- Sep 14, 2011

- 63,931

- 9,965

- 2,040

Senate Democrats To Push 'Buffett Rule' Bill This Week

aka, The Fair Share Rule.

Brace yourselves. All you 1% here are gonna hate this.

Don't worry. The pubs will filibuster it because, as we all know, they are owned by the 1%.

aka, The Fair Share Rule.

Brace yourselves. All you 1% here are gonna hate this.

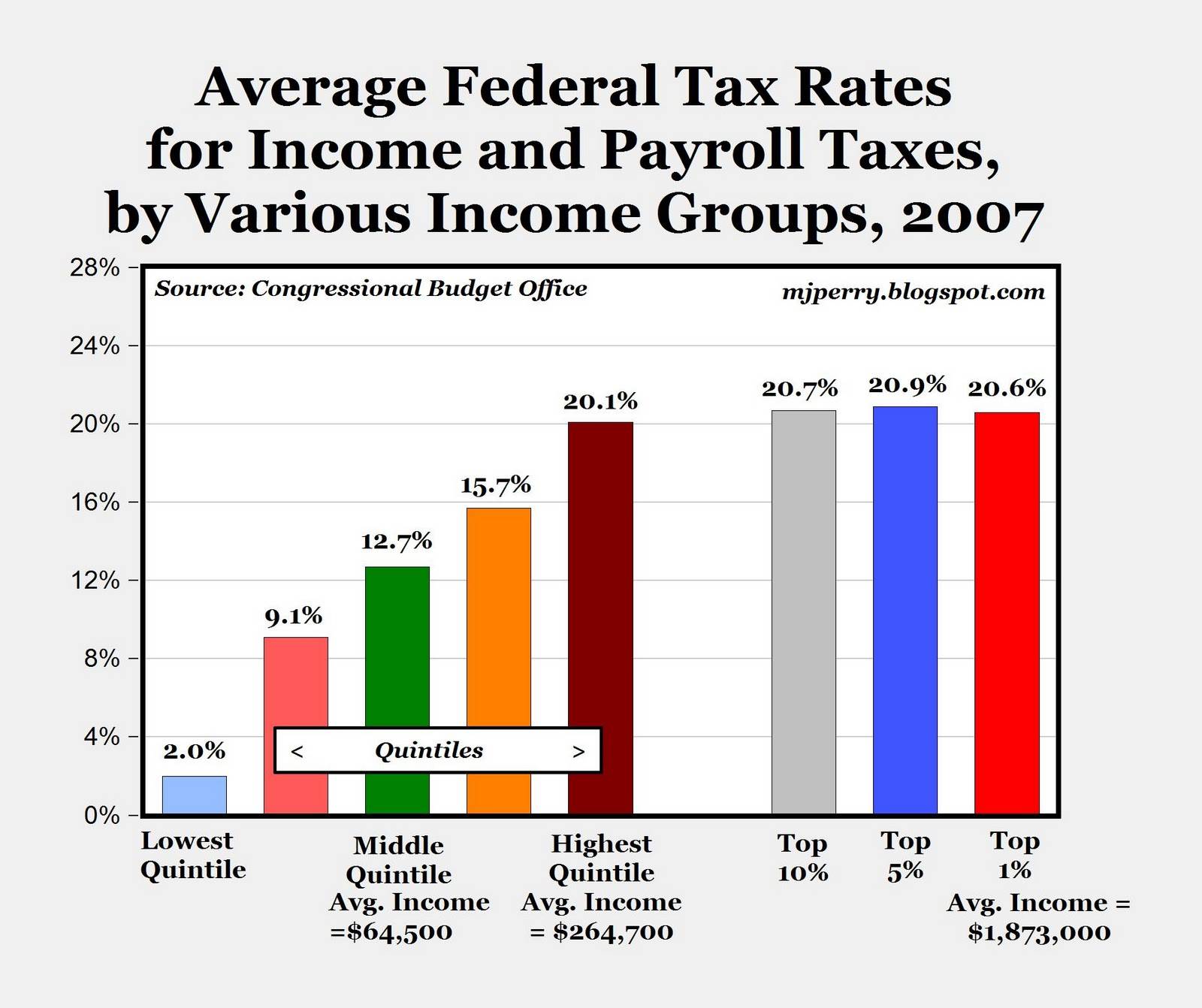

It would require people who make more than $1 million to pay a 30 percent effective tax rate. Tax loopholes now allow some of the wealthiest Americans to pay lower tax rates than people in the middle class.

Don't worry. The pubs will filibuster it because, as we all know, they are owned by the 1%.