ShackledNation

Libertarian

- Thread starter

- #21

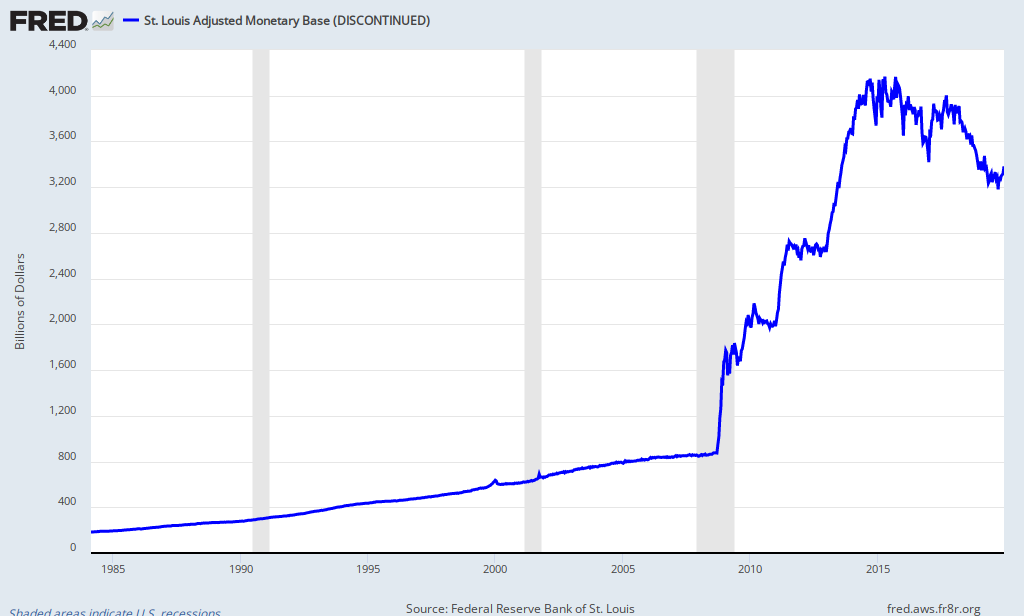

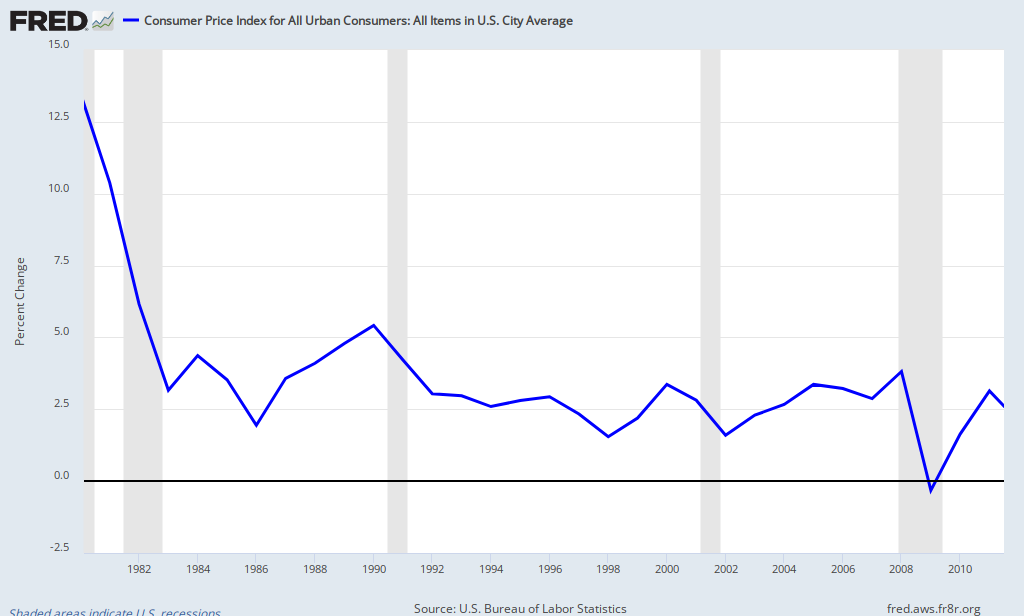

And their spending will cause prices to rise, lowering the standard of living for everyone who did not get newly printed money. So in other words, they are indirectly stealing from everyone else.And your spending will cause prices to rise, lowering the standard of living for everyone who did not get newly printed money. So in other words, you are indirectly stealing from everyone else.If the fed will print me 50K I promise to spend it in America on American products. I swear I will.

So------50K is chump change compared to what the Fed printed for the richest people in the world.