2013:

2017:

So what sticks out to you? For me,

Thoughts?

.

2017:

So what sticks out to you? For me,

- Interest on the debt nearly doubles, from 7% to 12%, and that's assuming that interest rates stay under control. How many of us would like to bet the house on that one?

- Defense spending is reduced significantly, from 24% to 18%. If done right, I'd bet that won't decay the effectiveness of the military.

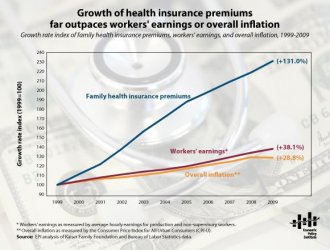

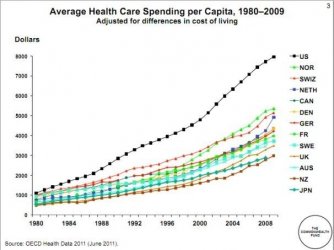

- Health care, from 24% to 28%. Holy crap. The politicians are too busy fundraising and posing for the teevee camera to work on our biggest health care problem, costs.

Thoughts?

.