California Girl

Rookie

- Oct 8, 2009

- 50,337

- 10,058

- 0

- Banned

- #21

--that according to Abraham Lincoln most quotes on the internet are made up.YO expat-panama

Are you suggesting that I have been inaccurate in my memory?

How much of your rep are you willing to risk?

Do you want to admit you know nothing of such an important testimony?

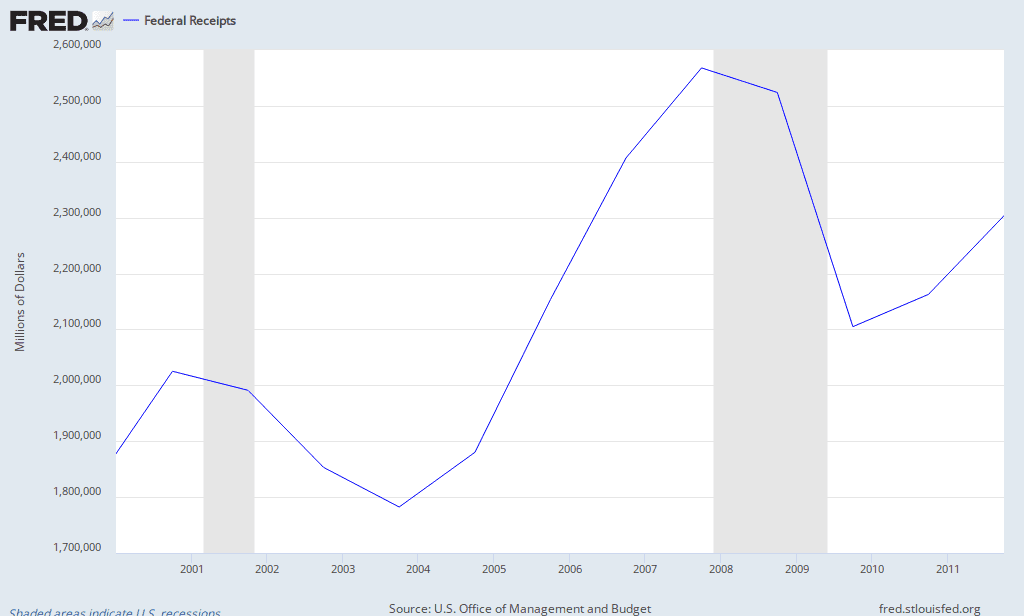

As far as your chart goes, what mystery is there in cutting cap gains and watching the pigs feed?

Do you come here to mislead often?

How much of his rep?

You must be a sock.

And I think I know whose sock you are.

Idiot.