indago

VIP Member

- Oct 27, 2007

- 1,114

- 109

- 85

Toro touted:

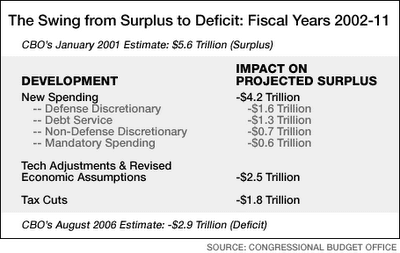

Now, we wouldn't want you attempting to deceive anyone into believing that the DEBT has been repaid when the chart shows otherwise, now would we?

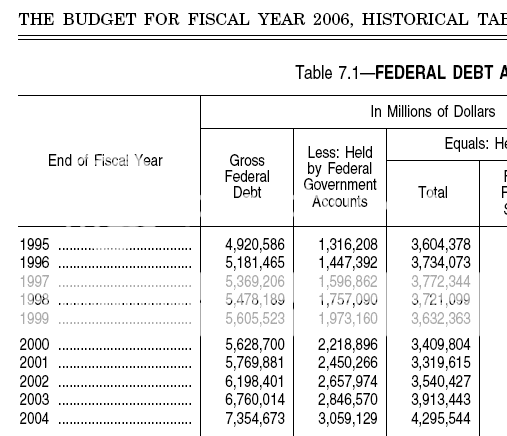

The debt is the accumulation of all deficits over time less any debt repayment. Debt is repaid when a government runs a surplus, or when government revenues exceed expenditures in a given fiscal year.

Now, we wouldn't want you attempting to deceive anyone into believing that the DEBT has been repaid when the chart shows otherwise, now would we?