Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The coming collapse in gold!

- Thread starter Neubarth

- Start date

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

Trade deficits are always caused if country is not competitive or if their currency is overvalued. If there is trade deficit it also must be paid back. The only way to do this is of course is to let dollar to fall, so the trade relations can reverse (other countries will then start to buy from US).

US is the strongest trade deficit nation, it doesn't matter if the economy is big. Further there are no savings, no capital goods.... So they can't pay back in any other way than dollar losing value. They also have lots of promises to be paid to their citizens that can't be paid, this must be financed with debt or inflation.

China has the produce, US has dollars that they send there. Now who is in trouble again if dollar falls? Not china... it has citizen too, and they get richer when government stops the peg. They are rich enough to consume their own TVs, how would it be possible to not consume the stuff you made?

Soviet union also was a huge economy and it collapsed BTW.

spot on.

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

We've run a trade deficit for most of our history, the period 1940 to 1965 roughly was an exception. I have yet to see any problem as a result.

you don't quite get it. The US can run twin deficits explicitly because it prints the world's commodity exchange currency. Our world reserve currency status is already gone.

If other nations did not need US dollars in order to buy oil and food they would not need to have export based economies running trade surpluses to get commodities.

Their need for dollars facilitates our ability to run perpetual trade deficits, but this won't last.

We've run a trade deficit for most of our history, the period 1940 to 1965 roughly was an exception. I have yet to see any problem as a result.

you don't quite get it. The US can run twin deficits explicitly because it prints the world's commodity exchange currency. Our world reserve currency status is already gone.

If other nations did not need US dollars in order to buy oil and food they would not need to have export based economies running trade surpluses to get commodities.

Their need for dollars facilitates our ability to run perpetual trade deficits, but this won't last.

You sound like a mercantilist. Which means you're an idiot.

The dollar is still the world reserve currency. Guess which currency the yuan is pegged to?

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

We've run a trade deficit for most of our history, the period 1940 to 1965 roughly was an exception. I have yet to see any problem as a result.

you don't quite get it. The US can run twin deficits explicitly because it prints the world's commodity exchange currency. Our world reserve currency status is already gone.

If other nations did not need US dollars in order to buy oil and food they would not need to have export based economies running trade surpluses to get commodities.

Their need for dollars facilitates our ability to run perpetual trade deficits, but this won't last.

You sound like a mercantilist. Which means you're an idiot.

The dollar is still the world reserve currency. Guess which currency the yuan is pegged to?

The dollar formally lost world reserve currency status several years ago when virtually everybody began using a basket of currencies as reserves.

The yuan is pegged to the dollar simply because they want to maintain a fixed exchange rate with their biggest trade partner and the issuer of their bond reserves.

And nothing I posted had a damned thing to do with mercantilism, fool. CHINA pegs yuan to the dollar BECAUSE they practice mercantilism.

We've run a trade deficit for most of our history, the period 1940 to 1965 roughly was an exception. I have yet to see any problem as a result.

you don't quite get it. The US can run twin deficits explicitly because it prints the world's commodity exchange currency. Our world reserve currency status is already gone.

If other nations did not need US dollars in order to buy oil and food they would not need to have export based economies running trade surpluses to get commodities.

Their need for dollars facilitates our ability to run perpetual trade deficits, but this won't last.

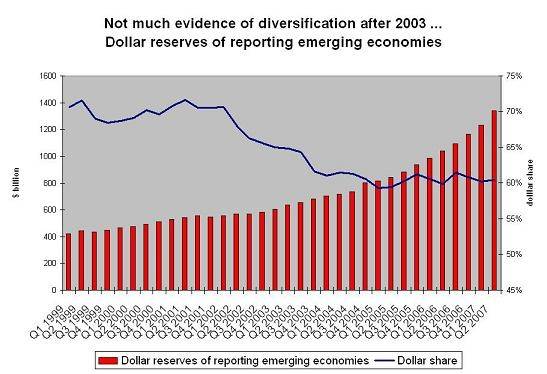

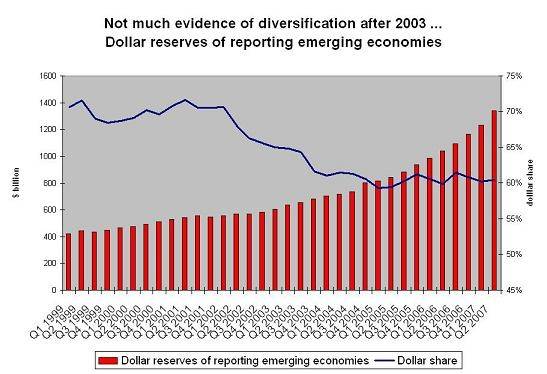

The dollar is the world's reserve currency. It accounts for about 60% of global reserves. It has fluctuated between 55% and 70% for the past four decades.

Though I don't rule out that the dollar will not be the reserve currency in the future, that won't likely happen for at least several generations.

The dollar formally lost world reserve currency status several years ago when virtually everybody began using a basket of currencies as reserves.

The dollar has never been the sole currency used as a reserve currency. It is mechanically impractical to do so, given that world trade occurs in other currencies besides the dollar. So the dollar has always been the largest currency amongst several owned by central banks.

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

We've run a trade deficit for most of our history, the period 1940 to 1965 roughly was an exception. I have yet to see any problem as a result.

you don't quite get it. The US can run twin deficits explicitly because it prints the world's commodity exchange currency. Our world reserve currency status is already gone.

If other nations did not need US dollars in order to buy oil and food they would not need to have export based economies running trade surpluses to get commodities.

Their need for dollars facilitates our ability to run perpetual trade deficits, but this won't last.

The dollar is the world's reserve currency. It accounts for about 60% of global reserves. It has fluctuated between 55% and 70% for the past four decades.

Though I don't rule out that the dollar will not be the reserve currency in the future, that won't likely happen for at least several generations.

In the early 70's it accounted for nearly all of the world's reserves.

Valerie

Platinum Member

- Sep 17, 2008

- 31,521

- 7,388

- 1,170

The other factor to remember is that mining production is increasing. Increased supply and decreased demand.........

BANGALORE, Oct 20 (Reuters) - Canada's Minera Andes (MAI.TO: Quote) said silver and gold production at its flagship San Jose mine in Argentina grew sequentially in the third quarter, helped by improved development of the high-grade Kospi vein, sending its shares up as much as 5 percent.

The San Jose mine is operated by Minera Santa Cruz SA, a joint venture between Hochschild Mining Plc (HOCM.L: Quote) and Minera Andes. About 49 percent of production at San Jose is attributable to Minera Andes.

Canaccord Genuity analyst Wendell Zerb expects improved production at the mine in the second half of the year, compared to the first.

Third-quarter silver production was up 15 percent at 1.4 million ounces sequentially, while gold production rose 12 percent to 22,025 ounces, compared with the second quarter.

However, sales of silver and gold were down 6 percent and 10 percent, respectively, compared with the prior quarter due to an increase in products inventory.

UPDATE 2-Minera says Q3 output at San Jose up sequentially | Metals & Mining | Reuters

you don't quite get it. The US can run twin deficits explicitly because it prints the world's commodity exchange currency. Our world reserve currency status is already gone.

If other nations did not need US dollars in order to buy oil and food they would not need to have export based economies running trade surpluses to get commodities.

Their need for dollars facilitates our ability to run perpetual trade deficits, but this won't last.

The dollar is the world's reserve currency. It accounts for about 60% of global reserves. It has fluctuated between 55% and 70% for the past four decades.

Though I don't rule out that the dollar will not be the reserve currency in the future, that won't likely happen for at least several generations.

In the early 70's it accounted for nearly all of the world's reserves.

Yes, it was 80% at one time. Then it fell to less than 50% as the yen surged. Now it is back into the middle of its range.

The falling dollar: Losing faith in the greenback | The Economist

http://www.rgemonitor.com/blog/setser/230795

The IMF's authoritative Currency Composition of Official Foreign Exchange Reserves (COFER) report last week indicated that the dollar's share of global reserves (where the allocation is reported) rose to 65%, to stand at its highest since 2007.

http://www.thestreet.com/p/_search/rmoney/currencies/10534879_2.html

Last edited:

Norman

Diamond Member

- Sep 24, 2010

- 31,254

- 15,176

- 1,590

In early 70s dollar was still backed by gold so there was actually real wealth behind it. What country had in dollars it had in gold, until it came obvious that US has no gold and the standard was broken. I have no idea why the dollar was kept as reserve currency after that.

As inflation picks up I don't think other countries are going to continue holding the toxic assets (dollars). There is no backing against the dollar now, unless taxes are raised in US substantially and inflation stopped there won't ever be. And there is no willingness to do either of those.

So inflation or the raise in interest rates could pop the bubble (everyone tries to sell the old low rate US debt if interest rates raise). I think it is a bit stupid to think countries will hold this bag of trash and let US print and import for free while making almost nothing. I doubt this will go on for generations anymore.

You never know though....

As inflation picks up I don't think other countries are going to continue holding the toxic assets (dollars). There is no backing against the dollar now, unless taxes are raised in US substantially and inflation stopped there won't ever be. And there is no willingness to do either of those.

So inflation or the raise in interest rates could pop the bubble (everyone tries to sell the old low rate US debt if interest rates raise). I think it is a bit stupid to think countries will hold this bag of trash and let US print and import for free while making almost nothing. I doubt this will go on for generations anymore.

You never know though....

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

In early 70s dollar was still backed by gold so there was actually real wealth behind it. What country had in dollars it had in gold, until it came obvious that US has no gold and the standard was broken. I have no idea why the dollar was kept as reserve currency after that.

As inflation picks up I don't think other countries are going to continue holding the toxic assets (dollars). There is no backing against the dollar now, unless taxes are raised in US substantially and inflation stopped there won't ever be. And there is no willingness to do either of those.

So inflation or the raise in interest rates could pop the bubble (everyone tries to sell the old low rate US debt if interest rates raise). I think it is a bit stupid to think countries will hold this bag of trash and let US print and import for free while making almost nothing. I doubt this will go on for generations anymore.

You never know though....

The US exited WWII with 60% of the world's golds in the possession of the US Treasury. At the Bretton Woods accord in the late 40's the allied nations explicitly agreed to use the dollar as the world's formal reserve currency, and the IMF was founded to establish exchange rates.

Bretton Woods system - Wikipedia, the free encyclopedia

The US still had considerable gold in 71, but other factors convinced Nixon to terminate our gold standard:

After the Second World War, a system similar to a Gold Standard was established by the Bretton Woods Agreements. Under this system, many countries fixed their exchange rates relative to the U.S. dollar. The U.S. promised to fix the price of gold at $35 per ounce. Implicitly, then, all currencies pegged to the dollar also had a fixed value in terms of gold. Under the regime of the French President Charles de Gaulle up to 1970, France reduced its dollar reserves, trading them for gold from the U.S. government, thereby reducing U.S. economic influence abroad. This, along with the fiscal strain of federal expenditures for the Vietnam War, led President Richard Nixon to end the direct convertibility of the dollar to gold in 1971, resulting in the system's breakdown, commonly known as the Nixon Shock.

Gold standard - Wikipedia, the free encyclopedia

The French were gaming the dollar by exchanging dollars for gold and selling the gold for more, then repeating this sequence systematically.

william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,402

- 280

The US dollar never had 100% backing in Gold and Silver. What has backed the US dollar is having the world's largest contiguous barge network servicing the second best and second largest farm belt. Having the second largest rail system and fourth largest basket of natural resources didn't hurt either. Russia, Canada, Brazil, India, China and Australia are the only other countries with comparable size and gifts. If Brazil gets its act together it could become a serious competitor to the US with its development of the tropical soybean but the rest of the world lacks the combination of geography and low cost infrastructure needed to be a serious long term threat.In early 70s dollar was still backed by gold so there was actually real wealth behind it. What country had in dollars it had in gold, until it came obvious that US has no gold and the standard was broken. I have no idea why the dollar was kept as reserve currency after that.

As inflation picks up I don't think other countries are going to continue holding the toxic assets (dollars). There is no backing against the dollar now, unless taxes are raised in US substantially and inflation stopped there won't ever be. And there is no willingness to do either of those.

So inflation or the raise in interest rates could pop the bubble (everyone tries to sell the old low rate US debt if interest rates raise). I think it is a bit stupid to think countries will hold this bag of trash and let US print and import for free while making almost nothing. I doubt this will go on for generations anymore.

You never know though....

In early 70s dollar was still backed by gold so there was actually real wealth behind it. What country had in dollars it had in gold, until it came obvious that US has no gold and the standard was broken. I have no idea why the dollar was kept as reserve currency after that.

As inflation picks up I don't think other countries are going to continue holding the toxic assets (dollars). There is no backing against the dollar now, unless taxes are raised in US substantially and inflation stopped there won't ever be. And there is no willingness to do either of those.

So inflation or the raise in interest rates could pop the bubble (everyone tries to sell the old low rate US debt if interest rates raise). I think it is a bit stupid to think countries will hold this bag of trash and let US print and import for free while making almost nothing. I doubt this will go on for generations anymore.

You never know though....

The US exited WWII with 60% of the world's golds in the possession of the US Treasury. At the Bretton Woods accord in the late 40's the allied nations explicitly agreed to use the dollar as the world's formal reserve currency, and the IMF was founded to establish exchange rates.

Bretton Woods system - Wikipedia, the free encyclopedia

The US still had considerable gold in 71, but other factors convinced Nixon to terminate our gold standard:

After the Second World War, a system similar to a Gold Standard was established by the Bretton Woods Agreements. Under this system, many countries fixed their exchange rates relative to the U.S. dollar. The U.S. promised to fix the price of gold at $35 per ounce. Implicitly, then, all currencies pegged to the dollar also had a fixed value in terms of gold. Under the regime of the French President Charles de Gaulle up to 1970, France reduced its dollar reserves, trading them for gold from the U.S. government, thereby reducing U.S. economic influence abroad. This, along with the fiscal strain of federal expenditures for the Vietnam War, led President Richard Nixon to end the direct convertibility of the dollar to gold in 1971, resulting in the system's breakdown, commonly known as the Nixon Shock.

Gold standard - Wikipedia, the free encyclopedia

The French were gaming the dollar by exchanging dollars for gold and selling the gold for more, then repeating this sequence systematically.

"The French were gaming the dollar by exchanging dollars for gold and selling the gold for more, then repeating this sequence systematically"

Commonly referred to now-a-days as investing and creating jobs.

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

The dollar is the world's reserve currency. It accounts for about 60% of global reserves. It has fluctuated between 55% and 70% for the past four decades.

Though I don't rule out that the dollar will not be the reserve currency in the future, that won't likely happen for at least several generations.

In the early 70's it accounted for nearly all of the world's reserves.

Yes, it was 80% at one time. Then it fell to less than 50% as the yen surged. Now it is back into the middle of its range.

The falling dollar: Losing faith in the greenback | The Economist

Roubini Global Economics - Home

The IMF's authoritative Currency Composition of Official Foreign Exchange Reserves (COFER) report last week indicated that the dollar's share of global reserves (where the allocation is reported) rose to 65%, to stand at its highest since 2007.

http://www.thestreet.com/p/_search/rmoney/currencies/10534879_2.html

Thanks Toro.

In 71 Nixon took us off the gold standard. We had previously been the formal gold standard due to treaties following WWII. Between 45 and 71 almost every currency in the world pegged to the dollar because of the exchange rates established by the IMF and via the BIS (bank of international settlements).

The yen took off in the 80s. In the mid-early 70s the saudis and thus OPEC stopped accepting dollars for oil, briefly. Since then the dollar has lost a lot of it's world reserve currency status, but retained it's commodity exchange status.

When the Chinese began using a basket of currencies instead of just the dollar a few years ago our world reserve currency stake fell toward 60%. But that isn't world reserve status. Our official status as a world reserve currency is gone, as the IMF has moved on to other missions and the BIS promotes a diversified basket, as does China and every nation that copies China's dollar peg.

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

The US dollar never had 100% backing in Gold and Silver.

that didn't matter. We had 60% of the world's gold and we backed every dollar with gold at a $35/oz exchange rate.

The dollar was as good as gold until 1971.

Valerie

Platinum Member

- Sep 17, 2008

- 31,521

- 7,388

- 1,170

4 hours ago - TheStreet 2:59 | 652 views

NEW YORK (TheStreet) -- Will Rhind, head of U.S. operations for ETF Securities, argues that despite gold's sell-off Tuesday the fundamentals supporting higher prices are still intact.

Gold Fundamentals Still Intact

NEW YORK (TheStreet) -- Will Rhind, head of U.S. operations for ETF Securities, argues that despite gold's sell-off Tuesday the fundamentals supporting higher prices are still intact.

Gold Fundamentals Still Intact

Similar threads

- Replies

- 2

- Views

- 104

- Replies

- 98

- Views

- 1K

Latest Discussions

- Replies

- 73

- Views

- 482

- Replies

- 1K

- Views

- 14K

- Replies

- 233

- Views

- 2K

Forum List

-

-

-

-

-

Political Satire 8032

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 468

-

-

-

-

-

-

-

-

-

-