GreatDay

Wasn't it?

- Aug 21, 2012

- 436

- 37

- 16

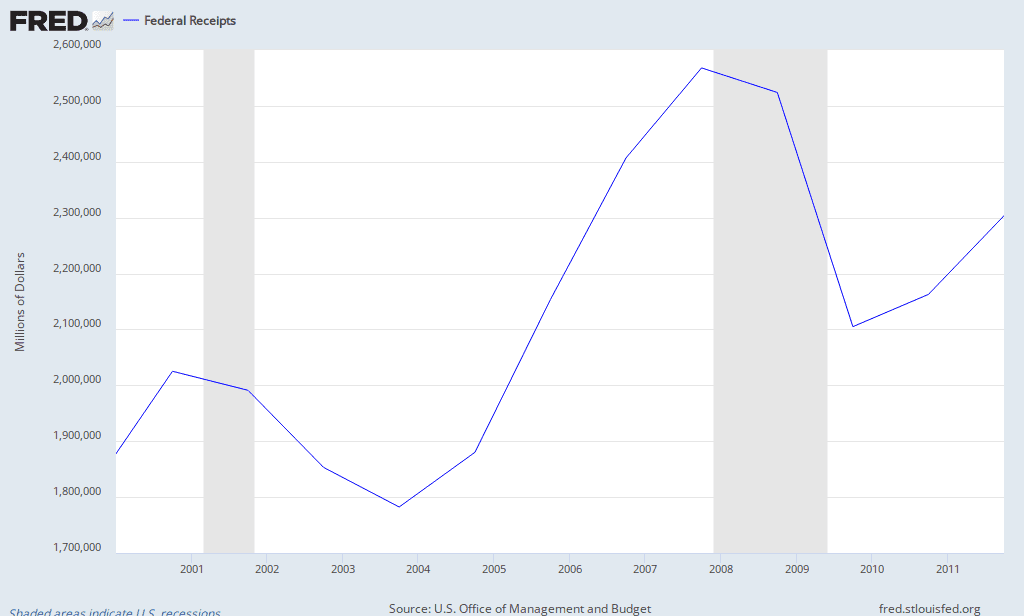

In 2001 in support of the Bush tax cut Alan Greenspan testified before congress that the greatest economic threat he saw was that the nation would pay it’s debt off entirely within 10 years and congress would not adjust taxes quickly enough resulting in an accumulation of capital in Washington which would then be inefficiently applied.

As examples of problems developing he pointed to reduced bond auctions which caused a shortage of marketable securities for certain hedge investments.

At the time the total debt was a bit over 5 trillion, now we are over 15 trillion, why did Greenspan get it so wrong?

“The most recent projections from OMB and CBO indicate that, if current policies remain in place, the total unified surplus will reach about $800 billion in fiscal year 2010, including an on-budget surplus of almost $500 billion. Moreover, the admittedly quite uncertain long-term budget exercises released by the CBO last October maintain an implicit on-budget surplus under baseline assumptions well past 2030 despite the budgetary pressures from the aging of the baby-boom generation, especially on the major health programs.

These most recent projections, granted their tentativeness, nonetheless make clear that the highly desirable goal of paying off the federal debt is in reach and, indeed, would occur well before the end of the decade under baseline assumptions. This is in marked contrast to the perception of a year ago, when the elimination of the debt did not appear likely until the next decade. But continuing to run surpluses beyond the point at which we reach zero or near-zero federal debt brings to center stage the critical longer-term fiscal policy issue of whether the federal government should accumulate large quantities of private (more technically, nonfederal) assets.

At zero debt, the continuing unified budget surpluses now projected under current law imply a major accumulation of private assets by the federal government. Such an accumulation would make the federal government a significant factor in our nation's capital markets and would risk significant distortion in the allocation of capital to its most productive uses. Such a distortion could be quite costly, as it is our extraordinarily effective allocation process that has enabled such impressive increases in productivity and standards of living despite a relatively low domestic saving rate.”

“Returning to the broader fiscal picture, I continue to believe, as I have testified previously, that all else being equal, a declining level of federal debt is desirable because it holds down long-term real interest rates, thereby lowering the cost of capital and elevating private investment. The rapid capital deepening that has occurred in the U.S. economy in recent years is a testament to these benefits. But the sequence of upward revisions to the budget surplus projections for several years now has reshaped the choices and opportunities before us.

Indeed, in almost any credible baseline scenario, short of a major and prolonged economic contraction, the full benefits of debt reduction are now achieved well before the end of this decade--a prospect that did not seem reasonable only a year or even six months ago. Thus, the emerging key fiscal policy need is now to address the implications of maintaining surpluses beyond the point at which publicly held debt is effectively eliminated.”

Testimony of Chairman Alan Greenspan

Current fiscal issues

Before the Committee on the Budget, U.S. House of Representatives

March 2, 2001

As examples of problems developing he pointed to reduced bond auctions which caused a shortage of marketable securities for certain hedge investments.

At the time the total debt was a bit over 5 trillion, now we are over 15 trillion, why did Greenspan get it so wrong?

“The most recent projections from OMB and CBO indicate that, if current policies remain in place, the total unified surplus will reach about $800 billion in fiscal year 2010, including an on-budget surplus of almost $500 billion. Moreover, the admittedly quite uncertain long-term budget exercises released by the CBO last October maintain an implicit on-budget surplus under baseline assumptions well past 2030 despite the budgetary pressures from the aging of the baby-boom generation, especially on the major health programs.

These most recent projections, granted their tentativeness, nonetheless make clear that the highly desirable goal of paying off the federal debt is in reach and, indeed, would occur well before the end of the decade under baseline assumptions. This is in marked contrast to the perception of a year ago, when the elimination of the debt did not appear likely until the next decade. But continuing to run surpluses beyond the point at which we reach zero or near-zero federal debt brings to center stage the critical longer-term fiscal policy issue of whether the federal government should accumulate large quantities of private (more technically, nonfederal) assets.

At zero debt, the continuing unified budget surpluses now projected under current law imply a major accumulation of private assets by the federal government. Such an accumulation would make the federal government a significant factor in our nation's capital markets and would risk significant distortion in the allocation of capital to its most productive uses. Such a distortion could be quite costly, as it is our extraordinarily effective allocation process that has enabled such impressive increases in productivity and standards of living despite a relatively low domestic saving rate.”

“Returning to the broader fiscal picture, I continue to believe, as I have testified previously, that all else being equal, a declining level of federal debt is desirable because it holds down long-term real interest rates, thereby lowering the cost of capital and elevating private investment. The rapid capital deepening that has occurred in the U.S. economy in recent years is a testament to these benefits. But the sequence of upward revisions to the budget surplus projections for several years now has reshaped the choices and opportunities before us.

Indeed, in almost any credible baseline scenario, short of a major and prolonged economic contraction, the full benefits of debt reduction are now achieved well before the end of this decade--a prospect that did not seem reasonable only a year or even six months ago. Thus, the emerging key fiscal policy need is now to address the implications of maintaining surpluses beyond the point at which publicly held debt is effectively eliminated.”

Testimony of Chairman Alan Greenspan

Current fiscal issues

Before the Committee on the Budget, U.S. House of Representatives

March 2, 2001

Last edited: