EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

To restore prosperity implement conservative libertarian agenda:

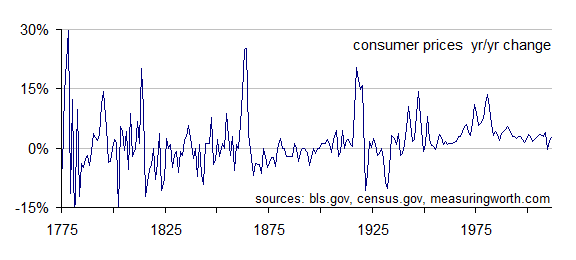

1) gold standard to create stable dollar

2) cut government so private sector has money to grow economy

3) balance budget so China and Japan have to buy our goods not out debt

4) make unions illegal to get 20 million new jobs back

5) end business taxation so business can focus on business , not avoiding taxes

6) end business taxation so business will be more competitive

7) makes health care capitalist to save each American $4000 a year.

1) gold standard to create stable dollar

2) cut government so private sector has money to grow economy

3) balance budget so China and Japan have to buy our goods not out debt

4) make unions illegal to get 20 million new jobs back

5) end business taxation so business can focus on business , not avoiding taxes

6) end business taxation so business will be more competitive

7) makes health care capitalist to save each American $4000 a year.