I thought government didn't create jobs per many of our GOP friends?

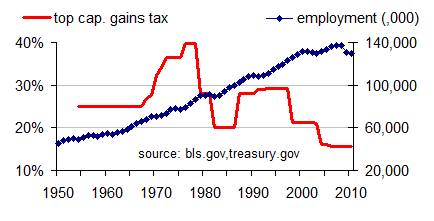

That being the case,,where are all the "Job Creators"? Seems to be that they went into hiding ever since Capital Gains taxes dropped to a record low.

That being the case,,where are all the "Job Creators"? Seems to be that they went into hiding ever since Capital Gains taxes dropped to a record low.