cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

- Thread starter

- #21

Again, history is not on the Fed's side.

1) the Fed is new so there is very little history. This crisis was new for the Fed; so far they have done an incredible job. No one knows the outcome but it will for sure rewrite the rules of central banking.

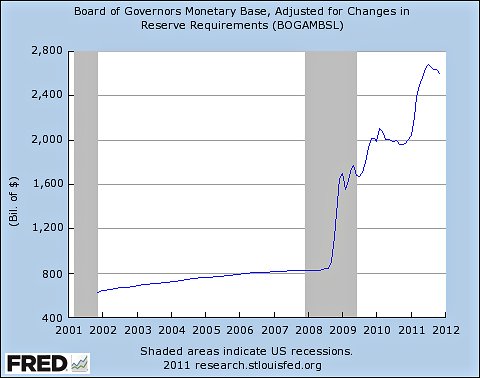

2) the most important lesson so far is that base money does not necessarily cause inflation in any timely way and the system is too interdependent and so too vulnerable to a another similar collapse. Dodd Frank did not address this issue at all.

There's ample history of the Fed not exiting properly and bringing about price inflation.

What there isn't history of, is a Fed balance sheet of this size.

That should scare people, not encourage them.

"Ample history"

There is 1979 and thats it. If anything the central bank has been hawkish on inflation through its history. It didnt do enough during the great depression, even by Milton Friedmans standards.