TakeAStepBack

Gold Member

- Mar 29, 2011

- 13,935

- 1,742

- 245

What's the motive of the audit again, g5000?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

Jesus, it is not even worth correcting that string you're trying to push. You sir, are absolutely clueless.

Prove my claim is bogus. I have backed up with evidence that financial crises have been further apart and less deep since the Great Depression. This is an indisputable fact.

Only an idiot would want to undo that progress.

Yes, because the fed can print money to offset downturns. This has led us to 16 trillion dollars in the hole, and now, the fed MUST remain a market actor. As I already pointed out.

Im not going to take a trip down history lane with you, because you're so confused about this issue, it would take a long time to get you up to speed. Time Im not going to expend.

Now, what is the motive of the audit again, g5000? One more time.....Jimmy 5 times over here...

the hope behind transparency is that it will help convince more people that the only way to fix and reform the system is by ending the Fed.

Yes, because the fed can print money to offset downturns. This has led us to 16 trillion dollars in the hole, and now, the fed MUST remain a market actor. As I already pointed out.

Im not going to take a trip down history lane with you, because you're so confused about this issue, it would take a long time to get you up to speed. Time Im not going to expend.

Now, what is the motive of the audit again, g5000? One more time.....Jimmy 5 times over here...

Educate yourself, you are the one who does not know what you are talking about.

The Federal Reserve does not print money.

The Treasury Dept. does.

The 16 trillion is due to borrowing from other countries.

Jimminey Xmas

Prove my claim is bogus. I have backed up with evidence that financial crises have been further apart and less deep since the Great Depression. This is an indisputable fact.

Only an idiot would want to undo that progress.

Yes, because the fed can print money to offset downturns. This has led us to 16 trillion dollars in the hole, and now, the fed MUST remain a market actor. As I already pointed out.

Im not going to take a trip down history lane with you, because you're so confused about this issue, it would take a long time to get you up to speed. Time Im not going to expend.

Now, what is the motive of the audit again, g5000? One more time.....Jimmy 5 times over here...

Educate yourself, you are the one who does not know what you are talking about.

The Federal Reserve does not print money.

The Treasury Dept. does.

The 16 trillion is due to borrowing from other countries.

Jimminey Xmas

The values of commodities are the easiest things in the world to manipulate.

Which as to do what with an audit?

The audit is a smokescreen. The motive behind it is to end the Fed and base our currency on things you dig out of the ground.

Things whose value can be easily manipulated, and frequently are.

I am just pointing out the real goal of this audit bill, and the consequences which would result if that goal were achieved.

The market also has the added benefit of being far more than arms reach away from politics.

The market is also easily manipulated when it is unregulated. The Fed keeps our monetary supply far more than an arm's reach away from the speculators.

Which as to do what with an audit?

The audit is a smokescreen. The motive behind it is to end the Fed and base our currency on things you dig out of the ground.

Things whose value can be easily manipulated, and frequently are.

I am just pointing out the real goal of this audit bill, and the consequences which would result if that goal were achieved.

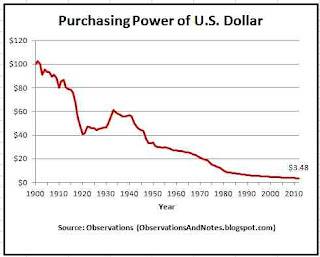

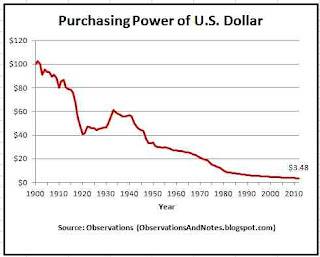

It's funny that your complaint regarding gold is that it's somehow "easily manipulated," when your currency of choice is paper. When comparing and contrasting the stability of gold versus paper, gold is the clear winner.

The audit is a smokescreen. The motive behind it is to end the Fed and base our currency on things you dig out of the ground.

Things whose value can be easily manipulated, and frequently are.

I am just pointing out the real goal of this audit bill, and the consequences which would result if that goal were achieved.

It's funny that your complaint regarding gold is that it's somehow "easily manipulated," when your currency of choice is paper. When comparing and contrasting the stability of gold versus paper, gold is the clear winner.

Tell that to John Paulson.

It's too late. The feds flow of purchases under Twist is now beyond the point of return. Auditing or limiting the federal reserve at this point is only going to lead to economic calamity.

I was a big proponent of this, until it became apparent that they must now remain as a market actor in the nature they have been since 2007-08. The entire market is now reliant on the feds ability to act freely in purchases and pumpping money into the system.

In other words, end game. Read about it here:

The Stock Is Dead, Long-Live The Flow: Perpetual QE Has Arrived | ZeroHedge

This is the Federal Reserve at work. Read it and weep, folks...

It's too late. The feds flow of purchases under Twist is now beyond the point of return. Auditing or limiting the federal reserve at this point is only going to lead to economic calamity.

I was a big proponent of this, until it became apparent that they must now remain as a market actor in the nature they have been since 2007-08. The entire market is now reliant on the feds ability to act freely in purchases and pumpping money into the system.

In other words, end game. Read about it here:

The Stock Is Dead, Long-Live The Flow: Perpetual QE Has Arrived | ZeroHedge

Is this the "too big to fail" argument ?

The way I see it is that we can deal with truth or fritter away some more time in this little economic fantasy. I would prefer to hear the bad news and start dealing with it.

We have a remarkably stable currency

It's too late. The feds flow of purchases under Twist is now beyond the point of return. Auditing or limiting the federal reserve at this point is only going to lead to economic calamity.

I was a big proponent of this, until it became apparent that they must now remain as a market actor in the nature they have been since 2007-08. The entire market is now reliant on the feds ability to act freely in purchases and pumpping money into the system.

In other words, end game. Read about it here:

The Stock Is Dead, Long-Live The Flow: Perpetual QE Has Arrived | ZeroHedge

Is this the "too big to fail" argument ?

The way I see it is that we can deal with truth or fritter away some more time in this little economic fantasy. I would prefer to hear the bad news and start dealing with it.

The bad news in this case is that if the federal reserve stops the flow of asset purchases, the end of the long curve becomes negative. this means people will ditch there long maturity bonds at loss and that means that the govt. will have to pay out on the them.

One way or another this system is coming to an end. If we audit the fed, it could mean that happens tomorrow 9the day after, as it were). Or, we can let the shell game fully mature and those who have paid attention can move their wealth around accordingly as the death pangs draw out. I still hold a good amount of asset in dollars, adn would prefer to get that wealth moved into the right place as this system caves in on itself ratehr than be caught in the shit storm. Your mileage may vary.