Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Ron Paul types and inflation

- Thread starter cbirch2

- Start date

Ron Paul believes in the so-called Austrian School of Economics which strongly favors gold-backed currency and views fiat currency as anathema to sound economic policy.

Ron Paul's economic doctrine has effectively become the party-line for the G.O.P.

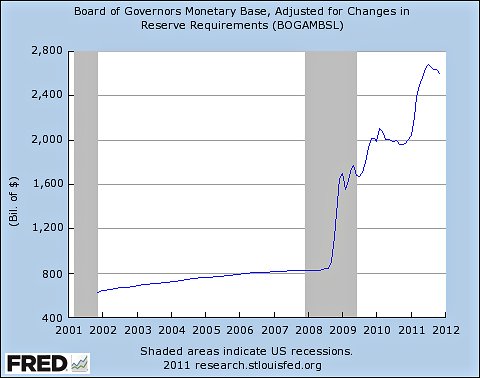

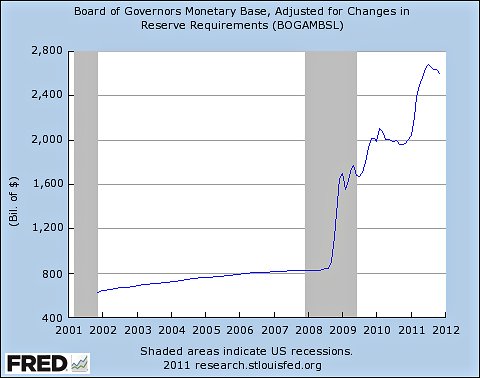

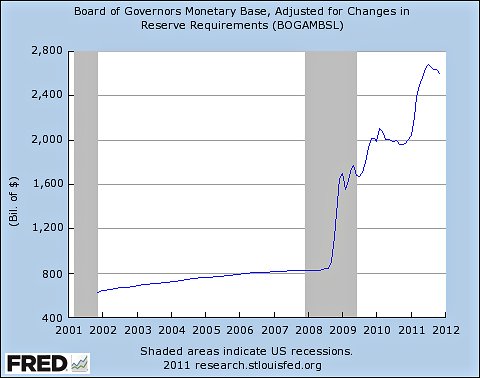

Three years ago the Fed started a series of policies that would greatly increase the monetary base. The essentially "printed" 2 dollars for every dollar we had. The Austrian School economists printed dire monetary inflation. It hasn't happened.

This is an excellent example of a monetary theory being put to test and failing to prove its hypothesis, but rather than simply admitting that and moving on, Ron Paul and, by extension, the Republican Party instead have dug in their heels and are insisting that they are right and have been all along despite the abundant evidence that proves the opposite.

Ron Paul would be an excellent addition to this message board.

Ron Paul's economic doctrine has effectively become the party-line for the G.O.P.

Three years ago the Fed started a series of policies that would greatly increase the monetary base. The essentially "printed" 2 dollars for every dollar we had. The Austrian School economists printed dire monetary inflation. It hasn't happened.

This is an excellent example of a monetary theory being put to test and failing to prove its hypothesis, but rather than simply admitting that and moving on, Ron Paul and, by extension, the Republican Party instead have dug in their heels and are insisting that they are right and have been all along despite the abundant evidence that proves the opposite.

Ron Paul would be an excellent addition to this message board.

cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

- Thread starter

- #3

Yea pretty much. The monetary base tripled at the same time inflation decreased.

Its amazing, because no one outside of a presidential debate could still stand behind the strict views of Ron Paul. Its a sad state of our society, facts do not matter.

Its amazing, because no one outside of a presidential debate could still stand behind the strict views of Ron Paul. Its a sad state of our society, facts do not matter.

You know, you would think after seeing those two graphs people would stop crying about the federal reserve causing inflation....

But no doubt they cant make any sense of those two graphs...

Or understand IS-LM

The problem is that the Austrian School generally discounts the CPI (or PCE) as a valid measure of inflation and inists on restricting "inflation" to mean only changes in the money supply.

cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

- Thread starter

- #5

You know, you would think after seeing those two graphs people would stop crying about the federal reserve causing inflation....

But no doubt they cant make any sense of those two graphs...

Or understand IS-LM

The problem is that the Austrian School generally discounts the CPI (or PCE) as a valid measure of inflation and inists on restricting "inflation" to mean only changes in the money supply.

Wow.

Who cares about changes in the money supply if the price level remains the same?

I guess he does call for an end to the fed. He would like to go back to the turn of the century when people like JP Morgan had to step in and save the economy and the government.

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

Yea pretty much. The monetary base tripled at the same time inflation decreased.

Its amazing, because no one outside of a presidential debate could still stand behind the strict views of Ron Paul. Its a sad state of our society, facts do not matter.

Actually, as a liberal you apparently don't know that inflation is a function of both money and velocity (P=MV). No one denies this, especially in the short term, especially Friedman, but most agree that in the long term velocity reverts to the mean and so inflation is always and everywhere a function of an inflated liberal money supply.

Last edited:

Yea pretty much. The monetary base tripled at the same time inflation decreased.

Its amazing, because no one outside of a presidential debate could still stand behind the strict views of Ron Paul. Its a sad state of our society, facts do not matter.

Actually, as a liberal you apparently don't know that inflation is a function of both money and velocity (P=MV). No one denies this, especially in the short term, especially Friedman, but most agree that in the long term velocity reverts to the mean and so inflation is always and everywhere a function of an inflated liberal money supply.

Inflation is a serious problem for people who have their life savings buried in the back yard.

- Moderator

- #8

Slightly over 2% inflation per year is considered healthy by most economists.

Mad Scientist

Feels Good!

- Sep 15, 2008

- 24,196

- 5,431

- 270

Too much fail.I guess he does call for an end to the fed. He would like to go back to the turn of the century when people like JP Morgan had to step in and save the economy and the government.

Inflation and the price of gold was pretty stable (low) from 1776 until 1913 when the Privately Owned Federal Reserve was created. Since then we've had many bubbles and crashes in our Economy as the Fed has increased and shrunk the money supply at their own whim. The Fed has had only one partial audit in it's almost 100 year history as well.

The Fed is also (until recently) secretly loaning out trillions of dollars to foreign banks while getting back about 78 Billion of it in the last year. Simple math shows that at that rate it'll take about 200 years to pay it all back.

If you did any research at all you'd know that International Bankers (Like JP Morgan and Goldman Sachs) are behind the Feds' current effort to destroy the dollar and remove it from it's place as the World Reserve Currency.

Paulie

Diamond Member

- May 19, 2007

- 40,769

- 6,382

- 1,830

You know, you would think after seeing those two graphs people would stop crying about the federal reserve causing inflation....

But no doubt they cant make any sense of those two graphs...

Or understand IS-LM

The problem is that the Austrian School generally discounts the CPI (or PCE) as a valid measure of inflation and inists on restricting "inflation" to mean only changes in the money supply.

Wow.

Who cares about changes in the money supply if the price level remains the same?

I guess he does call for an end to the fed. He would like to go back to the turn of the century when people like JP Morgan had to step in and save the economy and the government.

This post has much fail.

First of all, price levels don't immediately change when money supply changes. The multiplier effect must first begin via bank loans. Banks for now have been very content with simply taking their excess reserves and investing them throughout the markets. If you look at commodities, things people need to survive, prices are anything but steady, much less low.

And the other fail in your post is the JP Morgan part. I suppose you're unaware of JP Morgan's primary role during the 2008 collapse, where they backstopped much of the failure in the financial marketplace. And if it's not Morgan taking on these roles, it's Goldman.

Paulie

Diamond Member

- May 19, 2007

- 40,769

- 6,382

- 1,830

The question that the "there is no inflation" people need to ask themselves is, can the Fed exit 2 trillion dollars worth of asset positions efficiently enough to avoid massive inflation when the economy rebounds to the point that lending and borrowing increase pace?

History tells us no.

History tells us no.

cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

- Thread starter

- #12

Yea pretty much. The monetary base tripled at the same time inflation decreased.

Its amazing, because no one outside of a presidential debate could still stand behind the strict views of Ron Paul. Its a sad state of our society, facts do not matter.

Actually, as a liberal you apparently don't know that inflation is a function of both money and velocity (P=MV). No one denies this, especially in the short term, especially Friedman, but most agree that in the long term velocity reverts to the mean and so inflation is always and everywhere a function of an inflated liberal money supply.

Actually, austrians dont much care for Milton either.

"inflated liberal money supply"

As if its somehow monetary policy = politics. Idiocy.

Monetary policy is not always effective. If you can always combat deflation by printing money, whats the deal with japan

Last edited:

cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

- Thread starter

- #13

Too much fail.I guess he does call for an end to the fed. He would like to go back to the turn of the century when people like JP Morgan had to step in and save the economy and the government.

Inflation and the price of gold was pretty stable (low) from 1776 until 1913 when the Privately Owned Federal Reserve was created. Since then we've had many bubbles and crashes in our Economy as the Fed has increased and shrunk the money supply at their own whim. The Fed has had only one partial audit in it's almost 100 year history as well.

The Fed is also (until recently) secretly loaning out trillions of dollars to foreign banks while getting back about 78 Billion of it in the last year. Simple math shows that at that rate it'll take about 200 years to pay it all back.

If you did any research at all you'd know that International Bankers (Like JP Morgan and Goldman Sachs) are behind the Feds' current effort to destroy the dollar and remove it from it's place as the World Reserve Currency.

Lol wow. The fed is trying to remove the dollar as the worlds currency? Your an idiot.

The united states had no functional lender of last resort at the turn of the century. See: Europe today.

cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

- Thread starter

- #14

The problem is that the Austrian School generally discounts the CPI (or PCE) as a valid measure of inflation and inists on restricting "inflation" to mean only changes in the money supply.

Wow.

Who cares about changes in the money supply if the price level remains the same?

I guess he does call for an end to the fed. He would like to go back to the turn of the century when people like JP Morgan had to step in and save the economy and the government.

This post has much fail.

First of all, price levels don't immediately change when money supply changes. The multiplier effect must first begin via bank loans. Banks for now have been very content with simply taking their excess reserves and investing them throughout the markets. If you look at commodities, things people need to survive, prices are anything but steady, much less low.

And the other fail in your post is the JP Morgan part. I suppose you're unaware of JP Morgan's primary role during the 2008 collapse, where they backstopped much of the failure in the financial marketplace. And if it's not Morgan taking on these roles, it's Goldman.

And your fully aware that a lender of last resort is a necessary part of our financial system, right?

cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

- Thread starter

- #15

The question that the "there is no inflation" people need to ask themselves is, can the Fed exit 2 trillion dollars worth of asset positions efficiently enough to avoid massive inflation when the economy rebounds to the point that lending and borrowing increase pace?

History tells us no.

Understand the concept of a liquidity trap.

US Likely Caught In Liquidity Trap - BNP Paribas Executive | Fox Business

Finding a Prescription for the U.S.'s 'Liquidity Trap' - WSJ.com

Escaping The Liquidity Trap - Forbes.com

If anything, the problem now is deflation. Forbes, WSJ, and fox business are hardly beacons of liberalism.

Paulie

Diamond Member

- May 19, 2007

- 40,769

- 6,382

- 1,830

Wow, this is one hell of a rebuttal!Wow.

Who cares about changes in the money supply if the price level remains the same?

I guess he does call for an end to the fed. He would like to go back to the turn of the century when people like JP Morgan had to step in and save the economy and the government.

This post has much fail.

First of all, price levels don't immediately change when money supply changes. The multiplier effect must first begin via bank loans. Banks for now have been very content with simply taking their excess reserves and investing them throughout the markets. If you look at commodities, things people need to survive, prices are anything but steady, much less low.

And the other fail in your post is the JP Morgan part. I suppose you're unaware of JP Morgan's primary role during the 2008 collapse, where they backstopped much of the failure in the financial marketplace. And if it's not Morgan taking on these roles, it's Goldman.

And your fully aware that a lender of last resort is a necessary part of our financial system, right?

As far as the liquidity trap response, this answers nothing about the Fed exiting their asset positions once the economy starts to move again.

You do realize that if they don't get it just aboit perfect, there is extreme risk of those excess reserves spilling out into the economy creating potentially damaging price inflation, right? And if they miss the mark on it, they will be forced to make drastic rate hikes to extinguish money which just starts the deflationary spiral all over again.

A liquidity trap, regardless if there's really one or not, doesn't last forever. At some point, that monetary base is going to multiply. The only question is can the Fed keep it to a minimum so as not to allow inflation, but not stifle growth.

Again, history is not on the Fed's side.

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

Again, history is not on the Fed's side.

1) the Fed is new so there is very little history. This crisis was new for the Fed; so far they have done an incredible job. No one knows the outcome but it will for sure rewrite the rules of central banking.

2) the most important lesson so far is that base money does not necessarily cause inflation in any timely way and the system is too interdependent and so too vulnerable to a another similar collapse. Dodd Frank did not address this issue at all.

Paulie

Diamond Member

- May 19, 2007

- 40,769

- 6,382

- 1,830

Again, history is not on the Fed's side.

1) the Fed is new so there is very little history. This crisis was new for the Fed; so far they have done an incredible job. No one knows the outcome but it will for sure rewrite the rules of central banking.

2) the most important lesson so far is that base money does not necessarily cause inflation in any timely way and the system is too interdependent and so too vulnerable to a another similar collapse. Dodd Frank did not address this issue at all.

There's ample history of the Fed not exiting properly and bringing about price inflation.

What there isn't history of, is a Fed balance sheet of this size.

That should scare people, not encourage them.

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

There's ample history of the Fed not exiting properly and bringing about price inflation.

1) 100 years is tiny in human history. Surely you know that? The Fed's job is not to exit but to control prices and jobs. Maybe what you really want to advocate is changing the Feds mission. That is 1000 times more likely than getting rid of it.

What there isn't history of, is a Fed balance sheet of this size.

That should scare people, not encourage them.

well obviously even with the size there is little inflation so , so far so good!

cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

- Thread starter

- #20

Wow, this is one hell of a rebuttal!This post has much fail.

First of all, price levels don't immediately change when money supply changes. The multiplier effect must first begin via bank loans. Banks for now have been very content with simply taking their excess reserves and investing them throughout the markets. If you look at commodities, things people need to survive, prices are anything but steady, much less low.

And the other fail in your post is the JP Morgan part. I suppose you're unaware of JP Morgan's primary role during the 2008 collapse, where they backstopped much of the failure in the financial marketplace. And if it's not Morgan taking on these roles, it's Goldman.

And your fully aware that a lender of last resort is a necessary part of our financial system, right?

As far as the liquidity trap response, this answers nothing about the Fed exiting their asset positions once the economy starts to move again.

You do realize that if they don't get it just aboit perfect, there is extreme risk of those excess reserves spilling out into the economy creating potentially damaging price inflation, right? And if they miss the mark on it, they will be forced to make drastic rate hikes to extinguish money which just starts the deflationary spiral all over again.

A liquidity trap, regardless if there's really one or not, doesn't last forever. At some point, that monetary base is going to multiply. The only question is can the Fed keep it to a minimum so as not to allow inflation, but not stifle growth.

Again, history is not on the Fed's side.

Lol a liquidity trap cannot last forever? Well a lot of people would argue that Japan is about 20 years into its lost decade. Maybe you can argue its not in a liquidity trap anymore, but if the scenarios are similar weve only got like 6 more years to go! 6 years might as well be forever, if you can do something.

But you realize friedman thought the fed and the central bank of japan should do more in in 30's and 90's, respectively....right?

And then you realize that they tried that. You think its just a matter of time?

Sorry, im about to post a krugman graph here, and i know you dont like him or numbers. But hes talked a lot about japan.

How does that compare with your theory? Central bank prints money and it should always spill out into the rest of the economy, right? History would probably disagree with that.

How is history not on the feds side?

And "at some point the monetary base is going to multiply". Well yea, the fed can control m0 by printing money. But can it control m2, for example?

Similar threads

- Replies

- 93

- Views

- 2K

Latest Discussions

- Replies

- 223

- Views

- 2K

- Replies

- 39

- Views

- 355

- Replies

- 252

- Views

- 2K

- Replies

- 41

- Views

- 165

- Replies

- 253

- Views

- 2K

Forum List

-

-

-

-

-

Political Satire 8032

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 468

-

-

-

-

-

-

-

-

-

-