Free market economies work if they are left alone to do so. It is when people start meddling (i.e., government interference) that bad things begin to happen.

Free markets usually work when they are left alone. But they do not always as the market is often riddled with inadequate information and market power by a few agents, allowing them to extract economic rents from everyone else.

How is that an example of the market not working? It would seem to be an example of the market working.

Similarly periodic contractions are examples of the market working, punishing people who made bad decisions and eventually rewarding those who didn't. I heard Soros in an interview say something like this, that markets don't have a policing method. I wanted to barf. Of course they do. It's called bankruptcy and dissolution. Failure is an important part of the market. It frees up resources for more productive uses.

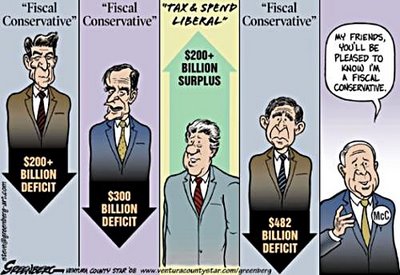

you must have been a McCain voter!

you must have been a McCain voter!