Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Facts About Gold

- Thread starter JBeukema

- Start date

- Status

- Not open for further replies.

- Apr 12, 2011

- 3,814

- 758

- 130

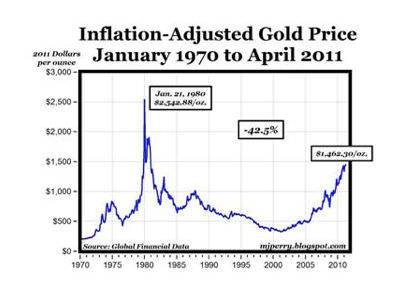

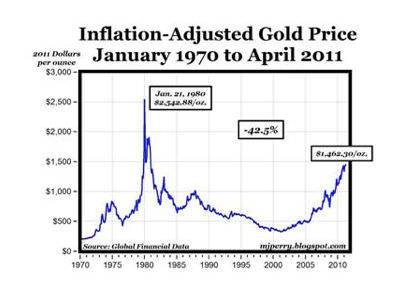

...Its not if you adjust for inflation.

Nice to have this fact being brought out, thanks.

What this is saying is that since 1980, a comparison of prices of gold and everything else show that gold is now worth less than everything else.

PLYMCO_PILGRIM

Gold Member

Ah so your saying Gold is still a smart investment in our current atmosphere, thanks for backing up my decision to buy more gold at the beginning of the year!

- May 20, 2009

- 23,425

- 8,069

- 890

BBD's facts about gold... It's pretty nice stuff.

Last year, Goldline, a company that advertised during the "Glenn Beck Show" -- and had the good fortune of Beck suggesting on air that gold was a good investment -- also became the subject of two state-level investigations. Beck has described the investigations as government efforts to eliminate opportunities to buy gold.

In a pair of companion cases, the CFTC and FTC have accused American Precious Metals of targeting investors -- particularly senior citizens -- across the country with a combination of high-pressure and illegal sales tactics and misleading and fraudulent claims.

"What these telemarketers said in general is ... you can't lose, you're going to make money, said Sana Chriss, an FTC attorney working on the case. "Well that just isn't true. The value of everything can change. At one point it was real estate that was the hot and infallible area and then we had the bust there. Before that it was tech stocks.

Gold Scams Rise On High Prices And Investor Anxiety

In a pair of companion cases, the CFTC and FTC have accused American Precious Metals of targeting investors -- particularly senior citizens -- across the country with a combination of high-pressure and illegal sales tactics and misleading and fraudulent claims.

"What these telemarketers said in general is ... you can't lose, you're going to make money, said Sana Chriss, an FTC attorney working on the case. "Well that just isn't true. The value of everything can change. At one point it was real estate that was the hot and infallible area and then we had the bust there. Before that it was tech stocks.

Gold Scams Rise On High Prices And Investor Anxiety

Granny been wonderin' why possum an' Uncle Ferd been comin' home late at night all covered with dirt like dey been diggin' a tunnel...

Ron Paul worries Fort Knox gold is gone

June 24, 2011: Ron Paul introduced a bill that would require the Fed to manually audit every U.S.-owned gold bar.

Ron Paul worries Fort Knox gold is gone

June 24, 2011: Ron Paul introduced a bill that would require the Fed to manually audit every U.S.-owned gold bar.

With the price of gold at record highs, presidential candidate Rep. Ron Paul wants to make sure the U.S. gold bars at Fort Knox are really there. Paul called a congressional hearing Thursday to grill federal officials about his bill to audit and inventory all of the gold reserves at Fort Knox, Ky., West Point, N.Y., and Denver, even though Treasury officials insist that the gold is audited annually and is all there. During the hearing, Paul suggested that the Federal Reserve of New York, which has 5% of the U.S. gold reserves, has the ability to secretly sell or swap gold with other countries without anyone knowing.

"The Fed is pretty secret, you know," said Paul, who leans Libertarian. "Congress doesn't have much say on what's going on over there. They do a lot of hiding." Paul, a Texas Republican who wants to convert the U.S. monetary system to one based on the gold standard, says the federal government owes it to taxpayers to make sure U.S.-owned gold is safe. "This is one of the few legitimate functions of government: To check our ownership and be fiscally responsible and find out just what we own and whether it's really there," said Paul, who is among those running for the Republican presidential nomination.

Audits by the Treasury Department and Government Accountability Office are based on samples. Paul wants to open up Fort Knox and other reserves and count the bars manually. "We know where it is. We know how much there is. We know it's there. None of it has been removed," said Treasury Inspector General Eric Thorson.

In September, Treasury completed its latest audit, showing that U.S. gold reserves total 9,300 tons with a market value of $320 billion, Thorson said. The recent run-up in gold prices -- the precious metal is trading at about $1,515 an ounce -- puts the market value at $340 billion as of Wednesday, according to Thorson's testimony. He added that each gold bar weighs about 27 pounds and is worth around $500,000.

MORE

Uncle Ferd been wantin' to take a peek at Granny's gold teeth...

The gold rush is on

August 11, 2011: The price of gold has surged from around $1,400 an ounce earlier this year, to trading around $1,800 this week.

The gold rush is on

August 11, 2011: The price of gold has surged from around $1,400 an ounce earlier this year, to trading around $1,800 this week.

Fear is high and investors are fleeing to gold. Amid a volatile stock market, Europe's debt woes and concerns about a weak U.S. economy, gold touched a new high above $1,800 earlier this week. It has fluctuated since, and is now back down around $1,750. Nevertheless, the surge was shocking, considering just earlier this year, the precious metal traded at about $1,400 an ounce. Five years ago, gold cost less than $500.

Granted, the gold market is small compared to stocks or bonds, so it can be dramatically influenced much more easily -- but the numbers can't be disputed -- a gold rush is on. Wary of the debt crisis debates in July, weak economic data and S&P's credit rating downgrade of the United States, investors have turned to the yellow metal because they perceive it as a tangible safe haven compared to paper currencies, bonds and stocks.

In the last week, traders bought 121,336 contracts for gold futures and options in the Chicago Mercantile Exchange. As of the end of trading Wednesday, investors held 951,623 contracts on COMEX gold, nearing an all-time high of 979,800 contracts in November 2010, according to figures tracked by the Commodity Futures Trading Commission. Meanwhile, exchange traded funds linked to physical gold had their fourth best week on record, as measured by the dollar amount flowing into those funds.

MORE

Mr. H.

Diamond Member

Gold, these days, is like oil (or any commodity for that matter) - made of paper, numbers, and electronic inputs.

B. Kidd

Diamond Member

Paulie

Diamond Member

- May 19, 2007

- 40,769

- 6,382

- 1,830

The reason why the gold boom is different than other booms is because gold has always been where cash moves to for protection during times of inflation. It's not like house flipping or tech stock flipping. It's the main protection from inflation. Right now Federal Reserve policy has us on the path towards some pretty serious price inflation in the marketplace, so the rush to gold and the continuing rise in it is justified.

The price of gold will come down when Federal Reserve policy of easy money changes. They just said they're keeping the fed funds rate at 0% for 2 more years. That is bullish for gold and only justifies the continuing increase in the price because now the potential for even worse inflation is there.

It's not just a gold rush because everyone else is doing it. There's a sound reason why people are putting their paper currency in gold.

The price of gold will come down when Federal Reserve policy of easy money changes. They just said they're keeping the fed funds rate at 0% for 2 more years. That is bullish for gold and only justifies the continuing increase in the price because now the potential for even worse inflation is there.

It's not just a gold rush because everyone else is doing it. There's a sound reason why people are putting their paper currency in gold.

...Its not if you adjust for inflation.

Nice to have this fact being brought out, thanks.

What this is saying is that since 1980, a comparison of prices of gold and everything else show that gold is now worth less than everything else.

at $34 in 1970 and a 7x CPI inflation rate gold should be priced at $200/ounce now?

- Sep 12, 2008

- 14,201

- 3,567

- 185

It also demonstrates it is a normal commodity, and it would be very unhealthy to base an economy on a commodity that has hysterical price swings

- Apr 12, 2011

- 3,814

- 758

- 130

If that were true then we'd all be seeing more inflation now than we saw when the price of gold was lower. We don't so it isn't. What I'm getting is the same people that lost half their life savings on real-estate a few years ago are now telling me how happy they are with their gold "investment".The reason why the gold boom is different than other booms is because gold has always been where cash moves to for protection during times of inflation...

If that were true then we'd all be seeing more inflation now

people are buying in anticipation of inflation which is very reasonable given the world's monetary history and the Fed's exploding balance sheet

- May 20, 2009

- 23,425

- 8,069

- 890

All the gold stuff I have turns green in about 3 weeks - especially if I sweat a lot. Something is wrong with my bling.

- Apr 12, 2011

- 3,814

- 758

- 130

The average London PM gold price for 1970 was $35.94, the cpi's gone from 38.8 to 223.7 which makes 1970 gold $207....at $34 in 1970 and a 7x CPI inflation rate gold should be priced at $200/ounce now?

Yup.

Paulie

Diamond Member

- May 19, 2007

- 40,769

- 6,382

- 1,830

If that were true then we'd all be seeing more inflation now than we saw when the price of gold was lower. We don't so it isn't. What I'm getting is the same people that lost half their life savings on real-estate a few years ago are now telling me how happy they are with their gold "investment".The reason why the gold boom is different than other booms is because gold has always been where cash moves to for protection during times of inflation...

Maybe you didn't notice the price of gas and food lately? How about the price of coffee? It's up 100% in a year. My produce costs have shot up out the ass lately, and I live in the Garden State. Milk was 3.69/gal a couple months ago and now it's 4.50.

I don't know where you're not seeing inflation.

Ernie S.

Diamond Member

Gold, these days, is like oil (or any commodity for that matter) - made of paper, numbers, and electronic inputs.

Not the stacks of coins and bars I have here..

Maybe over the last 30 years, it hasn't kept up with inflation, but in the last year, I've made 40% on my gold, 10% on platinum and a bit below 100% on my silver.

You can say what ever you want about precious metals as an investment, but show me anything that has outperformed it lately.

- Apr 12, 2011

- 3,814

- 758

- 130

In June 2008 oil was $134/bl. Now it's $83. Of course when it comes to money I like to talk numbers, while most posters on these threads ramble on about how they're so smart they never have to even think of numbers.Maybe you didn't notice the price of gas and food lately.......If that were true then we'd all be seeing more inflation now than we saw when the price of gold was lower. We don't so it isn't...

- Status

- Not open for further replies.

Similar threads

- Replies

- 14

- Views

- 246

- Replies

- 5

- Views

- 97

- Replies

- 0

- Views

- 195

Latest Discussions

- Replies

- 178

- Views

- 1K

- Replies

- 69

- Views

- 555

- Replies

- 16

- Views

- 75

Forum List

-

-

-

-

-

Political Satire 8040

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 469

-

-

-

-

-

-

-

-

-

-