Decepticon

Rookie

- Jan 11, 2012

- 1,138

- 189

- 0

- Banned

- #1

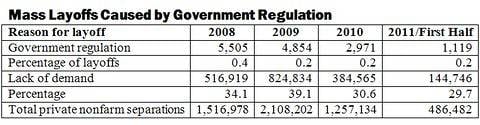

They propose tax cuts for small businesses and deregulation.

The problem with our economy isn't that businesses need breaks to hire people or that they're mired in red tape. Businesses need CUSTOMERS! They need DEMAND! The middle class doesn't have ANY MONEY TO SPARE, because it's been vampired out of them by insurance companies, phone companies, oil companies, speculators etc. et. al.

You just DON'T GET IT do you guys?

At some point, you're going to have to take care of the vast majority of the people at the small expense of the very rich. Not EVERY problem's solution is handing stuff over to them.

The problem with our economy isn't that businesses need breaks to hire people or that they're mired in red tape. Businesses need CUSTOMERS! They need DEMAND! The middle class doesn't have ANY MONEY TO SPARE, because it's been vampired out of them by insurance companies, phone companies, oil companies, speculators etc. et. al.

You just DON'T GET IT do you guys?

At some point, you're going to have to take care of the vast majority of the people at the small expense of the very rich. Not EVERY problem's solution is handing stuff over to them.

Last edited: