- May 20, 2009

- 144,099

- 66,367

- 2,330

- Thread starter

- #101

Coolidge derisively called Hoover "Wonder Boy" because he was a flaming Liberal who believed the government could do so much good

Coolidge? Oh right the Harding/Coolidge great depression where they cheered on 3 asset bubbles then handed it off to Hoover!

The 1920s Credit Bubble

The 1920s Credit Bubble spawned 3 asset bubbles

In a major paper by the Bank for International Settlements, "The Great Depression as a Credit Boom gone Wrong" Barry Eichengreen and Kris Michener (2003) set forth how the dramatic expansion of credit in the 1920s set the stage first for overconsumption, and then the drastic decline of the great depression:

The 1920s was a decade of expansion, reflecting recovery from World War I, new information and communications technologies like radio, and new processes like motor vehicle production using assembly-line methods. Accounts of the twenties in the United States ... emphasize the ready availability of credit, reflecting the ample gold reserves accumulated by the country during World War I, the stance of Federal Reserve policies, and financial innovations ranging from the development of the modern investment trust [i.e., mutual fund] to consumer credit tied to purchases of durable goods like automobiles. Credit fueled a real estate boom in 1925, a Wall Street boom in 1928-9, and a consumer durables spending spree spanning the second half of the 1920s. That these booms developed under the fixed exchange rates of the gold standard meant that they generated little inflationary pressure at home and that their effects were transmitted to the rest of the world. Absent overt signs of inflation, the Fed had no reason to raise the official short-term rate.

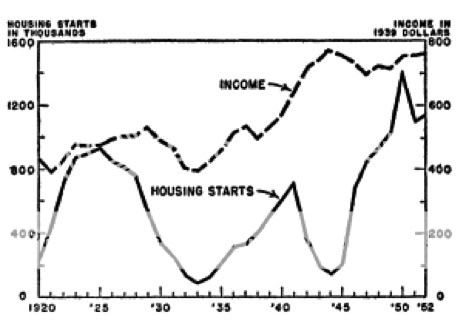

Graphically shown, we can see that the 1920s featured a property boom that peaked in 1925 (just as our own peaked in 2005-2006) but wages continued to climb until 1929:

Let's examine these bubbles one at a time.

The 20's featured 2 transformational technologies: Electricity and mass production. That's why they were roaring

FRANK, ALWAYS MISINFORMED

Statistical Portrait of the 1920s there was an explosion of consumer debt:

Consumer Credit

1925: $1.38 Billion (Consumer Credit outstanding)

1927: 15% of all consumer durables bought on installment payments

60% of automobiles bought on installment payments

80% of radios bought on installment payments

1

Whatever happened, the slump soon fed on itself. Weak spending depressed prices, which meant that many farmers, businesses, and nations couldn't repay their debts. Rising bad debts prompted banks to restrict new loans and sell financial assets, usually bonds. Scarce credit led to less borrowing, less spending, lower prices, and more bankruptcies. Trade and investment spiraled downward.

As another essayist put it:

The market crashes undermined ... confidence. The rich stopped spending on luxury items, and slowed investments. The middle-class and poor stopped buying things with installment credit for fear of loosing their jobs, and not being able to pay the interest. As a result industrial production fell by more than 9% between the market crashes in October and December 1929. As a result jobs were lost, and soon people starting defaulting on their interest payment. Radios and cars bought with installment credit had to be returned. All of the sudden warehouses were piling up with inventory. The thriving industries that had been connected with the automobile and radio industries started falling apart.

In summary, consumer credit underwent explosive growth in the 1920s. This growth meant that consumers were proverbially "loaded to the gills" with debt. Remember that some 80% of American families in the 1920s had no savings to fall back on if the (usually sole) breadwinner lost his job.

To make matters worse, installment credit loans had a hair trigger: if the consumer missed even one payment, the car, radio, furniture, or other durable good purchased could be immediately repossessed, the consequence of which was to prove devastating to the economy in 1929.

V. The Stock Market Margin credit bubble

I am sure you are very well familiar with this bubble, but let cite you one fact you may not already know:

Between the end of 1927 and October 1929, loans to brokers rose 92 percent. At the start of October, loans equaled nearly a fifth of the value of all stocks....

VI. When the credit bubble burst, consumers hit the wall

Initially, the 1929 depression was no worse than the business depressions of 1923 or 1927. For example, the 1929 Fed report on economic conditions noted:

[T]his reduction in employment, severe though it was (and it involved the discharge of over 700,00 workers between the time of the seasonal peak in September and December) did not approach in magnitude the decline in the years 1923 and 1924.

But that was no matter. The over-reliance on consumer credit now wreaked havoc with the economy:

What made matters worse was a big drop in U.S. consumer spending—far more than can be explained by the stock market crash. The drop may have been a backlash to the rise of installment lending (for cars, furniture, and appliances) in the twenties. The prevailing practice allowed lenders to repossess an item if the borrower missed just one payment. People may have stopped making new purchases to reduce the risk of losing things they already had bought on credit.

The 1920s Credit Bubble

It's not a bubble when the Fed cuts the money supply by 1/3, that's strangulation.

I'll say it again for the Progs, the 20's were an economy bouyed by 2 simultaneous and transformational technologies: electricity and mass production

Buoyed by those transformational technology's? Oh right, AIDED BY HARDING/COOLIDGE'S 3 ASSET BUBBLES THEY CHEERED ON

WHAT ROLE DID THE FED PLAY IN CAUSING THE GREAT DEPRESSION?

A favorite conservative argument is that the Federal Reserve Board caused the Great Depression by contracting the money supply.

This is a complete myth. According to the Federal Reserve's own records, at no time did the Fed pull money out of the system. Although it's true that the money supply contracted 31 percent between 1929 and 1933, this was not because of the Fed. Rather, the contraction was caused by three dramatic runs on banks, which would close 10,000 banks by 1933. So many failures were significant, because bank deposits formed 92 percent of all the money in circulation.

The Fed's Actions in the Great Depression

...The Run on Banks

So what caused a 31-percent contraction in the money supply? Pretty clearly, the public run on banks. The first banking panic occurred in late 1930; the second in the spring of 1931, and the third in March 1933. When it was over, 10,000 banks had gone out of business, with well over $2 billion in deposits lost.

WHAT ROLE DID THE FED PLAY IN CAUSING THE GREAT DEPRESSION

Bernanke admits Friedman was right. Stop wasting electrons on stupid fuckwit morons

FRB Speech, Bernanke -- On Milton Friedman's ninetieth birthday -- November 8, 2002