- Banned

- #81

America was one of the few nations in the world left with any significant industrial capacity after WWII...Little wonder we made damn near everything.Addressing class warfare pimps only lends their arguments of avarice and covetousness validity.The OP is correct, I don't see anyone refuting the facts.

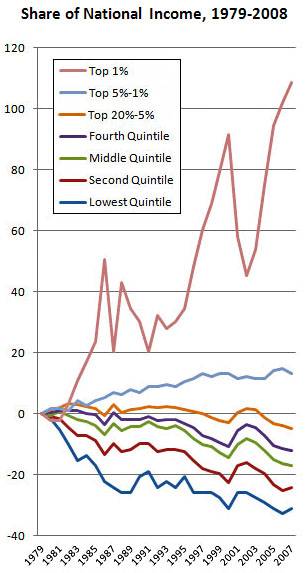

This trend will continue. Look, we have wages about where they were in constant 1982 Real Dollars and it's been an over 30 year trend. And at the same time, Corporate America which dictates the marketable wage, is enjoying great profits, while holding down wages. Now, the trend includes not only holding wages but also making great profits while minimizing their workforce. But they are hiring overseas where labor is cheaper.

Why would this tend not continue? What will happen to the Middle Class?

We've had going on 100 years of a central bank issuing a worthless currency, the income tax, nearly 70 years of New Deal socialism, more than 45 years of Great Society socialism, untold domestic handout and "investment" programs...Yet things keep getting worse.

And all the the class warfare pimps can tell us is that it's all the fault of the evil rich people.

Fuck Robert Reich.

Actually things have only been getting worse for the last 40 years. The two decades after WWII witnessed the greatest prosperity in modern times, if not world history. But when the elites discovered that they could make themselves even richer by investing in Asia rather than the US, things started to fall apart. Look for the decline to accelerate.

But why let niggling little facts like that get in the way of a good old fashioned populist hand-wringing?