DSGE

VIP Member

- Dec 24, 2011

- 1,062

- 30

- 71

No it isn't. Maybe in the economic community you follow, but it is simply not true to say that is what everyone uses.actually there are many definitions that make the dictionary

That's the one that everybody in the economics community uses.

Everybody in the non-Austrian economics community.

If a good rises in price, other goods must fall in price unless there is inflation caused by an expansion of the money supply to fuel the higher prices. If you have $100 to spend, and you spend $25 on four different items, if one of the items increases in price you will not be able to afford all of the items as before, so you will have to buy less of another item, thus reducing demand for that item and lowering its price.

I know. But not all goods and services are included in the CPI. So it's possible for the price of a CPI good to rise and the rise of a non-CPI good to fall.

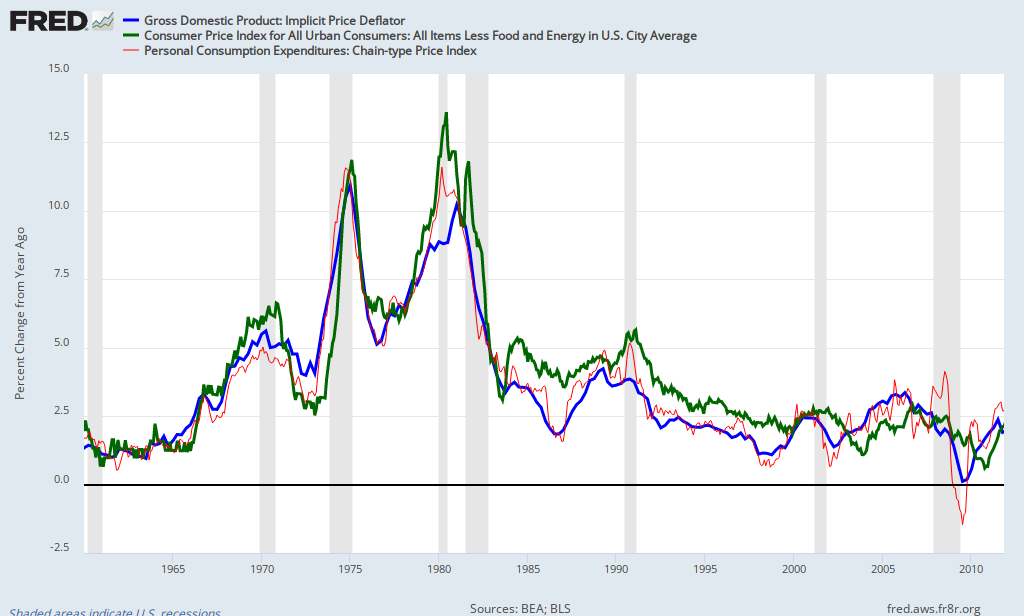

The CPI just happens to factor out the sectors in the economy that are most heavily affected by inflation to hide the negative effects of monetary policy.

The great thing about a nominal GDP target is that you don't have to choose a price index. There's only one NGDP.