deltex1

Gold Member

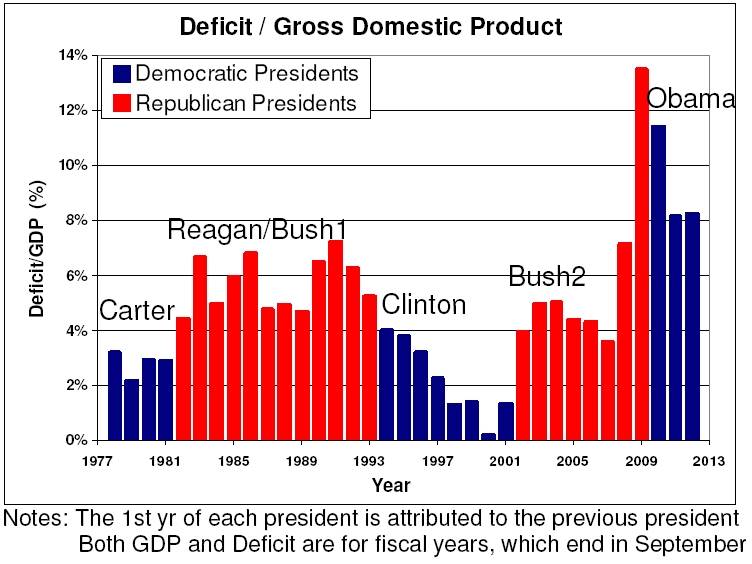

It's already made me 50k richer this year. Who needs a tax cut?Bear in mind that Trump's tax plan increases the national debt, with the knowledge that pseudocons have been howling for years about how increasing debt depresses household income and is a threat to national security.

Do you still buy that Trump's debt-exploding plan will make you richer?