Truthmatters

Diamond Member

- May 10, 2007

- 80,182

- 2,272

- 1,283

- Banned

- #1

OpEdNews - Article: A History of Recession in the United States 1950 to 2008

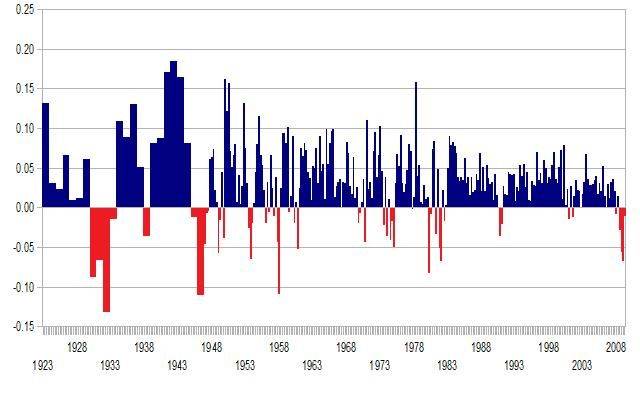

There is a pattern here that is plain to all but the most partisan. Ten of the last eleven recessions have occurred under the direction of Republican economic policy. And history does repeat itself. Look at the three greatest slowdowns in US economic history, 1929, 1982, 2008, all three were attributed to poor economic and tight credit policy, all three featured deregulation and lack of oversight of the financial markets, and all three were presided over by a Republican President.

Recession/Depression of 2008 George W. Bush (R) greatest downturn since 1929, blamed on lack of regulation of financial markets and collapse of credit markets

Recession of 2001 George W. Bush (R) began in April of 2001, -marked the beginning of greatest deficit spending in all of recorded human history-

Recession of 1990-1991 George H.W. Bush (R) Deregulation of Savings and Loan industry led to a collapse and panic, which led to election of Bill Clinton, who produced the greatest increase in jobs and wealth in all of recorded human history.

There is a pattern here that is plain to all but the most partisan. Ten of the last eleven recessions have occurred under the direction of Republican economic policy. And history does repeat itself. Look at the three greatest slowdowns in US economic history, 1929, 1982, 2008, all three were attributed to poor economic and tight credit policy, all three featured deregulation and lack of oversight of the financial markets, and all three were presided over by a Republican President.

Recession/Depression of 2008 George W. Bush (R) greatest downturn since 1929, blamed on lack of regulation of financial markets and collapse of credit markets

Recession of 2001 George W. Bush (R) began in April of 2001, -marked the beginning of greatest deficit spending in all of recorded human history-

Recession of 1990-1991 George H.W. Bush (R) Deregulation of Savings and Loan industry led to a collapse and panic, which led to election of Bill Clinton, who produced the greatest increase in jobs and wealth in all of recorded human history.

Last edited: