Skylar

Diamond Member

- Jul 5, 2014

- 51,016

- 14,750

- 2,180

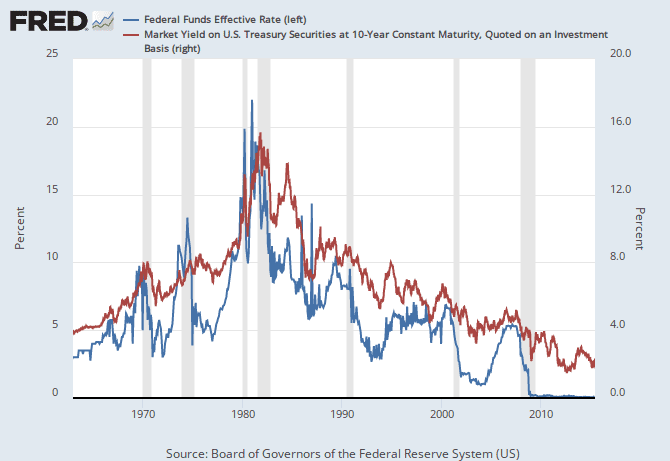

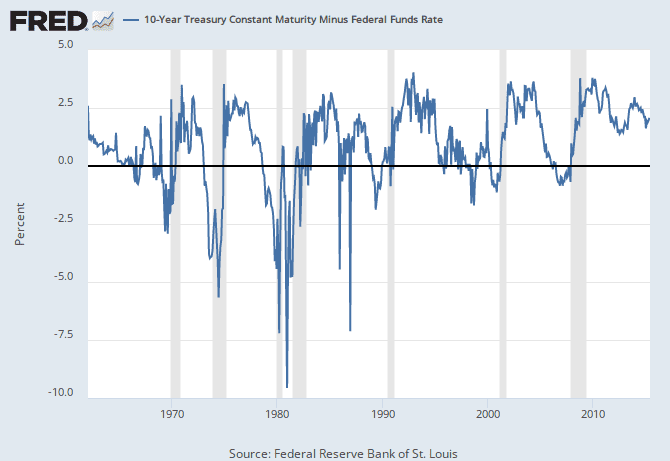

If interest rates rise, that is a sign of inflation. During periods of inflation the Fed sells its assets to soak up excess liquidity. If the Fed attempts to sell 2.75% bonds in a market where the rates have risen above that, they have to sell them at a loss.

We're talking past each other, describing the same thing. My point isn't in regard to new debt. Its in reference to old debt.

Lets say that in 2010 the Fed sold a 30 year bond with a yield of 2.5%. If, in 2016 interest rates rose sufficiently, a 30 year bond being sold in 2016 would have to have an interest rate of 5%.

However.......the 2010 bond, which will be making yearly interest payments for 30 years before principle is returned, will still be paying only 2.5%. The Fed isn't selling that 2010 bond again. They sold it in 2010. Future increases in interest rates only affect new debt. Not securities that have already been sold.