000 19%

$8,000 - $12,000 22%

$12,000 - $16,000 25%

$16,000 - $20,000 28%

$20,000 - $24,000 32%

$24,000 - $28,000 36%

$28,000 - $32,000 39%

$32,000 - $36,000 42%

$36,000 - $40,000 45%

$40,000 - $44,000 48%

$44,000 - $52,000 50%

$52,000 - $64,000 53%

$64,000 - $76,000 55%

$76,000 - $88,000 58%

$88,000 - $100,000 60%

$100,000 - $120,000 62%

$120,000 - $140,000 64%

$140,000 - $160,000 66%

$160,000 - $180,000 68%

$180,000 - $200,000 69%

$200,000 - and over 70%

THAT is an excellent point, SP.

Inflation needs to be taken into account when we fix tax rates.

In 1979, $24,000 was a fairly decent wage.

Hell back in 79, a million dollars was actually a lot of money!

But one minor point...those numbers reflect the taxable income AFTER standard or itemized deductions.

Tax rates are imposed on AGI not gross income.

Cammmpbell

Senior Member

- Sep 13, 2011

- 5,095

- 519

- 48

Cool so you're for a flat tax?

I like 10% off the top for all income regardless of the source no deductions no exemptions period.

Won't pay the bills. 30% to 35% is a realistic amount, and that includes SS and Medicare taxes.

No all we need to do is replace the income tax and a 10% flat tax would do that. You people want SS then it can stay as it is.

LMAO!! A Steve Forbes, Rich Man's dream. 10% would mean jack shit to the wealthy and to a middle earner(about $45,000 a year) would just add to the gasoline,sales, property, state income, payroll, federal excise, fees etc. they're already paying. Not only that it wouldn't pay the bills. Over a trillion and a half dollars of the accumulated debt under Obama went to pay the interest on the Reagan/Bushes debt. By gawd how's about you coming up with something fair.

Not only that a flat tax of 10% would not even come close to paying down the Reagan/Bushes debt. Try about 16%-18%.

Last edited:

Mad Scientist

Feels Good!

- Sep 15, 2008

- 24,196

- 5,431

- 270

Gov't Spending was $676 Billion when Microsoft and Apple were founded. Military budget was $114 Billion.Top tax rates were at 70% when Microsoft and Apple were founded

I guess they forgot to tell Steve Jobs and Bill Gates that high tax rates kill incentives to innovate.

US Government Spending Breakdown: Federal, State, Local for 1976 - Charts

Now it's $5.9 Trillion, 884 Billion on Defense (That we know of), 1 Trillion on ObamaCare.

US Government Spending Breakdown: Federal, State, Local for 2010 - Charts

I guess they forgot to tell Obama that Massive Gov't Spending destroys the Economy.

- Sep 19, 2011

- 28,389

- 9,969

- 900

Yes, I do! Why wouldn't I?

We should rise the capital gain tax as well.

Why don't we stop the bullshit here and tell the truth for once.

You guys want to get as much money as you can in the hands of government as possible.

BS is that claim of yours. What we want the rich to pay their fair share. And not "to the government", but to seniors and disabled, to support children in poor families, to support our military, etc.

AND YOU KNOW WHAT I couldn't agree with YOU MORE regarding soldiers,etc... EXCEPT

When especially Obama administration SENDS Billions to Egypt to what protect Middle East OIL ALL the while the Obama Administration REDUCES oil production on Federal lands EXCEPT..

When Obama approves (remember he promised to "And when I'm president, I will go line by line to make sure that we are not spending money unwisely."

PolitiFact | Obama's promise to go after earmarks 'line by line'

- spend $2.6 million to make sure prostitutes in China drink less on the job.

- $1.44 million in federal funds estimating the size of the population and examining the “social milieu” of male prostitutes in Hanoi and Ho Chi Minh City, Vietnam.

- Washington spends $25 billion annually maintaining unused or vacant federal properties

And he went through the budget LINE by LINE and approved spending TAX dollars that could go to soldiers, et.al. on Chinese/Vietnamese prostitutes???

Last edited:

Skull Pilot

Diamond Member

- Nov 17, 2007

- 45,446

- 6,163

- 1,830

Won't pay the bills. 30% to 35% is a realistic amount, and that includes SS and Medicare taxes.

No all we need to do is replace the income tax and a 10% flat tax would do that. You people want SS then it can stay as it is.

LMAO!! A Steve Forbes, Rich Man's dream. 10% would mean jack shit to the wealthy and to a middle earner(about $40,000 a year) would just add to the gasoline,sales, property, state income, payroll, federal excise, fees etc. they're already paying. Not only that it wouldn't pay the bills or especially begin to pay down Reagan/Bushes national debt. The money was borrowed and funneled to the top 1% through low tax rates. By gawd the only fair thing is for them to pay it back. Now over a trillion and a half dollars of the accumulated debt under Obama went to pay the interest on the Reagan/Bushes debt. By gawd how's about you coming up with something fair.

Not only that a flat tax of 10% would not even come close to paying down the Reagan/Bushes debt. Try about 16%-18%.

Actually a flat 10% tax on dollar one of all income would increase tax revenue as compared to the current income tax and we could gut the IRS and save billions more.

Take a minute to think will you?

Summary of Latest Federal Individual Income Tax Data | Tax Foundation

The average tax rate in 2009 was just over 11% but that is caclulated on AGI not gross income.

The total tax revenue in 2009 was 865 billion

The total of all personal income in 2009 was 11.8 trillion

10% of that would be 1.8 trillion a net gain in tax revenue.

Add to that what we could save by cutting the 13 billion dollar annual IRS budget by 2 thirds and then tell me 10% isn't enough.

Trajan

conscientia mille testes

I guess they forgot to tell Steve Jobs and Bill Gates that high tax rates kill incentives to innovate.

fine, I bet they would trade that for the lack of burden i.e. the local, state and fed. ( like SOX) gov. the tax structures, environmental strictures HR/labor practices, have heaped upon them/their co's since the late 70's and 80's...and of course as the second poster said, theres always that earned income vs. cap gains difference.

On a related note to fees/regulatory burdens, legalese driven there by, my father who is moving from the house he lived in/purchased since/in 1978, was packing and came across his original Loan/mortgage agreement..............12 pages....

Euroconservativ

Member

- Dec 5, 2011

- 385

- 32

- 16

Founded with high tax rates.... Succeed with low tax rates

We don't have companies like that in Europe

We don't have companies like that in Europe

ilia25

I can do math

- Jan 12, 2012

- 1,859

- 100

- 48

- Thread starter

- #74

Instead of giving them money....why not provide a better education?

Because a better education will not reduce inequality. A post-industrial economy creates relatively few high-paying jobs (though those are really high paying). Better education may increase the competition for those, but it won't make them more abundant.

ilia25

I can do math

- Jan 12, 2012

- 1,859

- 100

- 48

- Thread starter

- #75

Gov't Spending was $676 Billion when Microsoft and Apple were founded.Top tax rates were at 70% when Microsoft and Apple were founded

I guess they forgot to tell Steve Jobs and Bill Gates that high tax rates kill incentives to innovate.

Ever heard of inflation? Or about population growth?

It is obvious that most of the "tax the rich" crowd have never been in a tax bracket where more than half of their income is confiscated by the government. If you ever found yourself in that position, you would make rational economic decisions such as sheltering taxable income or making tax-free investments, such as municipal bonds.

Do any of you understand that "capital gains" are made from invested money that has already been taxed? This is the reason for Romney's and Buffet's apparently low tax rates. If you want to kill private investment and municipal borrowing, go ahead and make everything taxable at the earned income rate.

The real protector of wealth in this country is the automatic step-up basis for inherited assets, along with deductions for "charitable" contributions at current market value, which allow them to escape capital gains taxes altogether. Unfortunately, this subject is strictly verbotten by the large campaign contributors to both political parties.

Do any of you understand that "capital gains" are made from invested money that has already been taxed? This is the reason for Romney's and Buffet's apparently low tax rates. If you want to kill private investment and municipal borrowing, go ahead and make everything taxable at the earned income rate.

The real protector of wealth in this country is the automatic step-up basis for inherited assets, along with deductions for "charitable" contributions at current market value, which allow them to escape capital gains taxes altogether. Unfortunately, this subject is strictly verbotten by the large campaign contributors to both political parties.

ilia25

I can do math

- Jan 12, 2012

- 1,859

- 100

- 48

- Thread starter

- #77

So yes Jobs/Gates had 70% tax rate which (by the way never affected them with their initial startup costs but ACTUALLY HELPED because investors were able to write off against their 70% taxes the capital used by Jobs/Gates!

Thanks for making that point for me

ilia25

I can do math

- Jan 12, 2012

- 1,859

- 100

- 48

- Thread starter

- #78

I guess they forgot to tell Steve Jobs and Bill Gates that high tax rates kill incentives to innovate.

What you forget to mention is that someone making 24000 a year in 1975 was in the 36% bracket.

So if you want to go back to 1975 be prepared to pay more in taxes yourself.

I'm not suggesting going back to 1975. I'm suggesting 70% for the money people earn on top of, say, $500,000.

.

Amazes me how many people think that business owners just have to open the doors and - poof! - they're "rich" as hell on Day One. For most, success takes years of insane hours, massive risk, painful failure and generally getting the living shit beat out of you, often before you're even able to hire your first employee.

An example was that guy who said something like "I’m always struck by people who think, well, it must be because I was just so smart. There are a lot of smart people out there. It must be because I worked harder than everybody else. Let me tell you something — there are a whole bunch of hardworking people out there."

I doubt he ever started, grew and operated a business.

.

Amazes me how many people think that business owners just have to open the doors and - poof! - they're "rich" as hell on Day One. For most, success takes years of insane hours, massive risk, painful failure and generally getting the living shit beat out of you, often before you're even able to hire your first employee.

An example was that guy who said something like "I’m always struck by people who think, well, it must be because I was just so smart. There are a lot of smart people out there. It must be because I worked harder than everybody else. Let me tell you something — there are a whole bunch of hardworking people out there."

I doubt he ever started, grew and operated a business.

.

So yes Jobs/Gates had 70% tax rate which (by the way never affected them with their initial startup costs but ACTUALLY HELPED because investors were able to write off against their 70% taxes the capital used by Jobs/Gates!

Thanks for making that point for me

So you favor high income tax rates and low capital gains rates? That is a great way to preserve wealth for those who already have it while making it more difficult for those who don't.

Similar threads

- Replies

- 69

- Views

- 621

- Replies

- 11

- Views

- 140

- Replies

- 98

- Views

- 1K

- Replies

- 90

- Views

- 1K

Latest Discussions

- Replies

- 2K

- Views

- 67K

- Replies

- 8

- Views

- 21

- Replies

- 61

- Views

- 177

- Replies

- 510

- Views

- 3K

Forum List

-

-

-

-

-

Political Satire 8029

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 468

-

-

-

-

-

-

-

-

-

-