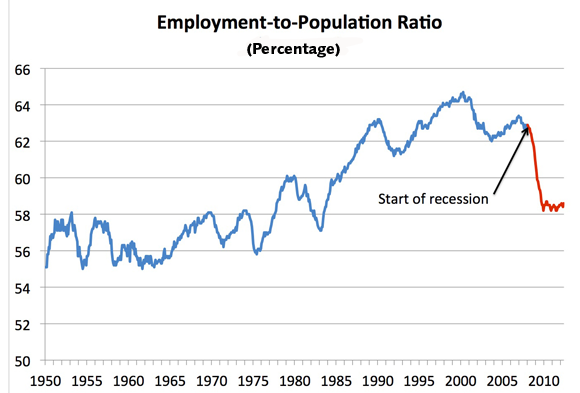

he characterized the latest numbers as a step in the right direction. For those Americans determined to continue believing a president who plays it fast and loose with the facts, perhaps such steps are comforting. Yet the actual facts tell another story: president Obama has presided over the weakest recovery on record.

The stats are daunting. The unemployment rate has been above 8 percent for 41 consecutive months, yet as cited above, that number only reflects those people participating in the labor force. The labor force participation rate was 63.8 percent last month, one of the lowest percentages on record. If not for that convenient anomaly, unemployment would be 11 percent. Chronic unemployment, which reflects the length of time people remain out of work, rose to 39.9 weeks in June. That number is sixteen weeks higher than the number in June 2009, when the recession officially ended. And despite the presidents assertion that businesses have created 4.4 million new jobs over the past 28 months, including 500,000 new manufacturing jobs, the nation has endured a net decline of roughly half a million jobs during the presidents tenure in office.

Yet jobs tell only part of the story. 2011 was the worst sales year ever recorded for housing, and home values remain nearly 35 percent lower than they were five years ago. The decline in Americans standard of living is the steepest since government began keeping records 50 ago, and family income has declined more post-recession than it did in the actual recession itself. In addition, record numbers of Americans are living on food stamps and a record number are living in poverty. Thus it is no surprise that overall government dependency, defined as the percentage of persons receiving one or more federal benefit payments, is the highest in American history.

Economist Michael Boskin reveals a list of other dubious, post-WW II records set by this administration. They include federal spending as a percentage of GDP at 25 percent, federal debt as a percentage of GDP at 67 percent, and a budget deficit as a percentage of GDP at 10 percent.

The Worst Recovery Ever | FrontPage Magazine